- United States

- /

- Auto

- /

- NasdaqGS:LI

What Li Auto (LI)'s Lower Delivery Guidance Means for Shareholders

Reviewed by Simply Wall St

- Li Auto Inc. reported its August 2025 delivery update and issued third quarter guidance, projecting vehicle deliveries between 90,000 and 95,000 and total revenues between RMB 24.8 billion (US$3.5 billion) and RMB 26.2 billion (US$3.7 billion), both representing a year-over-year decline.

- This guidance came shortly after a quarterly earnings report showing minimal growth, and ahead of the upcoming launch of the Li i6 battery electric SUV and other technological upgrades announced for September.

- We'll assess how Li Auto's projected drop in deliveries challenges previous assumptions about its revenue growth and competitive positioning.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Li Auto Investment Narrative Recap

To be a Li Auto shareholder, an investor needs to believe that the company's ongoing innovation, especially in autonomous driving and new models, will ultimately drive long-term growth, despite temporary setbacks. The recent guidance pointing to a significant year-over-year drop in deliveries and revenue puts the spotlight on sales momentum as both the main near-term catalyst and the main risk, making the impact of this news decidedly material for the business outlook.

Among recent developments, the announcement of the upcoming Li i6 battery electric SUV is particularly relevant. With an entry price of RMB 250,000, the i6 launch looks set to address shifting consumer preferences and expand the product lineup, which is central to Li Auto’s strategy to recover sales growth after the expected shortfall in deliveries this quarter.

Yet, against this backdrop, investors should pay close attention to how intensifying competition in the NEV market could...

Read the full narrative on Li Auto (it's free!)

Li Auto's narrative projects CN¥249.5 billion in revenue and CN¥17.0 billion in earnings by 2028. This requires 19.9% yearly revenue growth and an earnings increase of CN¥8.9 billion from the current CN¥8.1 billion.

Uncover how Li Auto's forecasts yield a $32.84 fair value, a 35% upside to its current price.

Exploring Other Perspectives

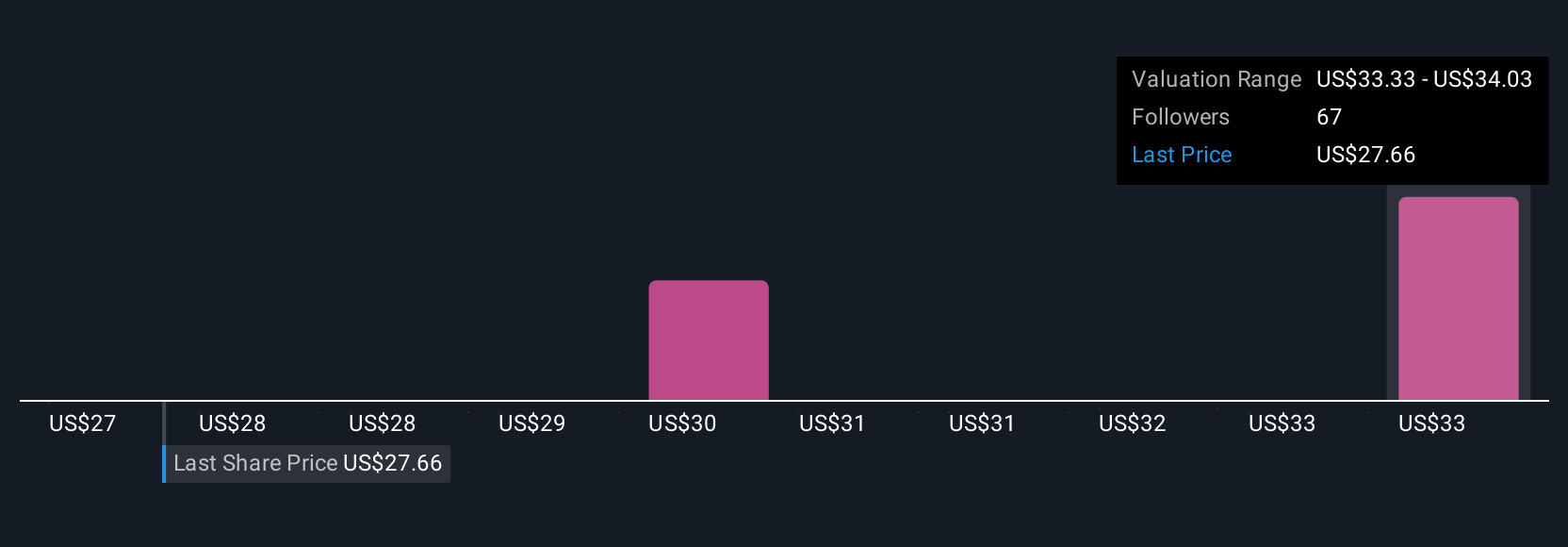

Five members of the Simply Wall St Community estimate Li Auto’s fair value between US$27.31 and US$32.84 per share. As delivery projections fall sharply for the third quarter, it’s clear opinions differ on growth expectations, explore these diverse analyses for a broader view.

Explore 5 other fair value estimates on Li Auto - why the stock might be worth just $27.31!

Build Your Own Li Auto Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Li Auto research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Li Auto research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Li Auto's overall financial health at a glance.

No Opportunity In Li Auto?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LI

Li Auto

Operates in the energy vehicle market in the People’s Republic of China.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives