- United States

- /

- Auto

- /

- NasdaqGS:RIVN

Rivian Automotive (RIVN) Is Down 10.5% After Cutting 2025 Delivery Guidance and Disclosing Regulatory Probes

Reviewed by Sasha Jovanovic

- Rivian Automotive recently narrowed its full-year 2025 delivery guidance to 41,500–43,500 vehicles and reported the launch of regulatory investigations related to seatbelt safety and emissions standards, leading to financial headwinds and lost revenue from weakened zero-emission vehicle credits.

- This combination of softer demand projections, impending expiration of federal EV tax credits, and ongoing regulatory scrutiny signals operational and competitive pressures for Rivian, just as the industry grapples with changing subsidy and tariff landscapes.

- We'll explore how Rivian's reduced vehicle delivery outlook and regulatory pressures are now influencing its evolving investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Rivian Automotive Investment Narrative Recap

To be a Rivian shareholder, you have to believe in the company’s ability to drive long-term adoption of its electric vehicles, scale its cost-reduced R2 platform, and overcome near-term margin pressures. The recent reduction in 2025 vehicle delivery guidance and new regulatory investigations highlight that the biggest risk right now is execution, both operational and financial, while the clearest short-term catalyst remains the launch and ramp of the upcoming, more affordable R2 model. These developments materially impact confidence in both risk and catalyst timelines.

Among Rivian’s latest announcements, the groundbreaking of its new Georgia manufacturing facility stands out. This expansion is directly tied to future R2 and R3 models, linking Rivian’s long-term growth potential to its ability to address current operational challenges and deliver on production promises, a key factor as market attention pivots to the post-tax credit era and the R2 launch’s role in driving volumes.

Yet, with regulators scrutinizing critical safety issues and subsidies fading, investors should be mindful that…

Read the full narrative on Rivian Automotive (it's free!)

Rivian Automotive's narrative projects $15.7 billion revenue and $788.9 million earnings by 2028. This requires 44.9% yearly revenue growth and a $4.3 billion increase in earnings from the current -$3.5 billion.

Uncover how Rivian Automotive's forecasts yield a $14.26 fair value, a 4% upside to its current price.

Exploring Other Perspectives

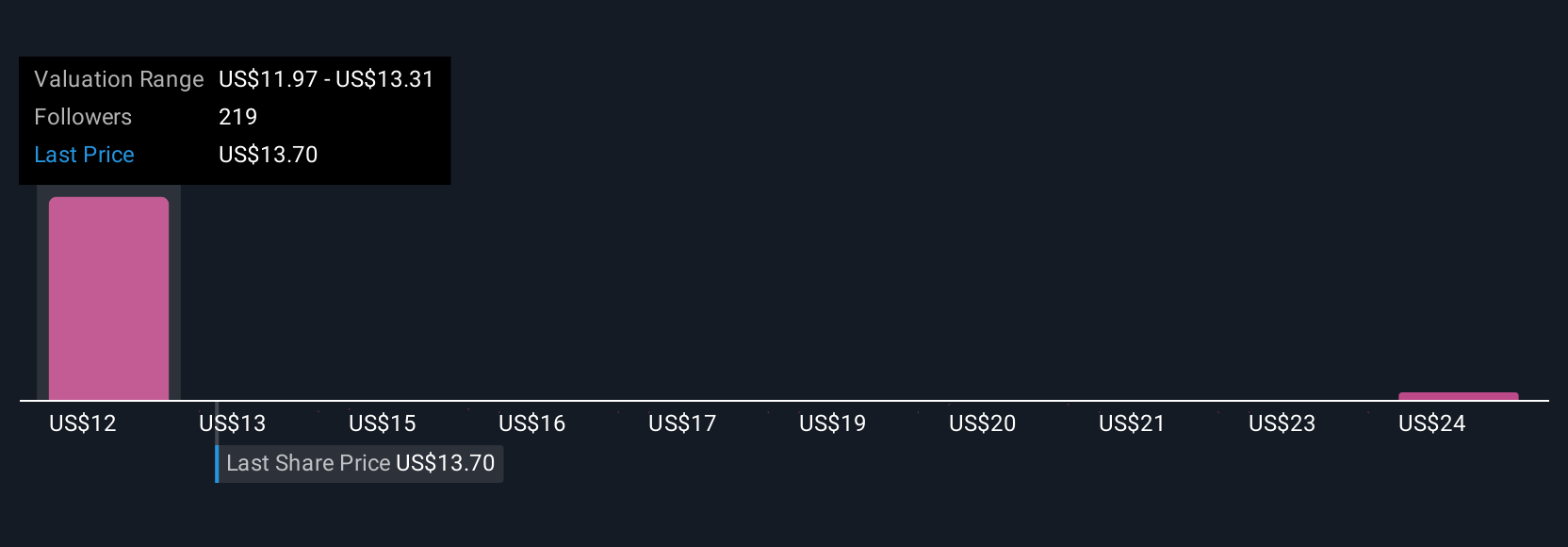

Sixteen members of the Simply Wall St Community provided fair value estimates for Rivian stock, ranging from US$8.25 to US$25.41. While some forecast robust growth, recent delivery guidance cuts spotlight execution risks that could affect profitability and shareholder outcomes, consider how your perspective aligns with these varied viewpoints.

Explore 16 other fair value estimates on Rivian Automotive - why the stock might be worth as much as 86% more than the current price!

Build Your Own Rivian Automotive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rivian Automotive research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Rivian Automotive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rivian Automotive's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RIVN

Rivian Automotive

Designs, develops, manufactures, and sells electric vehicles and accessories.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026