- United States

- /

- Auto Components

- /

- NasdaqCM:XPEL

XPEL (XPEL): Evaluating Valuation Following Launch of COLOR Paint Protection Film

Reviewed by Simply Wall St

Most Popular Narrative: 19.3% Undervalued

The most widely followed narrative suggests that XPEL is undervalued by nearly 20%, given the company's current fundamentals and expected growth trajectory.

Increasing investment and strong momentum in the personalization and referral platform, including online-to-offline installer network integration, is rapidly enhancing customer reach and upsell potential. This development is expected to drive higher attach rates, improved brand loyalty, and consequently higher net margins and earnings.

Curious what is powering this impressive fair value? According to the narrative, it is based on a bold expansion strategy, margin upgrades, and a future profit multiple that is far from average. Wondering which financial levers could spark a major rerating for this once-underappreciated stock? The answer may surprise you, as there is a set of core assumptions driving this price call.

Result: Fair Value of $47.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising competition from low-cost Asian manufacturers or a downturn in global car sales could quickly challenge XPEL's growth story.

Find out about the key risks to this XPEL narrative.Another View

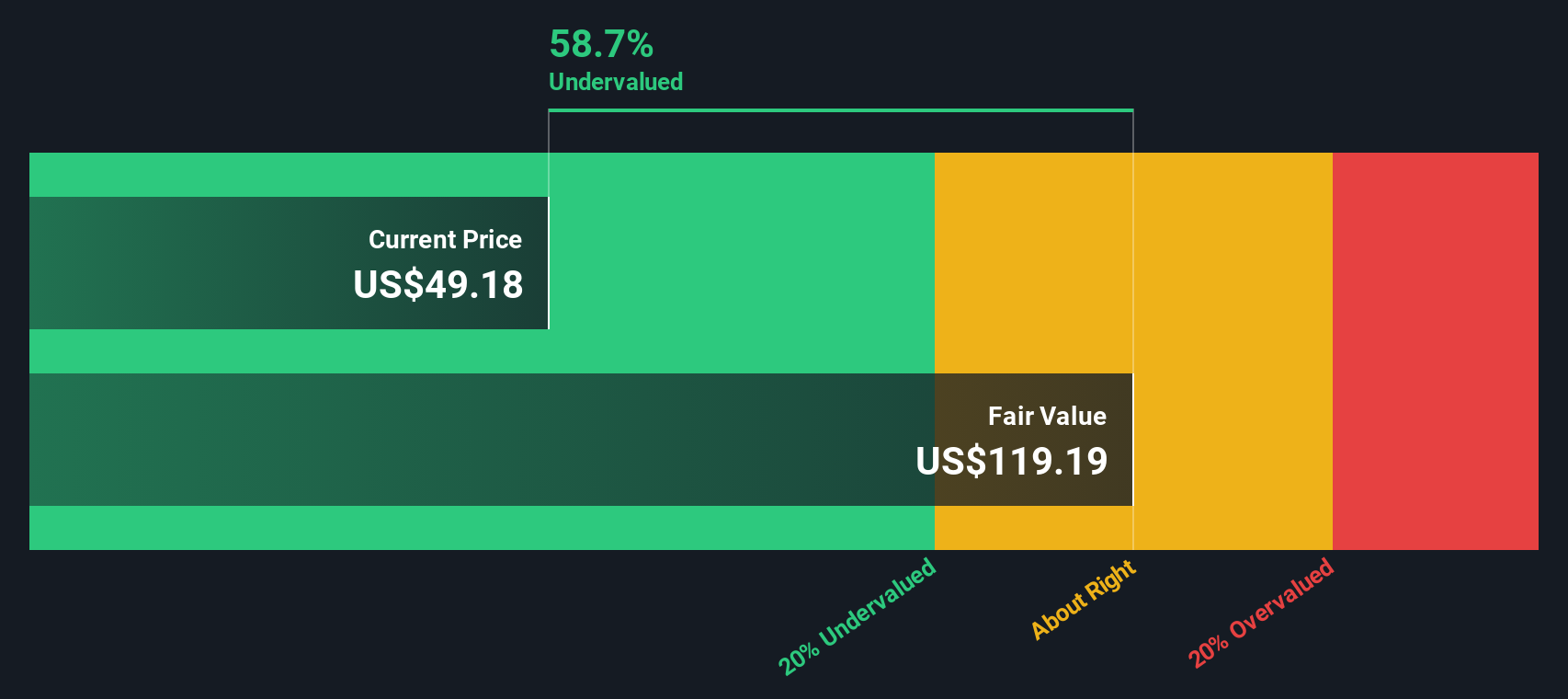

Taking a different approach, our DCF model paints a more optimistic picture and suggests XPEL is still undervalued in today's market. With different assumptions at play, could this model signal even more upside ahead?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own XPEL Narrative

If you want to dig deeper or believe there is another angle to this story, you can explore the numbers and build your own narrative in just a few minutes, too. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding XPEL.

Looking for More High-Potential Investing Opportunities?

If you are serious about making smart moves and staying ahead, don’t settle for yesterday’s winners. Get proactive and find other stocks that could deliver standout returns. Simply Wall Street’s powerful screeners surface fresh opportunities every day, so you do not have to hunt alone.

- Unlock hidden value by scanning for companies trading below their actual worth through our undervalued stocks based on cash flows and set yourself up for potential upside.

- Cash in on the income trend by targeting market leaders offering steady payouts via our dividend stocks with yields > 3%. This can help you put the power of compounding in your portfolio.

- Stay at the forefront of game-changing innovation by tapping into our AI penny stocks, where forward-thinkers are shaping the future with cutting-edge intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqCM:XPEL

XPEL

Manufactures, installs, sells, and distributes protective films, coatings and related services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)