- United States

- /

- Auto Components

- /

- NasdaqGS:MBLY

Mobileye (MBLY) Valuation Check as Quant Models Signal Potential Bullish Reversal After Recent Volatility

Reviewed by Simply Wall St

Mobileye Global (MBLY) just swung from a sharp valuation driven selloff to flashing early signs of a potential trend shift, as quantitative models flag a bullish tilt helped by the possibility that interest rate cuts could support growth stocks.

See our latest analysis for Mobileye Global.

Those signals are arriving after a tough stretch, with the latest share price at $11.78 and a year to date share price return of negative 41.16 percent. The 1 year total shareholder return of negative 31.03 percent shows longer term momentum has been weak but could be stabilizing as growth expectations and risk appetite start to thaw.

If Mobileye’s setup has you rethinking where the next big move might come from, it could be worth scouting other high growth tech and AI stocks that are starting to catch market attention.

With revenue still growing fast, losses narrowing and the share price trading at a steep discount to analyst targets, investors now face a key question: Is Mobileye a mispriced growth story, or is the market already discounting its next leg higher?

Most Popular Narrative Narrative: 39.1% Undervalued

With Mobileye Global’s fair value set well above the recent 11.78 dollar close, the most followed narrative paints a far more optimistic long term path.

The partnership with leading platforms like Uber and Lyft for the integration of Mobileye Drive is positioned to significantly enhance Mobileye’s revenue streams through upfront sales and recurring license fees tied to utilization rates.

Curious why this narrative believes today’s losses can flip into scalable, high margin software style cash flows, and still justify a premium future earnings multiple?

Result: Fair Value of $19.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering uncertainty around global light vehicle production and slower OEM adoption of advanced systems could delay achieving the scale needed to unlock those premium multiples.

Find out about the key risks to this Mobileye Global narrative.

Another Angle on Valuation

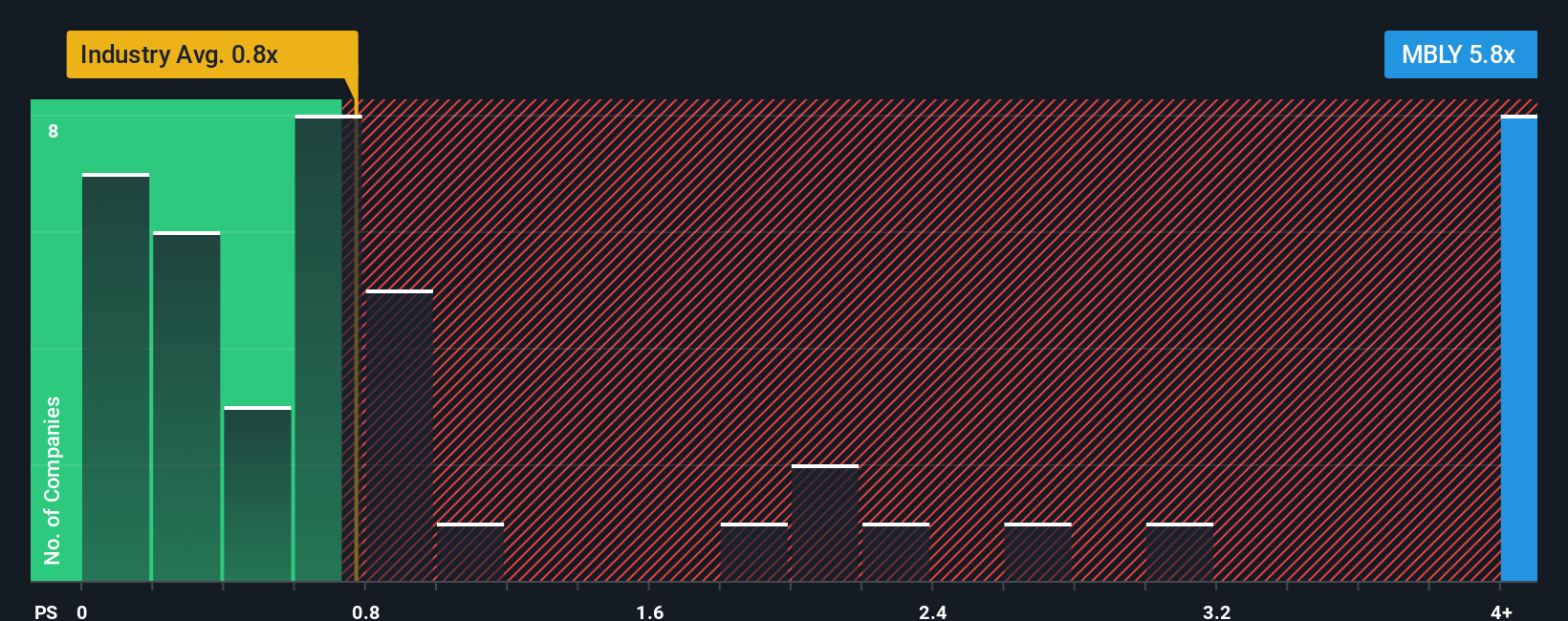

Our fair ratio lens tells a different story. Mobileye trades at a 4.9 times price to sales ratio, well above both the US Auto Components industry at 0.7 times and peers at 1.2 times, and even above its own fair ratio at 3.5 times. This raises the risk that sentiment, not fundamentals, is doing the heavy lifting right now.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mobileye Global Narrative

If the story so far does not quite fit your view, explore the numbers yourself and build a tailored thesis in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Mobileye Global.

Ready for your next investing move?

Put your research to work now, and use the Simply Wall St Screener to pinpoint stocks that match your strategy before the market prices in their potential.

- Capture growth trends by targeting these 24 AI penny stocks positioned at the heart of the artificial intelligence boom.

- Explore income potential with these 14 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow through market cycles.

- Look for mispriced opportunities using these 932 undervalued stocks based on cash flows where current prices may still lag behind future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MBLY

Mobileye Global

Develops and deploys advanced driver assistance systems (ADAS) and autonomous driving technologies and solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026