- United States

- /

- Auto

- /

- NasdaqGS:RIVN

Rivian Automotive (NasdaqGS:RIVN) Reports Q2 Production Figures and Reaffirms 2025 Guidance

Reviewed by Simply Wall St

Rivian Automotive (NasdaqGS:RIVN) recently announced its operating results and reaffirmed its production guidance for 2025. The company produced 5,979 vehicles and delivered 10,661 in Q2, maintaining its delivery goal of 40,000 to 46,000 for the year. This steady performance might have supported Rivian's 7.85% share price increase over the last quarter. Despite an overall flat tech market, Rivian's production and guidance announcements added weight to its positive stock movement. Broader market trends, including gains in major indices like the S&P 500 and Nasdaq, boosted stocks in the technology and EV sectors, also supporting Rivian's upward trajectory.

We've identified 2 weaknesses for Rivian Automotive that you should be aware of.

The recent developments discussed in the introduction could significantly influence Rivian Automotive's narrative. With the reaffirmation of its production guidance for 2025 and steady Q2 deliveries, Rivian's progress indicates potential for enhanced production efficiency and financial fortitude. These advancements could improve revenue and profitability forecasts as the company's R2 platform and AI-centric driving technology become operational, particularly in the new Georgia facility.

However, the company's total return over the last year was a 9.54% decline, suggesting cautious investor sentiment. In contrast, over the past year, Rivian underperformed both the US Auto industry, which returned 41.6%, and the broader US market, which gained 13.9%. This highlights the company's challenging positioning in a competitive market despite its recent positive news.

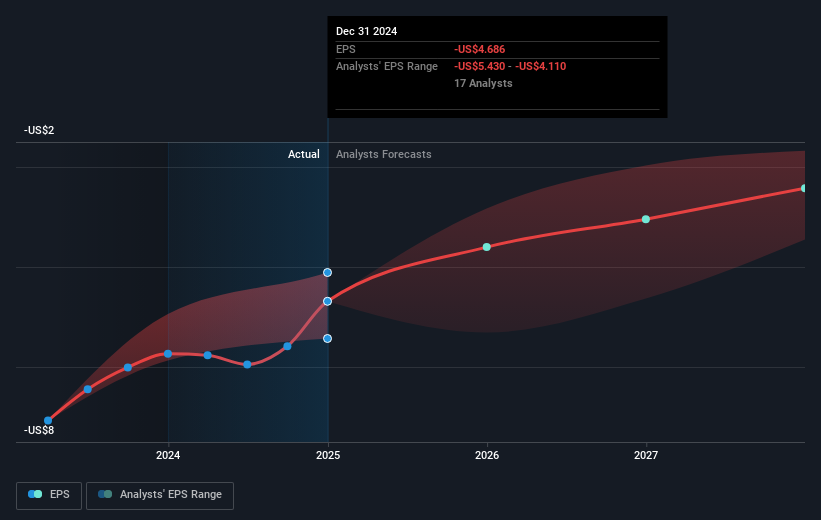

Rivian's share price movements in the context of the consensus price target further underline the mixed outlook. The share price increase of 7.85% last quarter is offset by the overall share price being 5.1% below analysts' price target of US$14.23. While the reaffirmed production targets and technological advancements aim to boost earnings and revenue, the market remains cautious, as Rivian is not expected to reach profitability within the next three years, affecting its longer-term valuation and investor confidence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RIVN

Rivian Automotive

Designs, develops, manufactures, and sells electric vehicles and accessories.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives