- United States

- /

- Auto Components

- /

- NYSE:BWA

Is BorgWarner Still Attractive After a 42% Rally and Strong EV Contract Wins?

Reviewed by Bailey Pemberton

- If you are wondering whether BorgWarner at around $44 is still a smart way to play the shift to electric and hybrid vehicles, you are not alone. This stock sits right at the crossroads of old school autos and future facing drivetrains.

- The share price is up 2.7% over the last week and a hefty 42.0% year to date, even after a slightly soft 30 day move of -0.7%, adding to an already strong 32.6% gain over the last year.

- Those gains have been underpinned by ongoing contract wins with major global automakers and steady progress in EV and hybrid components, which keep reinforcing BorgWarner as a key supplier in the industry transition. At the same time, investor sentiment has been buoyed by broader optimism around auto and EV demand, helping the stock rerate from earlier, more cautious levels.

- Despite that rally, BorgWarner only scores 2 out of 6 on our valuation checks, so we will walk through what different valuation methods are really saying about the stock, and then finish with a more complete way to think about its true long term value.

BorgWarner scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: BorgWarner Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting its future cash flows and discounting them back to the present. For BorgWarner, the model uses a 2 stage Free Cash Flow to Equity approach based on cash flow projections.

The company generated roughly $1.04 billion in free cash flow over the last twelve months. Analyst forecasts and subsequent extrapolations by Simply Wall St suggest BorgWarner can sustain around the $1.0 billion level in free cash flow over the next decade, with 2035 projected at about $1.12 billion. These future cash flows are then discounted back to today to reflect risk and the time value of money.

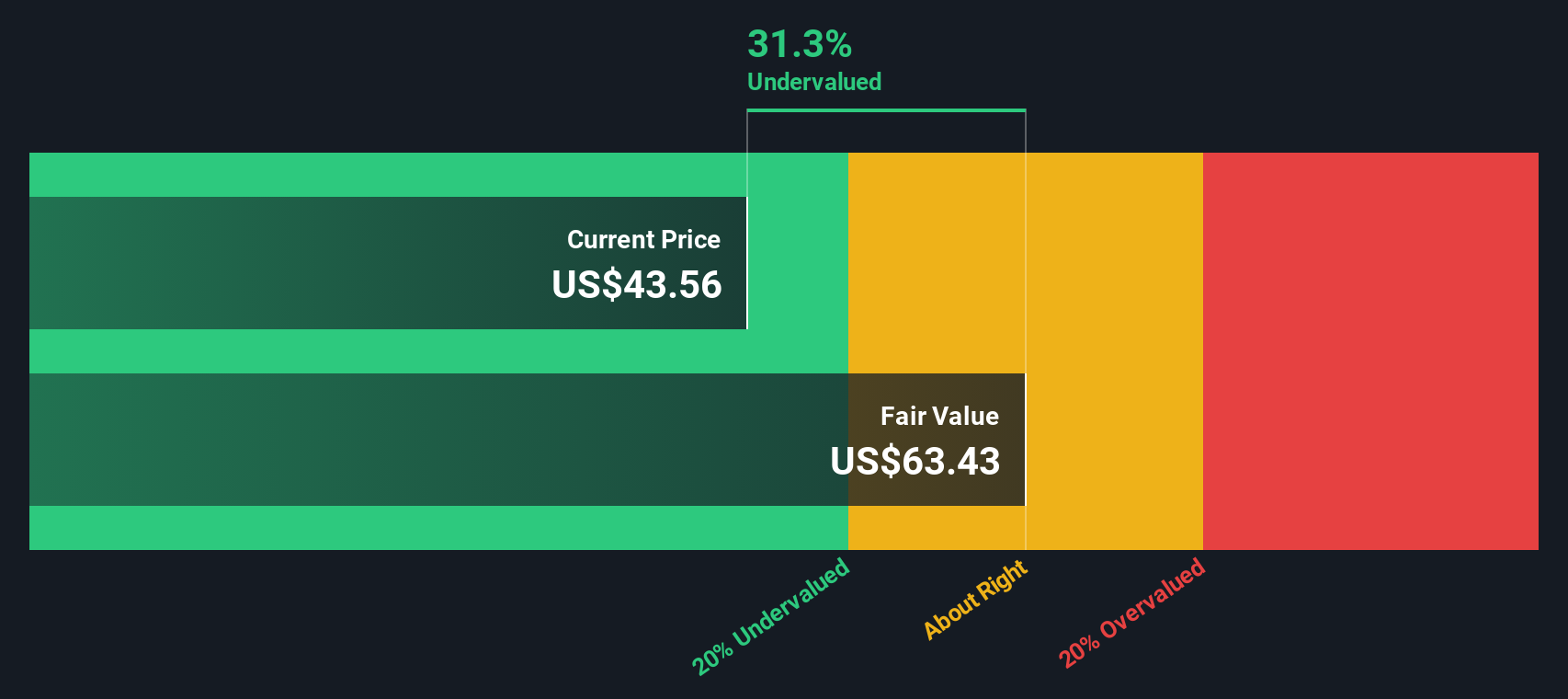

Putting all of those discounted cash flows together results in an estimated intrinsic value of about $68.32 per share. Compared with a current share price around $44, the DCF implies the stock is roughly 34.9% undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BorgWarner is undervalued by 34.9%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: BorgWarner Price vs Earnings

For profitable companies like BorgWarner, the price to earnings ratio is a useful yardstick because it links what investors are paying directly to the profits the business is generating today. In simple terms, higher growth and lower risk can justify a higher PE ratio, while slower growth or more uncertainty usually calls for a lower, more cautious multiple.

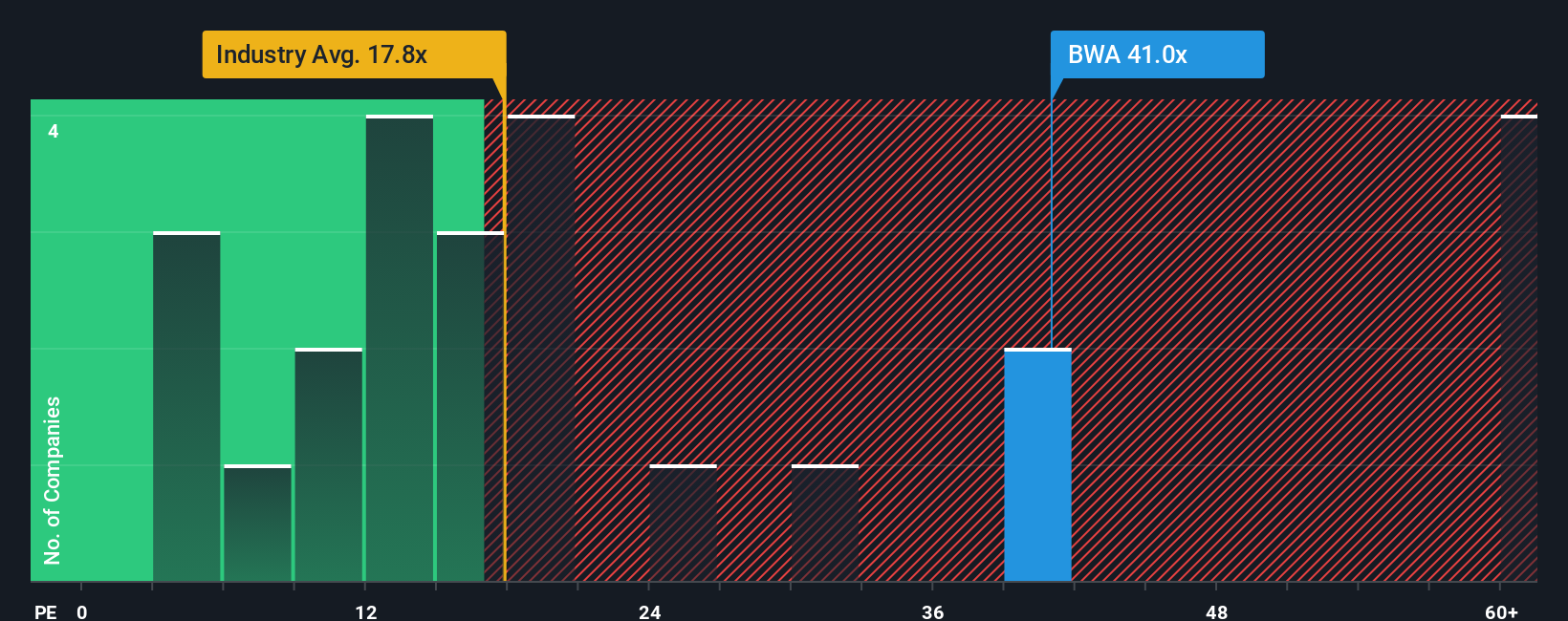

BorgWarner currently trades on a PE of about 69.98x, which is far above the Auto Components industry average of roughly 18.91x and also well ahead of the broader peer group at around 24.28x. To move beyond these blunt comparisons, Simply Wall St calculates a proprietary Fair Ratio, which for BorgWarner comes out at about 17.78x.

This Fair Ratio is designed to be more precise than a simple industry or peer comparison because it folds in company specific factors like expected earnings growth, profit margins, risk profile, market cap and the characteristics of its industry. When we stack the current 69.98x PE against the 17.78x Fair Ratio, the share price looks meaningfully above what those fundamentals would typically support.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BorgWarner Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page where millions of investors connect a company’s story to a concrete financial forecast that leads to a Fair Value they can compare with today’s share price. This can help them decide when to buy or sell. The Fair Value then updates dynamically as new news or earnings arrive. For BorgWarner, one investor might build a bullish Narrative around accelerating EV platform wins, improving margins and a Fair Value closer to the high analyst target of about $52. Another might focus on combustion exposure, execution risks and more muted electrification, landing nearer the $37 bear case. Narratives help you see these perspectives clearly by tying your own view of future revenues, earnings and margins directly to a live Fair Value range rather than relying solely on static multiples like PE.

Do you think there's more to the story for BorgWarner? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BorgWarner might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BWA

BorgWarner

Provides solutions for combustion, hybrid, and electric vehicles worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)