- United States

- /

- Auto

- /

- NasdaqGS:LI

Li Auto (NasdaqGS:LI) Surges 35% with 30% Jump in February Deliveries

Reviewed by Simply Wall St

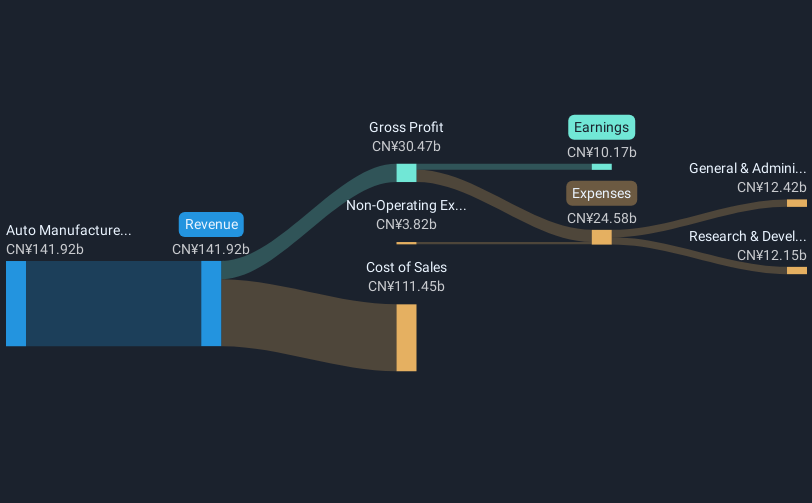

Li Auto (NasdaqGS:LI) posted an impressive 35% price increase in the last quarter, coinciding with a robust delivery growth reported in early 2025. The announcement on March 1, revealing a 29.7% increase in year-over-year vehicle deliveries for February totaling 26,263, spotlighted the company's accelerating momentum, which continued strong delivery numbers from January with nearly 30,000 vehicles. As the broader market grappled with 1.3% downturns amid economic uncertainties, Li Auto differentiated itself through consistent delivery growth, defying the trend impacting major indices like the Nasdaq, which faced a 4% decline in February. This contrast, set against a backdrop of concerns over trade policies and tariffs affecting other industries, underscores the resilience and expansion of the electric vehicle sector. The price uptick reflects positive investor sentiment, driven by Li Auto's performance and growth aspirations as it expands its market presence.

Click here and access our complete analysis report to understand the dynamics of Li Auto.

Over the past three years, Li Auto Inc. achieved a total shareholder return of 19.57%, a period defined by significant business developments. The company's listing on the Hang Seng Index in late 2023 marked a major milestone, reflecting its expanding market influence. The launch of the Li L6 in April 2024 and the earlier announcement of the Li MEGA bolstered its product line, boosting investor confidence despite market fluctuations. Adding an innovative, premium family SUV to its offerings underscored Li's commitment to growth.

Meanwhile, corporate challenges emerged, such as the June 2024 securities class action lawsuits, which may have pressured stock value by addressing past business projections. Despite these hurdles, substantial earnings growth, evidenced by the 61.3% increase in the past year, showcased Li Auto's resilience. This came even as the company underperformed the US Auto industry, which saw a stronger annual return, positioning Li Auto uniquely within its sector.

- Unlock the insights behind Li Auto's valuation and discover its true investment potential

- Discover the key vulnerabilities in Li Auto's business with our detailed risk assessment.

- Is Li Auto part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LI

Li Auto

Operates in the energy vehicle market in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives