- United States

- /

- Auto

- /

- NasdaqGS:LI

Li Auto (NasdaqGS:LI) Valuation in Focus as Q3 2025 Deliveries and Competitive Pressures Raise Investor Caution

Reviewed by Kshitija Bhandaru

Li Auto (NasdaqGS:LI) just reported its Q3 2025 vehicle delivery results, posting 93,211 units for the quarter and 33,951 in September alone. These numbers are front and center as investors brace for the company’s next earnings update.

See our latest analysis for Li Auto.

After a strong run earlier in the year, Li Auto’s share price has retreated, down almost 7% over the past month and roughly 5% for the year to date, with broader risk aversion toward Chinese EV makers weighing on sentiment. Still, the longer-term story is intact. Its 3-year total shareholder return of nearly 22% highlights the company’s growth potential despite short-term volatility and industry headwinds.

If electric vehicles are on your radar, now could be the perfect moment to discover more up-and-coming names with our curated See the full list for free..

With the stock trading below analyst targets and a three-year return still outpacing the sector, the key question now is whether Li Auto is undervalued or if the market has already priced in its next phase of growth.

Most Popular Narrative: 22% Undervalued

Li Auto’s most followed valuation thesis calls for significant upside from the current price of $22.80, assigning a fair value over $29. This sets a high bar and frames the ongoing debate as to whether the stock’s pullback truly reflects the company’s fundamental growth drivers.

The company's ongoing transition from extended-range vehicles (EREVs) to pure battery electric vehicles (BEVs), including successful launches of the Li MEGA and Li i8, and the upcoming Li i6, positions Li Auto to capture expanding market share as Chinese middle-class consumers upgrade and EV adoption accelerates. This directly supports long-term revenue growth and total addressable market expansion.

Want to know what underpins this bullish view? The narrative hinges on a bold shift in vehicle technology, premium pricing power, and aggressive network expansion. Intrigued by which financial levers analysts believe will propel Li Auto to its consensus price target? Uncover the detailed growth assumptions and find out the full story behind this compelling fair value estimate.

Result: Fair Value of $29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, mounting competition and headline-making regulatory changes could put pressure on Li Auto's margins and temper investor optimism in the near term.

Find out about the key risks to this Li Auto narrative.

Another Perspective: Multiples Tell a Different Story

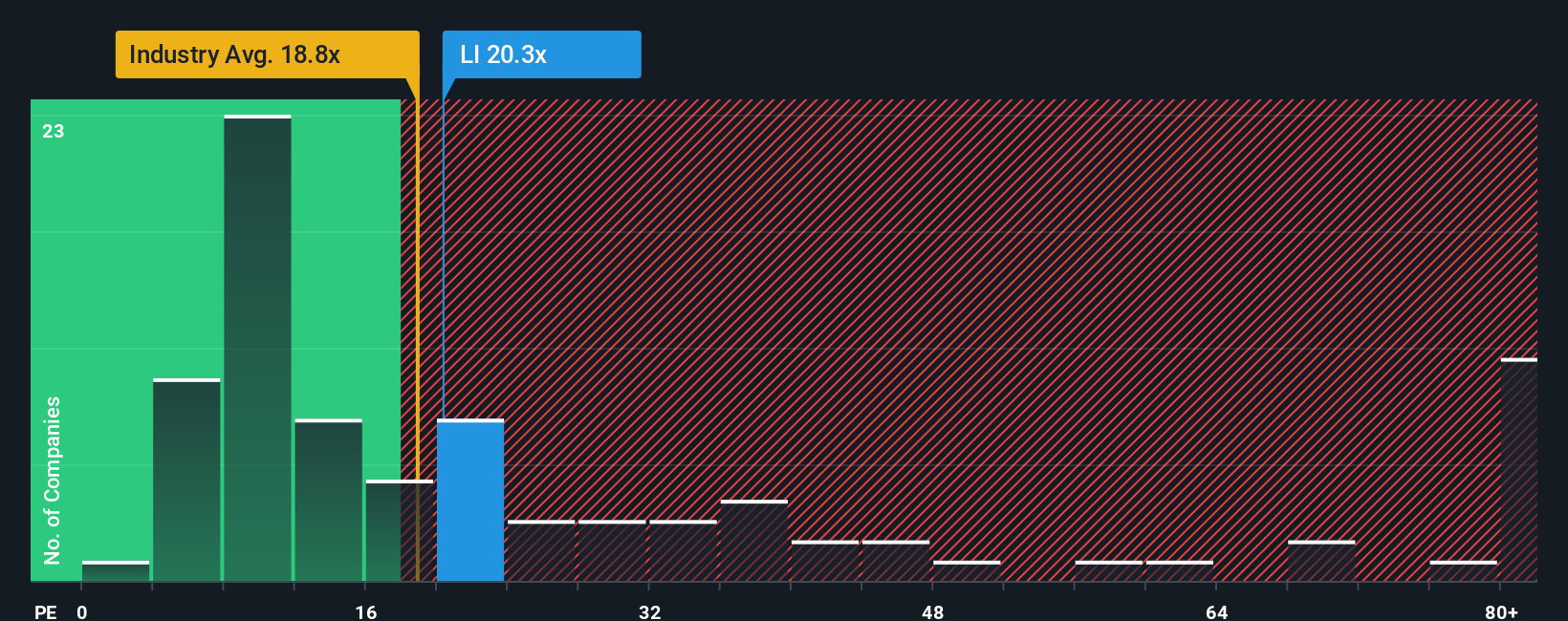

Looking at valuation through the lens of earnings, Li Auto's price-to-earnings ratio currently sits at 20.3x, which is notably higher than both the global auto industry average of 19x and its closest peers at 15x. However, when compared to its fair ratio of 25.5x, it may actually present hidden value. This difference means investors must weigh the premium paid today against potential future upside. Does this suggest a valuation risk, or could the stock be set to close the gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Li Auto Narrative

If you see things differently, or want to dive deeper into the numbers yourself, it's quick and easy to craft your own view in just a few minutes, starting here: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Li Auto.

Looking for more investment ideas?

Smart investors always keep an eye on the next big trend. Don’t miss your chance to get ahead. There’s a world of opportunity waiting, right now.

- Unlock opportunities in digital assets by checking out these 79 cryptocurrency and blockchain stocks before the next market wave catches everyone else off guard.

- Maximize long-term returns with the income potential of these 19 dividend stocks with yields > 3%, focused on solid yields above 3% every year.

- Tap into healthcare innovation and stay one step ahead with these 33 healthcare AI stocks pushing the boundaries of medicine and artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LI

Li Auto

Operates in the energy vehicle market in the People’s Republic of China.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives