- Kuwait

- /

- Construction

- /

- KWSE:CGC

3 High-Yield Dividend Stocks Offering Up To 4.4%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating inflation rates and varied central bank policies, investors continue to seek stable returns amid uncertainty. In this context, high-yield dividend stocks emerge as appealing options for those looking to generate steady income from their investments.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.27% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 8.00% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.70% | ★★★★★★ |

| Sonae SGPS (ENXTLS:SON) | 6.01% | ★★★★★★ |

| Globeride (TSE:7990) | 3.80% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.60% | ★★★★★★ |

| Ryoyu Systems (TSE:4685) | 3.51% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.54% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.43% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.18% | ★★★★★★ |

Click here to see the full list of 1956 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

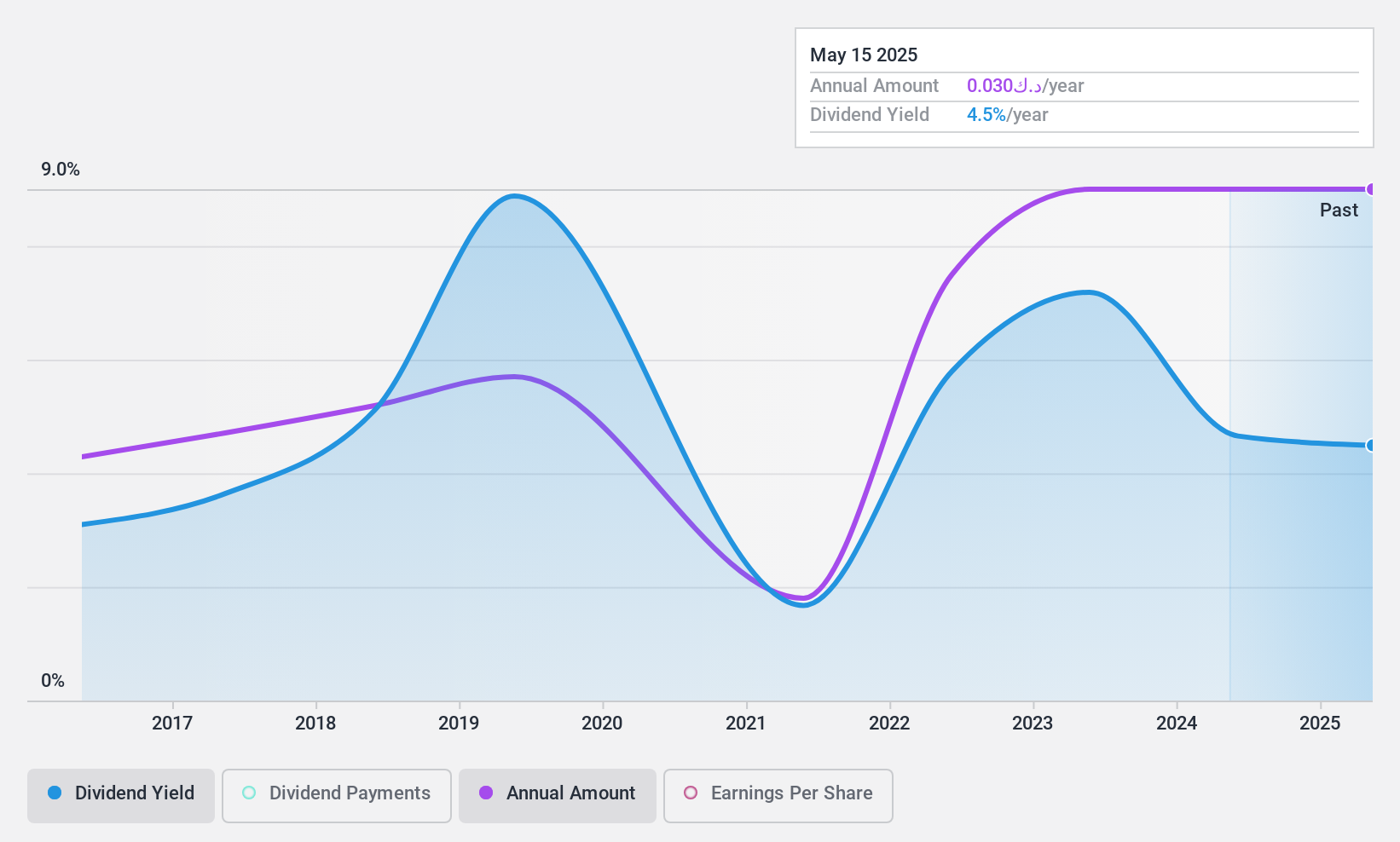

Al-Ahleia Insurance CompanyK.P (KWSE:AINS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Al-Ahleia Insurance Company S.A.K.P. offers insurance and reinsurance products and services in Kuwait, with a market capitalization of KWD 190.26 million.

Operations: Al-Ahleia Insurance Company S.A.K.P. generates revenue primarily through reinsurance operations (KWD 16.20 million), general risk insurance (KWD 6.34 million), and life and medical insurance (KWD 6.14 million).

Dividend Yield: 3.4%

Al-Ahleia Insurance Company has demonstrated a mixed performance in its dividend strategy. Over the past decade, dividends have shown growth but experienced significant volatility with annual drops exceeding 20%. Despite this instability, the dividends are well-supported financially, evidenced by a modest payout ratio of 30.6% and a cash payout ratio of 19%, indicating strong coverage by both earnings and cash flows. Recent financial results show an upward trend in earnings, with net income rising to KWD 8.79 million in Q1 2024 from KWD 7.6 million the previous year. However, its dividend yield at 3.42% remains below the top quartile of Kuwaiti market dividend payers at 6.48%.

- Click to explore a detailed breakdown of our findings in Al-Ahleia Insurance CompanyK.P's dividend report.

- The valuation report we've compiled suggests that Al-Ahleia Insurance CompanyK.P's current price could be inflated.

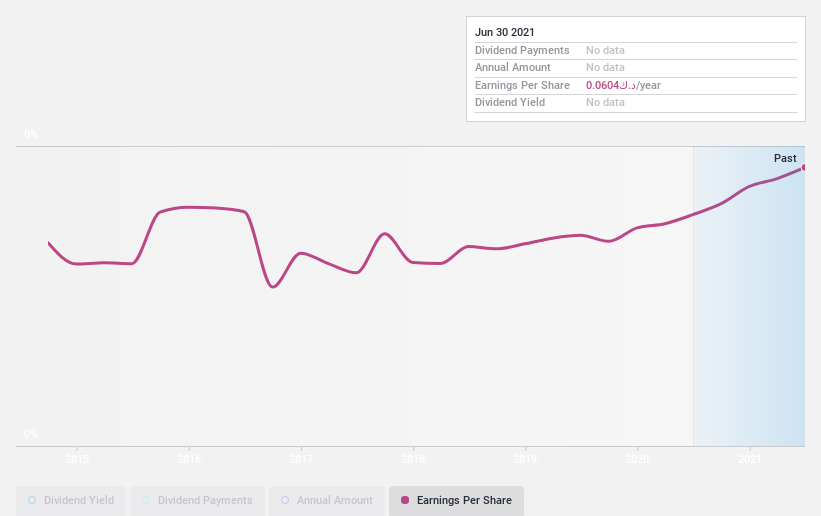

Combined Group Contracting Company - K.S.C. (Public) (KWSE:CGC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Combined Group Contracting Company - K.S.C. (Public) operates in the construction sector, focusing on infrastructure and building projects, with a market capitalization of approximately KWD 115.16 million.

Operations: Unfortunately, there is no specific revenue segment data provided for Combined Group Contracting Company - K.S.C. (Public) in the text you referenced.

Dividend Yield: 4.4%

Combined Group Contracting Company (CGC) offers a dividend yield of 4.42%, which falls below the top quartile for dividend payers in the Kuwaiti market at 6.48%. Despite this, CGC maintains a solid foundation for its dividends, with both earnings and cash flows sufficiently covering payouts at ratios of 51.1% and 55.8% respectively. However, investors should note CGC's dividends have shown instability over the past decade, reflecting some volatility in payments despite recent increases in dividend amounts. Recent financials indicate a stable performance with Q1 2024 net income rising to KWD 3.22 million from KWD 2.3 million year-over-year, supporting ongoing dividend commitments.

- Delve into the full analysis dividend report here for a deeper understanding of Combined Group Contracting Company - K.S.C. (Public).

- The valuation report we've compiled suggests that Combined Group Contracting Company - K.S.C. (Public)'s current price could be quite moderate.

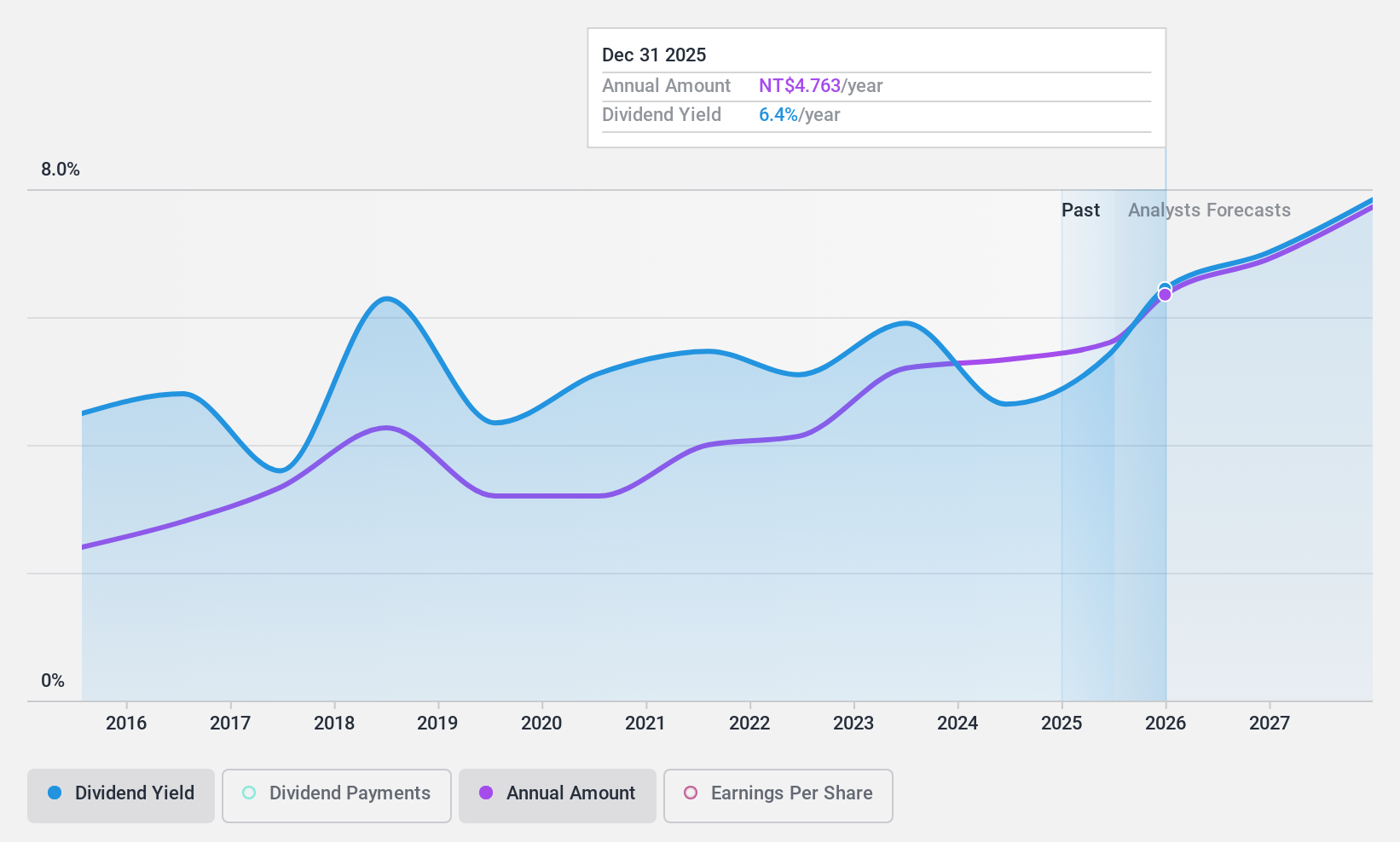

Primax Electronics (TWSE:4915)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Primax Electronics Ltd. operates globally, manufacturing and selling computer peripherals and non-computer peripherals, with a market capitalization of approximately NT$49.53 billion.

Operations: Primax Electronics Ltd. generates NT$23.01 billion from its Computer Peripheral Equipment Business Group and NT$36.45 billion from its Non-Computer Peripheral Equipment Business Group.

Dividend Yield: 3.6%

Primax Electronics has a mixed track record in dividend reliability, with volatile payments over the past decade. Despite this, dividends have grown overall and are supported by a reasonable payout ratio of 72.1% and a cash payout ratio of 29.1%, indicating coverage by both earnings and cash flows. However, its dividend yield of 3.62% is lower than the top quartile in the Taiwan market at 4.25%. Recent leadership changes could impact future financial strategies and dividend policies.

- Navigate through the intricacies of Primax Electronics with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Primax Electronics is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Embark on your investment journey to our 1956 Top Dividend Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KWSE:CGC

Combined Group Contracting Company - K.S.C. (Public)

Combined Group Contracting Company - K.S.C.

Solid track record with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)