- United States

- /

- Auto Components

- /

- NasdaqGS:FOXF

Some Confidence Is Lacking In Fox Factory Holding Corp.'s (NASDAQ:FOXF) P/E

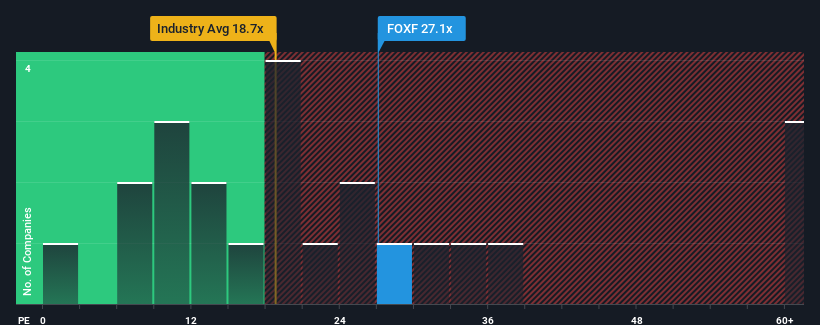

Fox Factory Holding Corp.'s (NASDAQ:FOXF) price-to-earnings (or "P/E") ratio of 27.1x might make it look like a strong sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 17x and even P/E's below 10x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Fox Factory Holding as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Fox Factory Holding

How Is Fox Factory Holding's Growth Trending?

In order to justify its P/E ratio, Fox Factory Holding would need to produce outstanding growth well in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 62%. As a result, earnings from three years ago have also fallen 38% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings growth is heading into negative territory, declining 0.7% over the next year. That's not great when the rest of the market is expected to grow by 12%.

With this information, we find it concerning that Fox Factory Holding is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Fox Factory Holding's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Fox Factory Holding that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FOXF

Fox Factory Holding

Designs, engineers, manufactures, and markets performance-defining products and system worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.