- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Tesla's Robotaxi and FSD Advances Might Change The Case For Investing In Tesla (TSLA)

Reviewed by Simply Wall St

- In recent days, Tesla announced advancements in autonomous driving, with its new robotaxi service in Austin set for a public launch and a more powerful Full Self-Driving software update expected by September, while also seeking broader regulatory approvals and expanding into the energy sector in the U.K.

- Analyst enthusiasm has grown as Tesla's robotaxi pilot reportedly offers rides at half the price of Uber and stands out for blending seamlessly with other cars, highlighting its distinctive approach in the competitive autonomous vehicle space.

- We'll explore how Tesla's planned robotaxi rollout and new Full Self-Driving software shape the outlook for its recurring software revenues.

Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

Tesla Investment Narrative Recap

To own Tesla stock, I think investors need to believe the company can scale its autonomous driving and robotaxi technology into high-margin, recurring software revenue, despite ongoing volatility in vehicle sales and rising operating costs. The recent jump in Tesla shares after the Fed's comments is a sentiment boost, but the near-term catalyst remains regulatory approval for wider robotaxi rollout, which is still a hurdle, so the news does not fundamentally alter the biggest risk of slow monetization outside the US.

One particularly relevant announcement is the advancement of Tesla’s Full Self-Driving software, with a more powerful model expected by September. This update underpins confidence in Tesla’s push toward a software-driven business but also reinforces that the company’s ability to convert innovation into widespread, approved commercial services, and thus unlock meaningful new revenue, still depends heavily on regulatory timelines.

However, it’s important to remember that while these technological milestones attract attention, investors also need to be mindful of the margin pressures arising from...

Read the full narrative on Tesla (it's free!)

Tesla's outlook anticipates $148.1 billion in revenue and $15.4 billion in earnings by 2028. This implies an annual revenue growth rate of 16.9% and a $9.5 billion increase in earnings from the current $5.9 billion level.

Uncover how Tesla's forecasts yield a $306.32 fair value, a 10% downside to its current price.

Exploring Other Perspectives

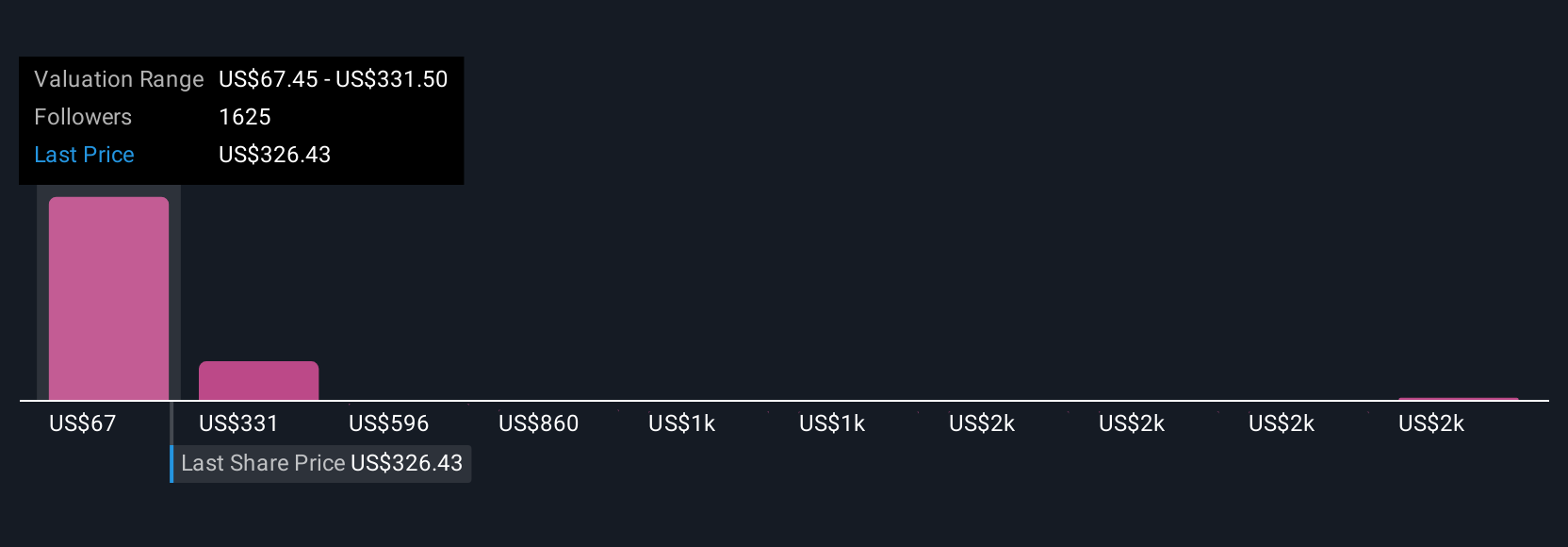

With 228 fair value estimates from the Simply Wall St Community, targets for Tesla range from US$67 to US$2,707 per share. While optimism surrounds autonomous robotaxi adoption, delays in regulatory approvals could have far-reaching effects on Tesla’s pace of software monetization, explore these contrasting viewpoints to inform your perspective.

Explore 228 other fair value estimates on Tesla - why the stock might be worth over 7x more than the current price!

Build Your Own Tesla Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tesla research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Tesla research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tesla's overall financial health at a glance.

No Opportunity In Tesla?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives