- United States

- /

- Auto

- /

- NasdaqGS:RIVN

Rivian Automotive (RIVN) Expands With New East Coast HQ in Atlanta

Reviewed by Simply Wall St

Rivian Automotive (RIVN) has been actively expanding its operations, with recent developments including the establishment of a new East Coast headquarters in Atlanta and a new service center in Quebec. These efforts reflect the company's focus on enhancing its presence and infrastructure. However, RIVN's stock price saw a 3.8% decline over the past month. This decline aligns with broader market trends, as stocks experienced downturns due to weak job reports and heightened tariff concerns, which may have exerted downward pressure on the company despite their operational expansions.

Rivian Automotive has 2 risks we think you should know about.

Rivian Automotive's recent expansion with a new headquarters in Atlanta and a service center in Quebec could bolster its operational capabilities, potentially impacting future revenue and earnings positively. However, these developments coincide with a 3.8% share price decline over the past month, partly in line with broader market trends influenced by weak job reports and tariff concerns.

Over the past year, Rivian's total shareholder returns, including both share price and dividends, saw a 15.90% decline. Compared to the US Auto industry, which returned 37.1% in the past year, Rivian underperformed significantly. This suggests a challenging year for the company amid industry-specific and broader market pressures.

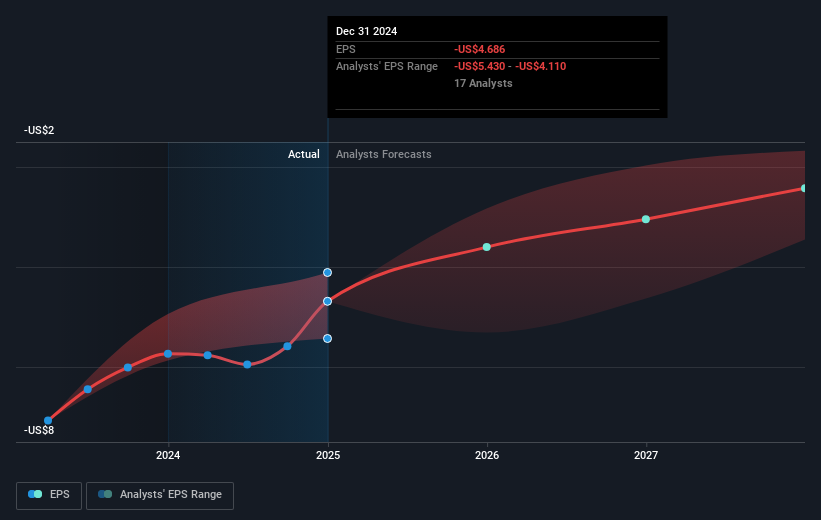

The news of operational expansions potentially impacts future revenue and earnings forecasts by enhancing production efficiency and infrastructure, creating a more robust foundation for Rivian's R2 platform and AI-centric driving initiatives. Rivian's revenue is forecasted to grow at 31.4% annually, while the company remains unprofitable in the near term.

In terms of valuation, Rivian's current share price of US$12.38 sits below the analyst consensus price target of US$14.80, representing a 19.19% discount. Investors may weigh the potential for growth against the risks associated with achieving profitability and meeting ambitious revenue and margin goals.

Our valuation report here indicates Rivian Automotive may be overvalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RIVN

Rivian Automotive

Designs, develops, manufactures, and sells electric vehicles and accessories.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives