- United States

- /

- Auto

- /

- NasdaqGS:LCID

Lucid Group (NasdaqGS:LCID) Jumps 14% In A Week As Q4 Results Show Increased Sales

Reviewed by Simply Wall St

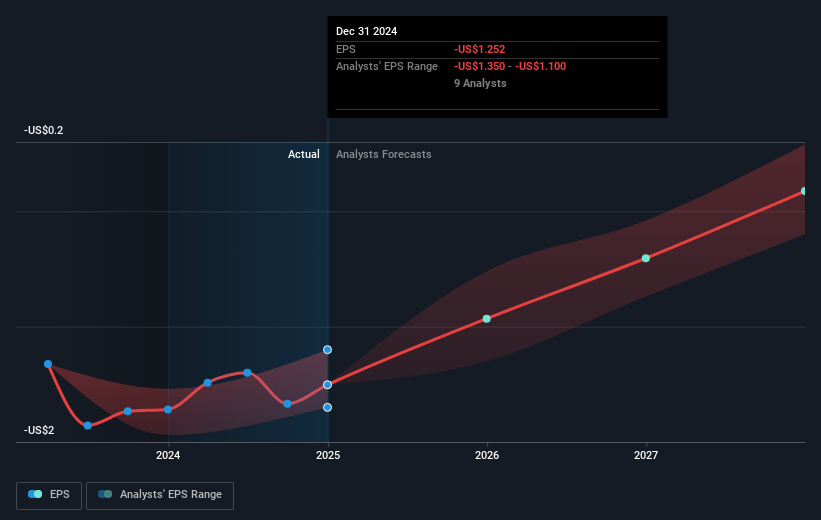

Last week, Lucid Group (NasdaqGS:LCID) reported its fourth-quarter results, showing increased sales and narrower net losses, alongside production guidance of 20,000 vehicles for 2025. The appointment of Marc Winterhoff as interim CEO signals a leadership adjustment as the company gears for future strategy. These developments occurred as the broader market, including the S&P 500 and Nasdaq, saw a modest rise, recovering from an earlier selloff. Against this backdrop, Lucid's shares rose by 14%, illustrating investor optimism despite its challenges, aligning with broader market recovery trends and a positive response to corporate updates.

Lucid Group has 2 risks (and 1 which is significant) we think you should know about.

Lucid Group's total shareholder return last year was a decline of 15.41%, underperforming both the US Auto industry's 44.5% return and the broader market's 10.2% rise. Several factors may have influenced this performance. Despite increased sales to US$807.83 million and a narrowed net loss of US$2.71 billion, ongoing production constraints, particularly concerning the new Lucid Gravity SUV, likely weighed on investor sentiment. These constraints risk limiting revenue growth if demand outstrips supply.

Leadership changes also may have introduced uncertainties, especially with Peter Rawlinson stepping down as CEO. Additionally, Lucid raised substantial capital through a private placement worth US$1.03 billion and a follow-on equity offering raising US$680 million. While these actions provide liquidity, they reflect reliance on external funding, underscoring liquidity risks. The launch of Lucid Gravity, anticipated to meet high consumer demand, points to potential future opportunities, yet production and financial stability challenges remain pivotal market concerns.

Upon reviewing our latest valuation report, Lucid Group's share price might be too optimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Lucid Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LCID

Lucid Group

A technology company, designs, engineers, manufactures, and sells electric vehicles (EV), EV powertrains, and battery systems.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives