- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Did Record Deliveries and Musk’s Pay Debate Shift Tesla’s (TSLA) Investment Narrative?

Reviewed by Sasha Jovanovic

- In the past week, Tesla announced record third-quarter vehicle deliveries driven by customers rushing to secure expiring US$7,500 EV tax credits, while also launching cheaper Standard Range versions of the Model Y and Model 3. Meanwhile, the company has faced heightened debate over CEO Elon Musk’s proposed pay package, as proxy advisor ISS encouraged shareholders to vote against it ahead of the upcoming annual meeting.

- These developments highlight the tension between Tesla’s immediate sales momentum, investor concerns over leadership governance, and uncertainty about the company’s trajectory as it transitions towards AI and autonomous technology platforms.

- We’ll examine how the strong vehicle delivery numbers and upcoming governance votes could influence Tesla’s evolving investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Tesla Investment Narrative Recap

To own Tesla shares today, you need to believe not just in the company’s vision for autonomous driving and AI-enabled mobility, but also in its ability to execute amid fierce competition and volatility in demand. This week’s record vehicle deliveries, largely fueled by customers acting before the expiry of the US$7,500 EV tax credit, provided short-term momentum but don’t materially change the biggest near-term catalyst: Tesla’s ongoing rollout of autonomous robotaxi services. The overriding risk remains whether Tesla can sustain U.S. demand as consumer incentives end and profit margins tighten.

The most relevant recent announcement is the launch of more affordable “Standard Range” Model Y and Model 3 vehicles. While this move broadens Tesla’s accessible product lineup ahead of an uncertain post-incentive market, investor reaction was muted over concerns the lower prices could pressure gross margins and signal waning pricing power, factors closely tied to Tesla’s ability to fund its AI and autonomous ambitions.

But beneath the strong sales headlines, investors should also be watching for growing debate around CEO governance and how it might impact...

Read the full narrative on Tesla (it's free!)

Tesla's outlook anticipates $148.1 billion in revenue and $15.4 billion in earnings by 2028. This projection assumes a 16.9% annual revenue growth rate and a $9.5 billion increase in earnings from the current $5.9 billion.

Uncover how Tesla's forecasts yield a $366.77 fair value, a 18% downside to its current price.

Exploring Other Perspectives

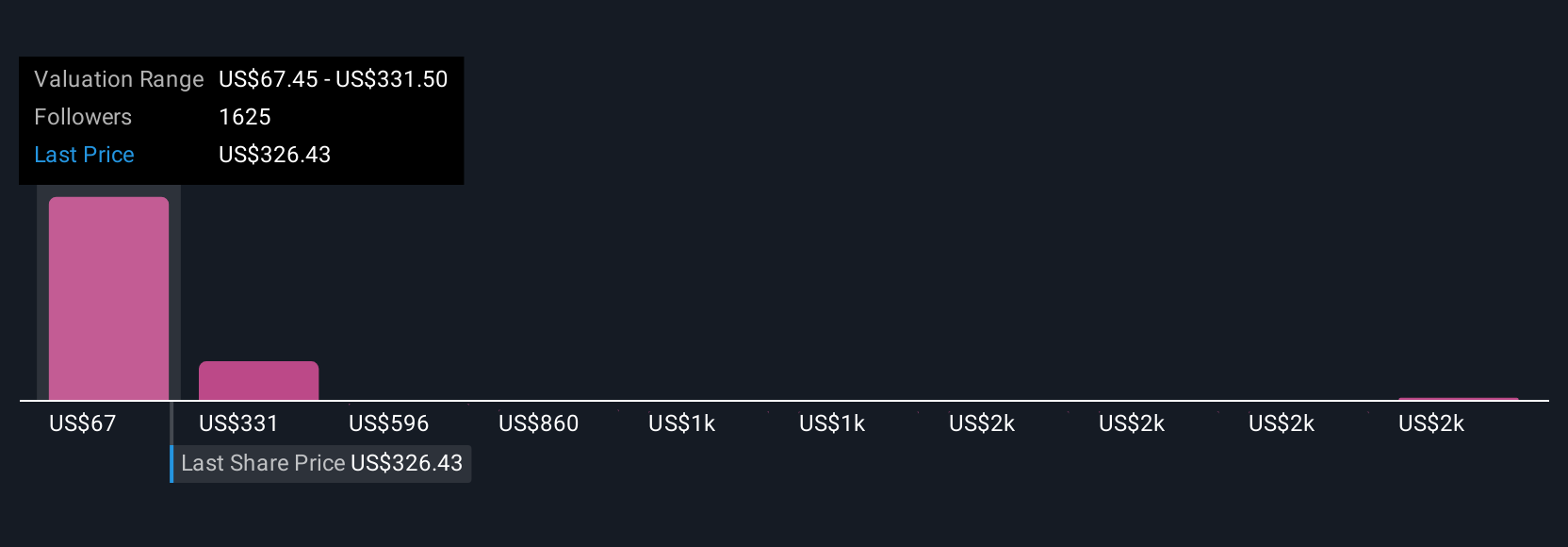

Simply Wall St Community members submitted 228 fair value estimates for Tesla, from as low as US$67.45 to US$2,707.91 per share. With lower margins and the post-tax credit demand risk in focus, check out how sharply these views diverge.

Explore 228 other fair value estimates on Tesla - why the stock might be worth less than half the current price!

Build Your Own Tesla Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tesla research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Tesla research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tesla's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives