- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Tesla’s (TSLA) Robotaxi Reveal And Leadership Shift Could Redefine The Investment Case

- Tesla presented at the Benchmark Mineral Intelligence Giga USA Conference in Washington D.C., with major investors like Cathie Wood and Gary Black recently reducing their stakes amidst anticipation for the upcoming robotaxi launch and renewed CEO focus.

- While Tesla is making moves to localize its battery supply chain and Elon Musk is refocusing on company leadership, investor debate intensifies around operational challenges, leadership shifts, and the critical robotaxi rollout.

- We'll explore how Elon Musk's renewed attention to Tesla and the anticipated robotaxi reveal could reshape the company's investment narrative.

Tesla Investment Narrative Recap

To be a Tesla shareholder today, you need to believe in the company’s vision for autonomous vehicles and its ability to maintain an innovation edge amid falling demand and intensifying competition. The biggest near-term catalyst remains the upcoming robotaxi launch, while the most immediate risk centers on declining vehicle sales and profitability, recent news around board moves and battery supply efforts does not materially alter these stakes.

The recent announcement that Tesla is moving away from reliance on Chinese battery suppliers is timely, but experts suggest it will take years before full independence is realized. This step matters as battery costs and supply chain resilience are foundational for Tesla’s future in autonomous mobility, especially as the robotaxi initiative draws closer.

Yet despite these forward-looking strategies, investors should be aware that issues around shrinking margins and unresolved leadership concerns may create complications if...

Read the full narrative on Tesla (it's free!)

Exploring Other Perspectives

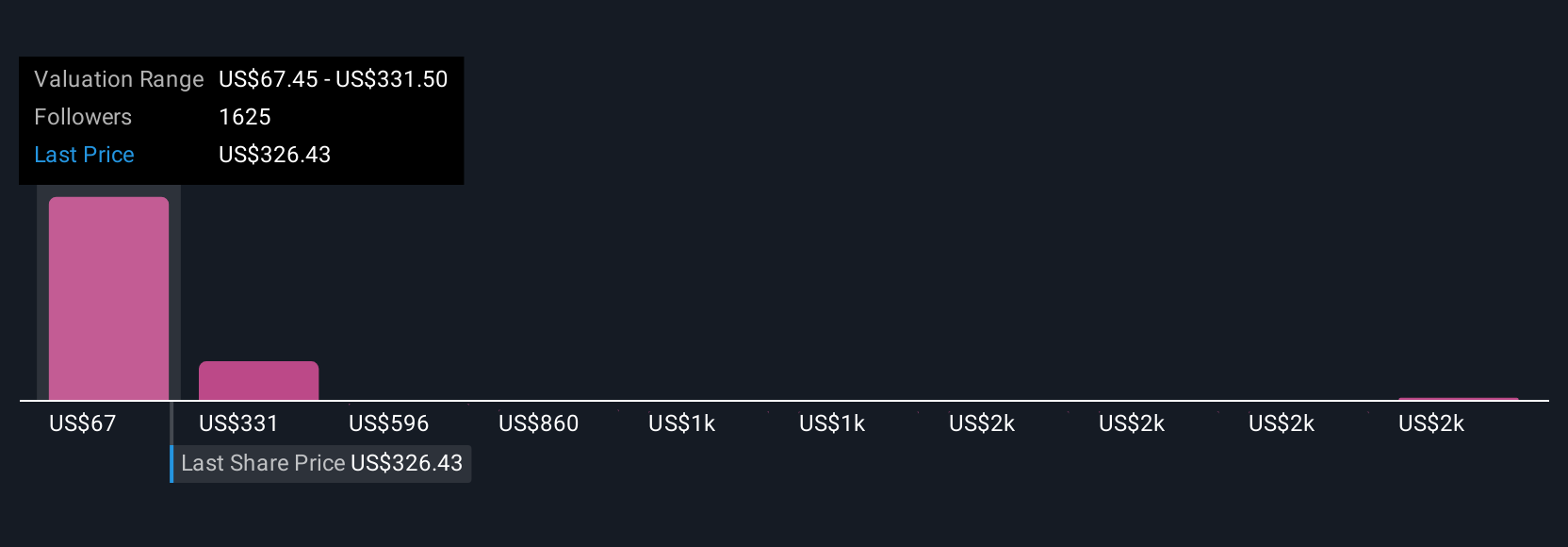

Simply Wall St Community members provided 188 unique fair value estimates for Tesla, from as low as US$1.10 to as high as US$1,000. As opinions diverge widely, shrinking profitability and operational risks remain front of mind in thinking about Tesla’s outlook.

Explore 188 other fair value estimates on Tesla - why the stock might be worth just $1.10!

Build Your Own Tesla Narrative

Disagree with existing narratives? Create your own in under 3 minutes , extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tesla research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Tesla research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tesla's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here, pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover the 22 stocks are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives