- United States

- /

- Auto Components

- /

- NasdaqGS:HSAI

What You Can Learn From Hesai Group's (NASDAQ:HSAI) P/SAfter Its 43% Share Price Crash

To the annoyance of some shareholders, Hesai Group (NASDAQ:HSAI) shares are down a considerable 43% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 79% share price decline.

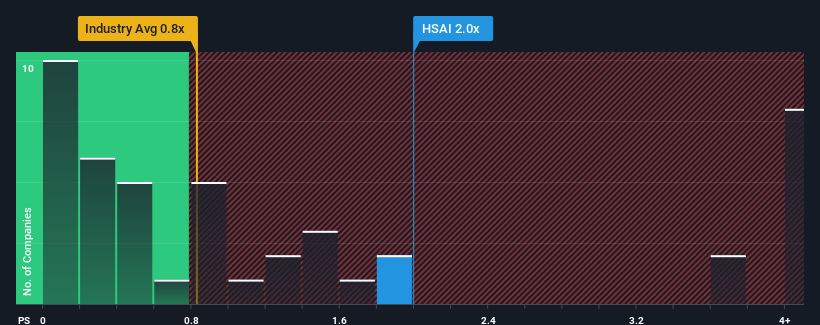

Even after such a large drop in price, when almost half of the companies in the United States' Auto Components industry have price-to-sales ratios (or "P/S") below 0.8x, you may still consider Hesai Group as a stock probably not worth researching with its 2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Hesai Group

What Does Hesai Group's P/S Mean For Shareholders?

Recent times have been advantageous for Hesai Group as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hesai Group.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Hesai Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 64%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 57% during the coming year according to the seven analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 5.0%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Hesai Group's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Hesai Group's P/S Mean For Investors?

There's still some elevation in Hesai Group's P/S, even if the same can't be said for its share price recently. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Hesai Group shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Having said that, be aware Hesai Group is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hesai Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HSAI

Hesai Group

Through with its subsidiaries, engages in the development, manufacture, and sale of three-dimensional light detection and ranging solutions (LiDAR) in Mainland China, Europe, North America, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)