- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Tesla (TSLA): Exploring Valuation as Short-Term Momentum Cools but Longer-Term Gains Stand Out

Reviewed by Simply Wall St

Tesla (TSLA) shares are always in the spotlight, so it is worth checking how the stock has moved recently and what may be behind it. Over the past month, Tesla is down about 4%, but has gained nearly 19% in the past 3 months.

See our latest analysis for Tesla.

After a sharp rally in recent months, Tesla's momentum seems to be moderating, with a 1-year total shareholder return of 23.4% and the latest share price closing at $417.78. While the short-term price retracement has caught attention, the stock’s longer-term gains remain impressive by industry standards.

If Tesla’s latest move has you thinking about what’s next in the auto sector, now might be the perfect time to explore See the full list for free.

With Tesla’s performance diverging over different timeframes, the critical question now is whether the stock remains undervalued after its climb, or if the market has already priced in all future growth potential. Does this present a genuine buying opportunity?

Most Popular Narrative: 1.8% Undervalued

Tesla's latest close of $417.78 sits just below the narrative’s assigned fair value of $425, making the stock a near-match in pricing but hinting at some remaining room to run. According to BlackGoat's widely followed viewpoint, investors are now contending with Tesla’s transformation story, and the market’s repricing could signal a pivotal moment for future returns.

Tesla is undergoing a transformation that extends far beyond its roots as an EV manufacturer. The company is methodically constructing an ecosystem that spans AI, robotics, energy, and autonomous mobility, creating an entirely new paradigm for technology-driven industry disruption.

Curious what’s powering this bold forecast? There is a fundamental growth theme here, along with future profit margins worthy of a tech giant. Find out which financial levers and valuation bets drive this surprisingly ambitious fair price. See what sets the narrative apart from consensus.

Result: Fair Value of $425 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in full self-driving approval or competitive pressure from Chinese EV makers could challenge the bullish narrative and quickly shift investor sentiment.

Find out about the key risks to this Tesla narrative.

Another View: Multiples Tell a Different Story

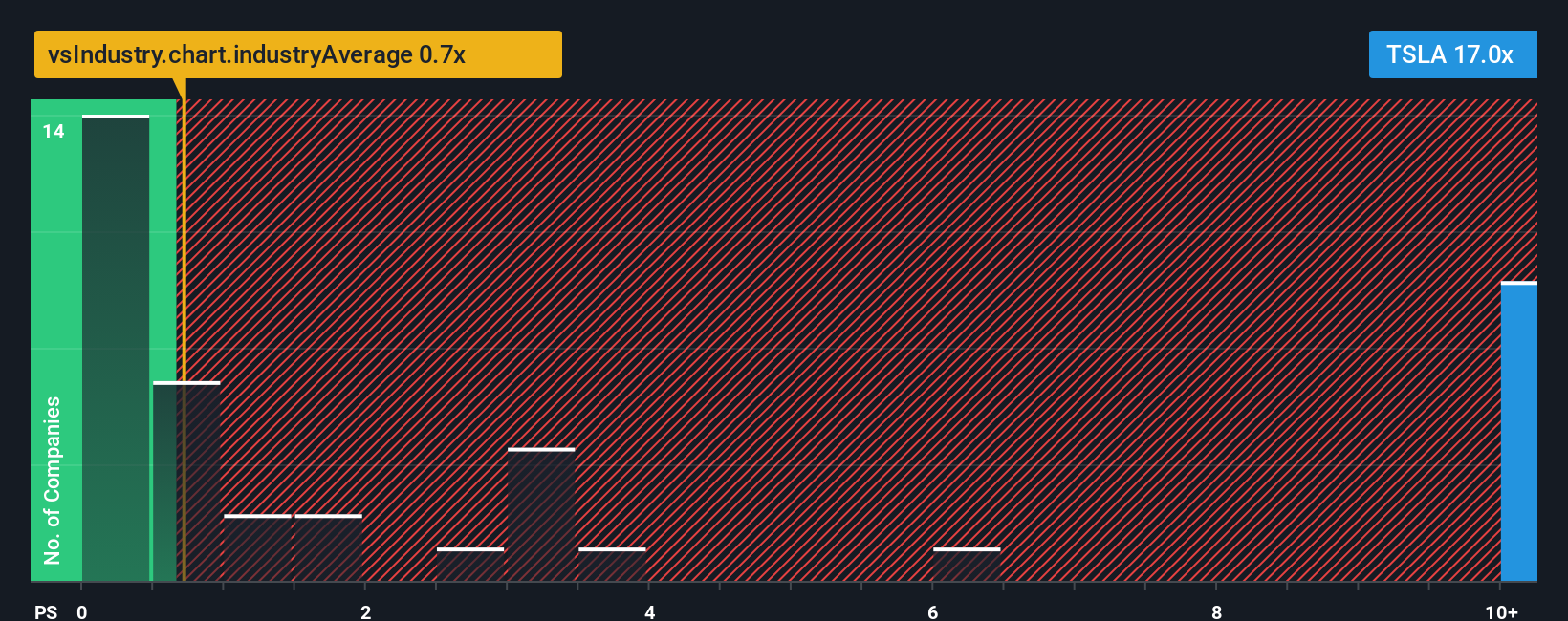

Taking a closer look at valuation through sales multiples, Tesla stands out as far more expensive than its peers. Its price-to-sales ratio of 14.5x is much higher than the US auto industry average of 0.8x and its peer average of 1x. Even the fair ratio for Tesla is estimated at just 3.4x, which highlights significant valuation risk if the market moves toward more typical levels. Does this rich premium suggest confidence in Tesla’s growth engine, or does it leave investors exposed if expectations slip?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tesla Narrative

If you have your own take on Tesla’s story or want to dig deeper into the numbers, you can put together a unique perspective in under three minutes, and Do it your way

A great starting point for your Tesla research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Do not miss the chance to find your next smart move. Let Simply Wall Street’s tools accelerate your investing journey with powerful new insights.

- Unlock the potential for high yields by targeting income opportunities through these 14 dividend stocks with yields > 3%, offering attractive returns above 3%.

- Seize the AI revolution by tapping into growth stories among these 26 AI penny stocks, leading the charge in advanced automation and intelligent technologies.

- Zero in on hidden value with these 917 undervalued stocks based on cash flows that the market may be overlooking based on strong underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026