- United States

- /

- Auto

- /

- NasdaqGS:RIVN

Rivian Automotive (NasdaqGS:RIVN) Updates 2025 Delivery Goals and Reports Reduced Losses

Reviewed by Simply Wall St

Rivian Automotive (NasdaqGS:RIVN) recently revised its production guidance, aiming to deliver 40,000 to 46,000 vehicles in 2025, which, along with its improved earnings report for Q1 2025, showing higher revenue and a reduced net loss, likely bolstered its share price by 20% over the past month. The company's positive developments contrast slightly with a market that remained relatively unchanged, as investors awaited Federal Reserve decisions and international trade talks. These actions by Rivian provided a catalyst for its outperformance against a backdrop of mixed market activity.

Rivian Automotive's recent production guidance revision and improved Q1 2025 earnings report are expected to bolster its long-term outlook. With a projected delivery target of 40,000 to 46,000 vehicles for 2025 and advancements in production efficiency, these developments align with analysts' expectations for revenue growth. Rivian's shares have appreciated 31.71% over the past year, demonstrating robust performance compared to the US Auto industry, which saw greater returns over the same period. While its shares have recently risen by 20% shortly after the news, the current share price remains slightly below the consensus price target of US$14.26, indicating a modest potential for further appreciation.

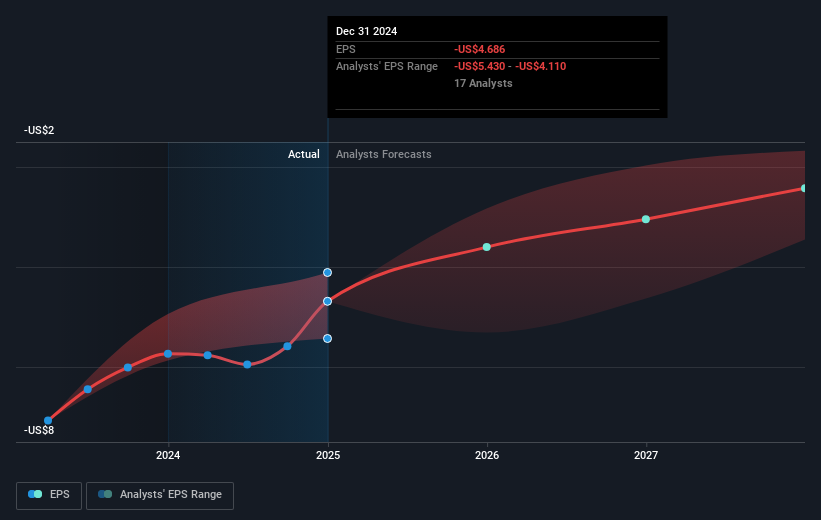

The company's revenue and earnings forecasts may benefit from improved cost structures and product offerings, potentially leading to better margins. The anticipated launch of the R2 platform with enhanced materials efficiency is likely to contribute to future profitability. However, analysts remain cautious, as Rivian is not expected to reach profitability within the next three years. As of now, the share price stands at US$13.3, representing a 6.8% discount to the analyst price target, suggesting that the market perceives Rivian to be fairly valued, though future developments could alter this perspective.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RIVN

Rivian Automotive

Designs, develops, manufactures, and sells electric vehicles and accessories.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives