- Japan

- /

- Electronic Equipment and Components

- /

- TSE:2763

3 Top Dividend Stocks Yielding Up To 5.4%

Reviewed by Simply Wall St

As global markets navigate a busy earnings season and mixed economic signals, investors are keenly observing how these dynamics impact various indices. With major indexes like the Nasdaq Composite and S&P MidCap 400 experiencing fluctuations amid cautious corporate earnings, many are turning their attention to dividend stocks as a potential source of steady income amidst market volatility. In this environment, a good dividend stock is often characterized by its ability to provide consistent payouts and maintain financial stability despite broader economic uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Mitsubishi Shokuhin (TSE:7451) | 3.86% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.69% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.19% | ★★★★★★ |

| Globeride (TSE:7990) | 4.12% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 5.03% | ★★★★★★ |

| Innotech (TSE:9880) | 4.86% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.97% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.01% | ★★★★★★ |

Click here to see the full list of 2033 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

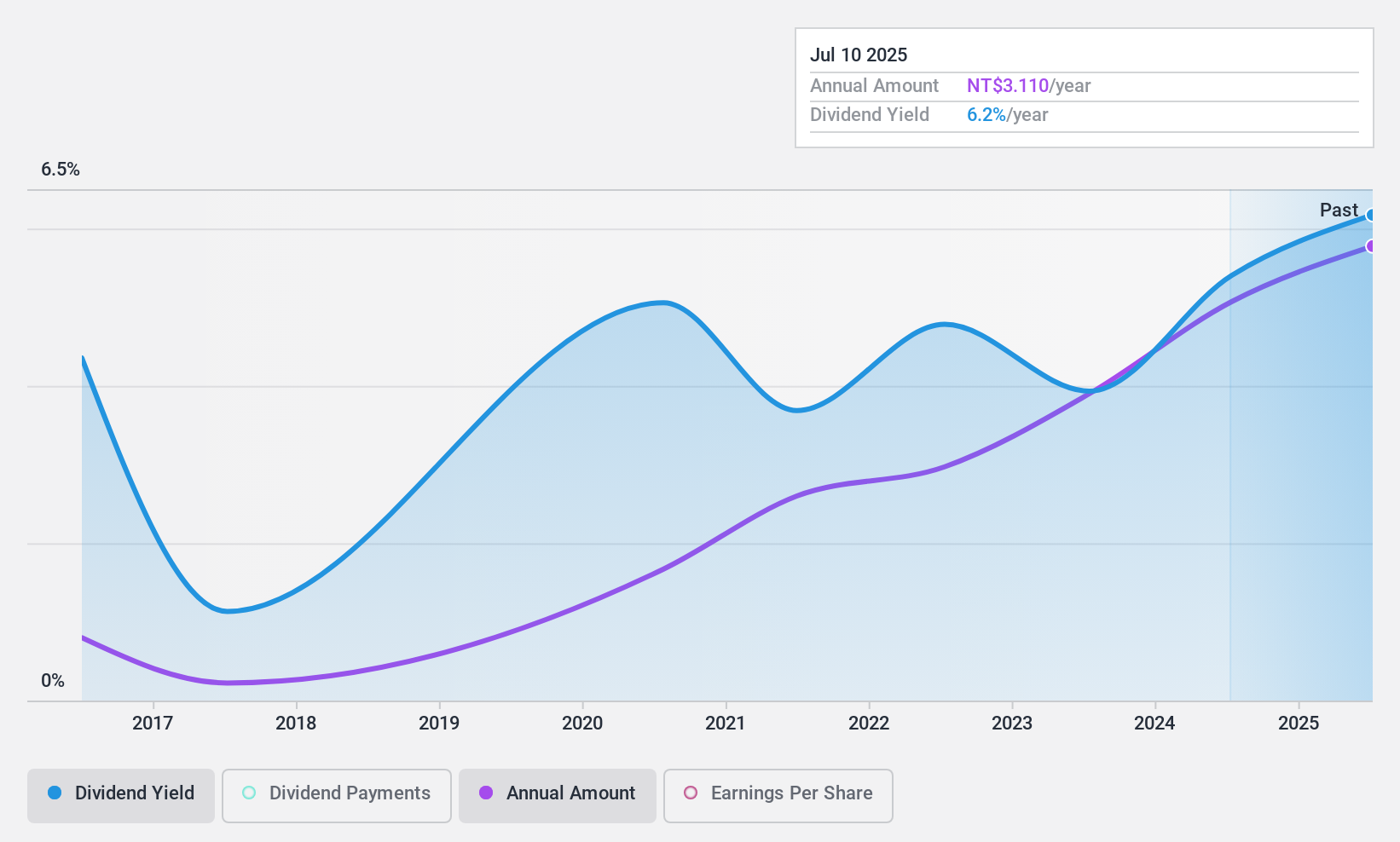

Welldone (TPEX:6170)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Welldone Company, along with its subsidiaries, operates in the telecommunication, mobile game publishing, and digital entertainment sectors mainly in Taiwan, with a market capitalization of approximately NT$4.85 billion.

Operations: Welldone Company's revenue is primarily derived from its Communications Service Department, contributing NT$2.02 billion, and the IC and Other Channel Segment, which adds NT$582.49 million.

Dividend Yield: 5.5%

Welldone's dividend yield of 5.48% ranks in the top 25% of the TW market, yet its high payout ratio (95.6%) suggests dividends aren't well covered by earnings, despite a reasonable cash payout ratio (33%). Dividend payments have been volatile over the past decade. Recent financials show increased sales but decreased quarterly net income, indicating potential challenges in sustaining dividends amidst high debt and shareholder dilution.

- Navigate through the intricacies of Welldone with our comprehensive dividend report here.

- Our valuation report here indicates Welldone may be undervalued.

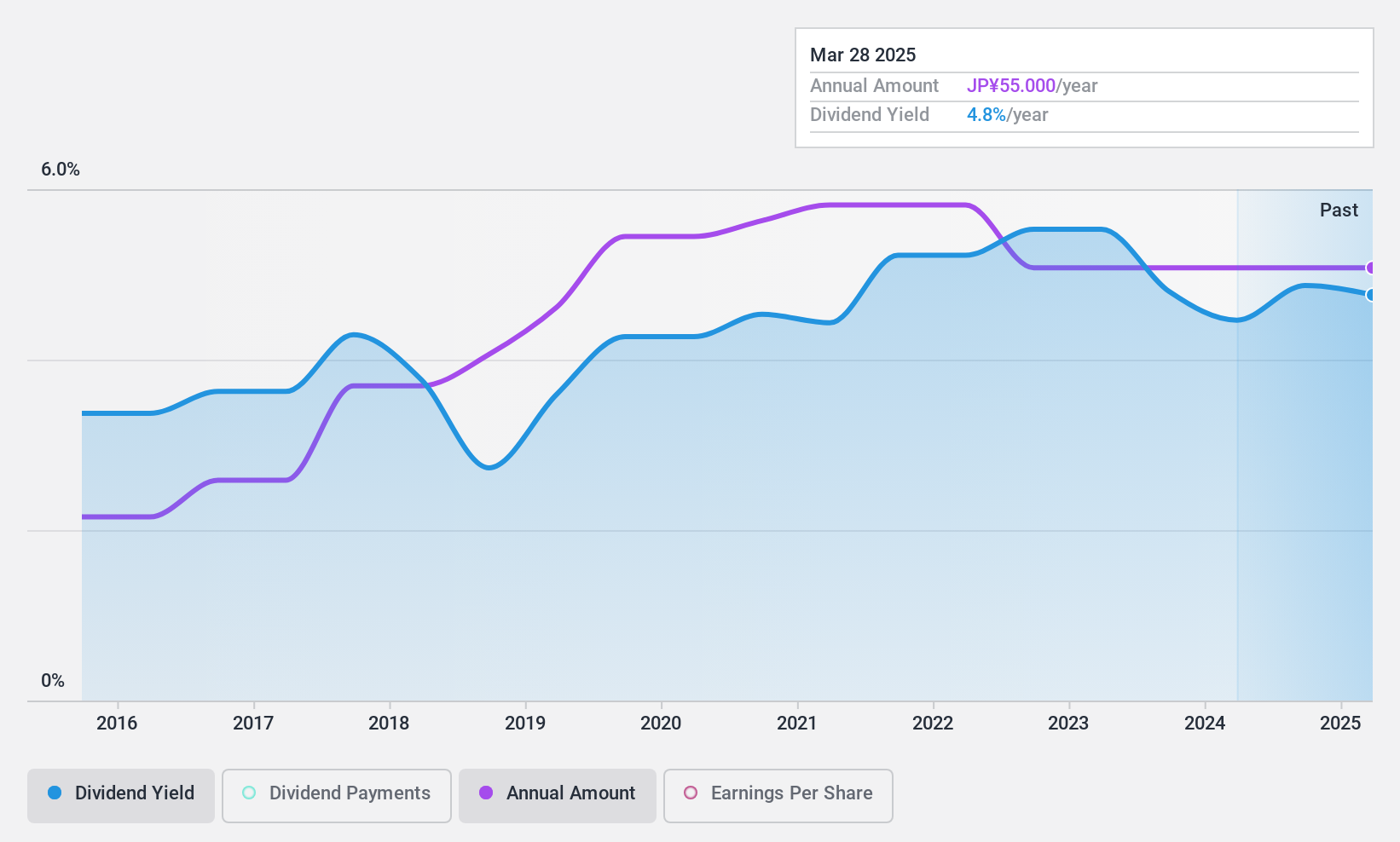

FTGroup (TSE:2763)

Simply Wall St Dividend Rating: ★★★★★★

Overview: FTGroup Co., Ltd. provides network infrastructure services in Japan and has a market cap of ¥32.88 billion.

Operations: FTGroup Co., Ltd. generates revenue through its Corporate Solutions Business, which accounts for ¥16.12 billion, and its Network Infrastructure Business, contributing ¥20.66 billion.

Dividend Yield: 5%

FTGroup offers a high dividend yield of 5.04%, placing it among the top 25% of dividend payers in Japan. The dividends are well-supported by earnings, with a payout ratio of 31.5%, and cash flows, with a cash payout ratio of 25.5%. Dividends have been stable and growing over the past decade, reflecting reliability. A recent share buyback program aims to enhance shareholder returns and adapt to market conditions, further supporting its capital strategy.

- Take a closer look at FTGroup's potential here in our dividend report.

- The valuation report we've compiled suggests that FTGroup's current price could be quite moderate.

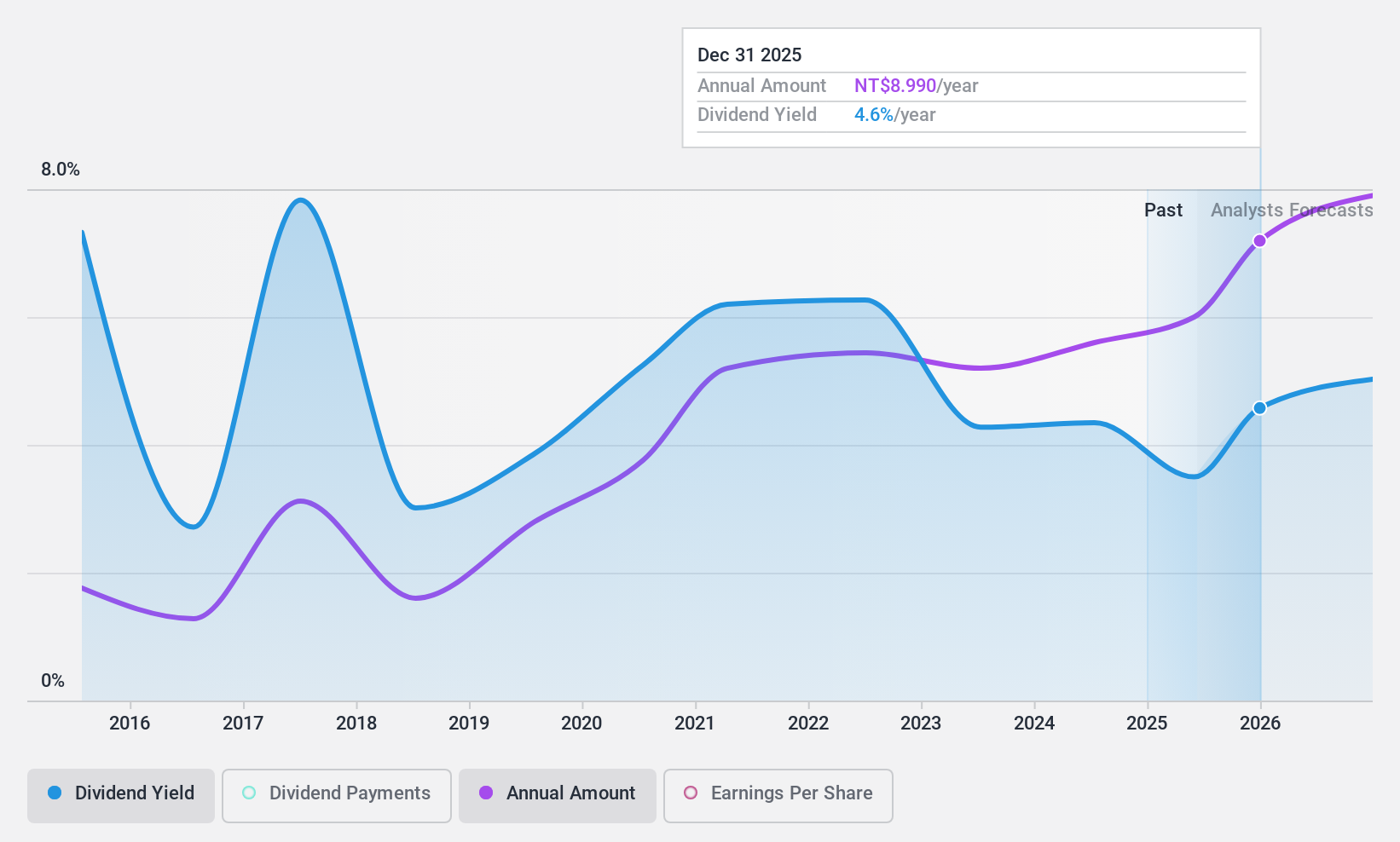

Arcadyan Technology (TWSE:3596)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arcadyan Technology Corporation, along with its subsidiaries, focuses on the research, development, manufacture, and sale of broadband access, multimedia, and wireless infrastructure solutions with a market cap of NT$35.59 billion.

Operations: Arcadyan Technology Corporation generates revenue primarily from its Communication Network segment, which accounted for NT$52.71 billion.

Dividend Yield: 4.3%

Arcadyan Technology's dividend is reasonably covered by earnings with a payout ratio of 60.3% and strongly supported by cash flows at a cash payout ratio of 17.3%. However, the dividend yield of 4.33% is slightly below the top tier in Taiwan, and payments have been volatile over the past decade despite some growth. The company's price-to-earnings ratio of 13.9x suggests good value compared to the broader market in Taiwan.

- Unlock comprehensive insights into our analysis of Arcadyan Technology stock in this dividend report.

- Our valuation report here indicates Arcadyan Technology may be overvalued.

Next Steps

- Unlock our comprehensive list of 2033 Top Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2763

Outstanding track record with flawless balance sheet and pays a dividend.