- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Tesla (TSLA) Is Up 6.7% After Q2 Results Amid Analyst Debate on Growth Path – Has The Bull Case Changed?

Reviewed by Simply Wall St

- Tesla recently reported its second-quarter operating results, producing 410,244 vehicles and deploying 9.6 GWh of energy storage products, amid continued focus on autonomous vehicles and energy solutions.

- The news highlights a split among analysts regarding Tesla's growth path, with ongoing debate about delivery rates, growing competition, and the impact of new initiatives in autonomy and robotics.

- We'll explore how concerns over persistent delivery challenges and competition may influence Tesla's investment narrative and future outlook.

Tesla Investment Narrative Recap

To be a Tesla shareholder today, you need to believe in the company's ability to execute on large-scale autonomy and robotics, which underpin investor optimism about future revenue growth. The latest production numbers confirm Tesla's strong operational capacity, but persistent delivery challenges and stiffening competition remain key near-term risks. For now, these operating results do not appear to materially alter the biggest risk facing Tesla: its high execution risk around autonomous vehicles and robotics.

Among Tesla's recent news, the planned expansion of its robotaxi service to the San Francisco Bay Area stands out. With regulatory approval pending, this move is closely tied to Tesla's most important growth catalyst, autonomous vehicle deployment, which investors see as central to justifying the company's high valuation and future revenue potential.

In contrast, investors should also consider how ongoing competition in the autonomous vehicle space could…

Read the full narrative on Tesla (it's free!)

Tesla's outlook anticipates $151.6 billion in revenue and $14.7 billion in earnings by 2028. This is based on analysts assuming a 16.6% annual revenue growth rate and a $8.6 billion increase in earnings from the current $6.1 billion.

Uncover how Tesla's forecasts yield a $289.43 fair value, a 8% downside to its current price.

Exploring Other Perspectives

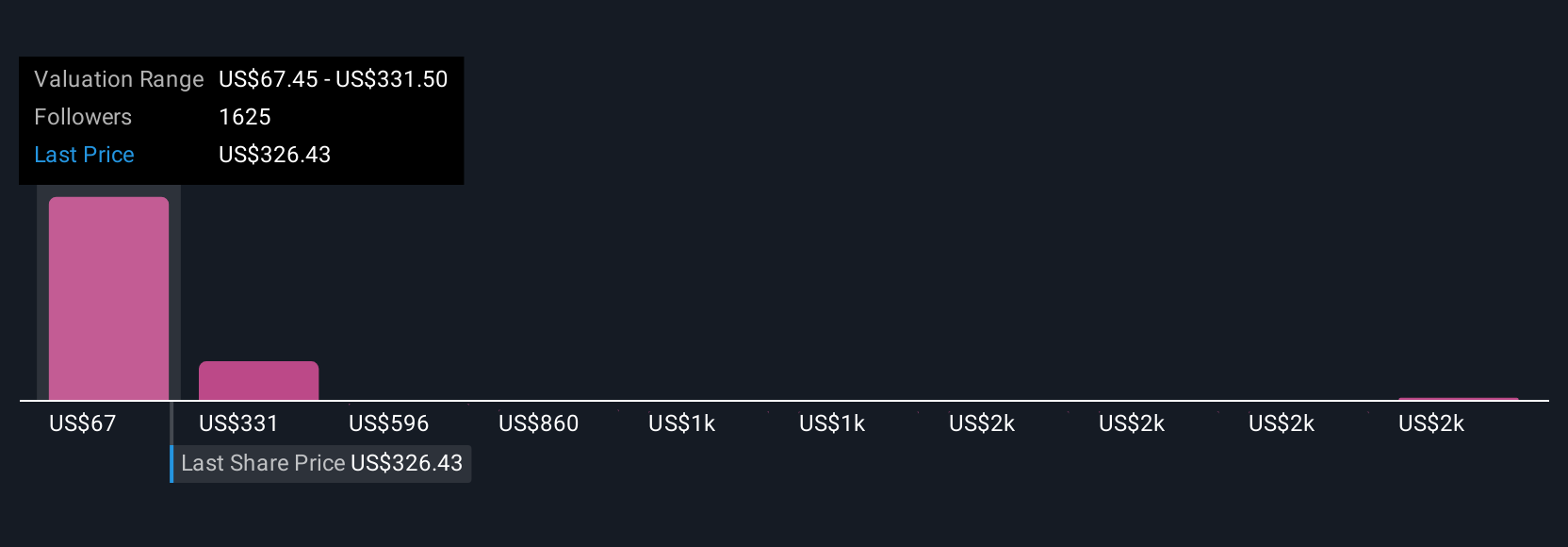

With 206 member-sourced fair value estimates for Tesla ranging from US$67 to US$2,708, opinions across the Simply Wall St Community are strikingly wide. While many focus on autonomy as the growth engine, persistent execution risks continue to shape expectations and could influence both outlooks and price targets.

Build Your Own Tesla Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tesla research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Tesla research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tesla's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives