- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Tesla (NasdaqGS:TSLA) Climbs 13% On Rumors Of Potential Deal With Nissan

Reviewed by Simply Wall St

Tesla (NasdaqGS:TSLA) recently experienced a 12.5% increase in its share price over the past week, a move potentially influenced by rumors of Tesla's proposed strategic investment in Nissan Motor Co. This follows reports of a high-level Japanese group's proposition led by former Tesla board member Hiro Izumi, suggesting Tesla acquire Nissan's U.S. operations. Although CEO Elon Musk denied these claims, emphasizing Tesla's unique production capabilities, the market reacted positively to the speculation. Concurrently, Tesla's agreement with WattEV for the delivery of 40 Semi trucks in 2026 further showcased its strengthening capability in the freight sector, potentially bolstering investor confidence. Meanwhile, despite broader market challenges, including a recent sell-off that led the Nasdaq to decline, Tesla's specific developments appear to have supported its recent price performance amidst mixed market movements.

Dive into the specifics of Tesla here with our thorough balance sheet health report.

Over the past five years, Tesla's total shareholder return was an impressive 763.41%, showcasing the company's exceptional growth trajectory. Throughout this period, pivotal events appear to have shaped its performance. The company achieved record production and deliveries in Q4 2024, with 459,000 vehicles produced and over 495,000 delivered, reflecting operational strength. Tesla's decision to allow General Motors customers access to over 17,800 Tesla Superchargers, announced in September 2024, could have bolstered its position in expanding charging infrastructure.

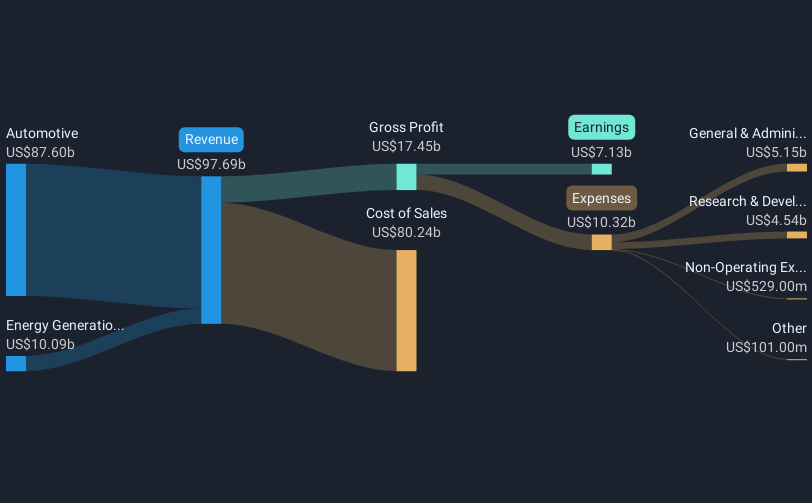

Tesla's impressive long-term performance contrasts with challenges it faced, like the significant decline in net income to US$7.09 billion in 2024. Despite earnings issues, Tesla exceeded the US auto industry return of 37.4% over the past year. Furthermore, discussions regarding potential M&A with Nissan stirred investor interest in early 2025, although CEO Elon Musk dismissed these as mere rumors. These factors, combined with broader market conditions, underscore Tesla’s robust five-year growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives