- United States

- /

- Auto Components

- /

- NasdaqGS:MBLY

Mobileye (MBLY): Valuation in Focus Following Deutsche Bank Upgrade and Anticipated Partnerships

Reviewed by Kshitija Bhandaru

Mobileye Global (MBLY) has seen a wave of renewed interest after Deutsche Bank upgraded its rating to "buy." This has sparked curiosity about what upcoming partnerships and company updates could mean for the stock’s direction.

See our latest analysis for Mobileye Global.

Even with the recent attention from Deutsche Bank’s upgrade and talk of new partnerships, Mobileye Global’s share price has swung lower, down nearly 29% year-to-date, even as its total shareholder return over the past year is up more than 10%. This hints that optimism among investors is just starting to rebuild after a tough stretch.

If the renewed buzz around Mobileye has you thinking bigger, this is an ideal moment to broaden your search and discover See the full list for free.

With shares trading well below recent analyst targets and anticipation building ahead of company updates, investors may wonder whether Mobileye Global is trading at an attractive discount or if the market is already factoring in the company’s future growth.Most Popular Narrative: 27.6% Undervalued

Mobileye Global’s current share price sits well below the narrative’s fair value estimate, setting up a sharp mismatch between market caution and growth projections. This divergence asks whether the market is missing something about the company’s outlook.

"The partnership with leading platforms like Uber and Lyft for the integration of Mobileye Drive is positioned to significantly enhance Mobileye’s revenue streams through upfront sales and recurring license fees tied to utilization rates. Expansion in partnerships, such as the new engagement with a European OEM after 8 years, portrays increasing market share and potential uplift in revenue due to wider adoption of Mobileye's technology."

Want to know what numbers are driving Mobileye’s bold future? There is a cash surge, margin turnaround, and a valuation logic rarely seen in this industry. Curious how these pieces fit together? Unlock the full narrative to see which projections justify this aggressive target.

Result: Fair Value of $19.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued uncertainty in global vehicle production and new tariffs could sharply impact Mobileye’s growth story and test the market’s renewed optimism.

Find out about the key risks to this Mobileye Global narrative.

Another View: What Do Sales Multiples Say?

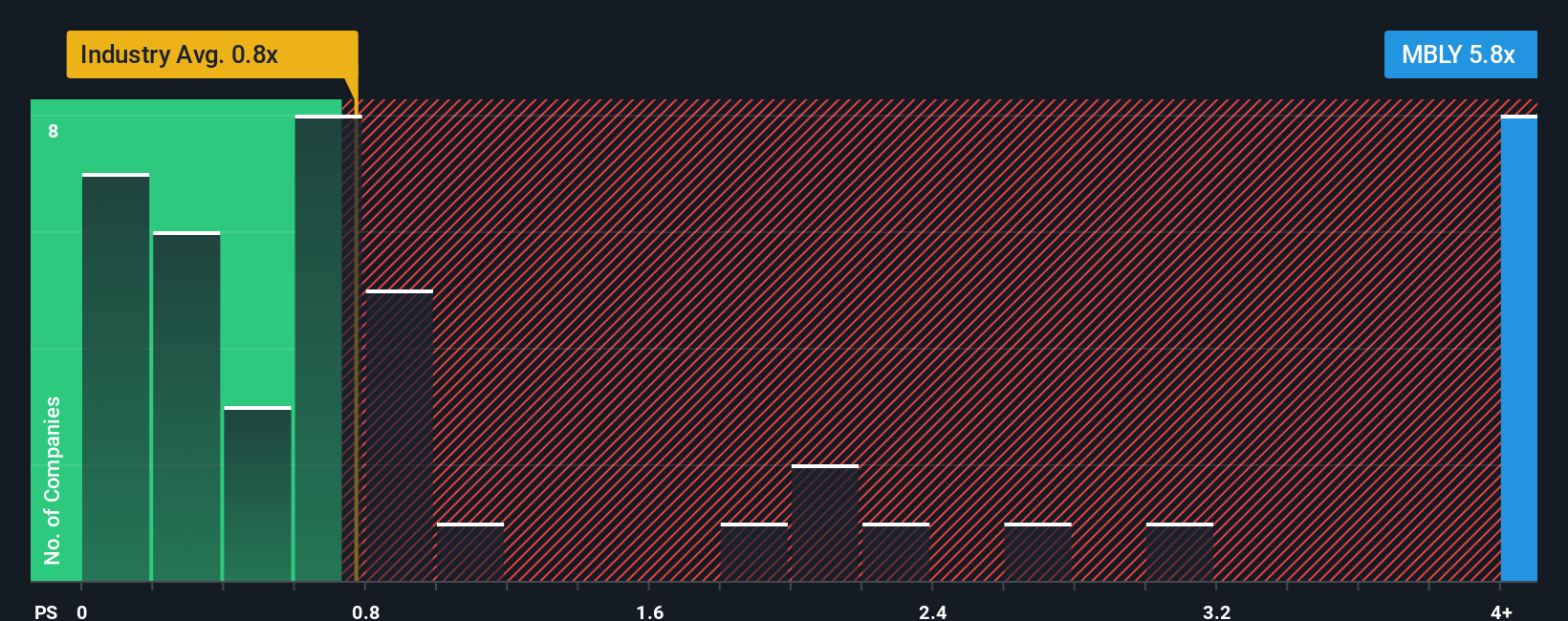

While fair value estimates point to Mobileye Global being undervalued, a quick look at its price-to-sales ratio tells a different story. The company trades at 6x sales, making it much more expensive than both the US Auto Components industry average of 0.7x and the peer average of 1.3x. Even compared to a fair ratio of 4.6x, Mobileye shares are priced for high expectations. This raises the question: is the market overestimating future growth, or is there still untapped upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mobileye Global Narrative

If you have a different perspective or would rather dive into the numbers on your own, you can easily craft your own view in minutes. Go ahead and Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Mobileye Global.

Looking for More Investment Ideas?

Don’t limit your strategy to just one company. There are more compelling stocks signaling opportunity right now. Supercharge your portfolio by targeting the sectors making headlines this year. Real growth may be available for investors who act now.

- Find high-yield opportunities and tap into growing income streams with these 19 dividend stocks with yields > 3% that have consistently delivered strong dividends above 3%.

- Seize the momentum in transformative tech by scanning these 24 AI penny stocks poised to benefit as artificial intelligence reshapes every corner of the market.

- Ride the wave of innovation and rapid growth by checking out these 3582 penny stocks with strong financials where overlooked companies are set for breakout potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MBLY

Mobileye Global

Develops and deploys advanced driver assistance systems (ADAS) and autonomous driving technologies and solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives