As global markets navigate a mixed economic landscape, with U.S. consumer confidence dipping and European stocks experiencing modest gains, investors are keenly observing how these trends might influence their portfolios. In such an environment, dividend stocks can offer a sense of stability by providing regular income streams even amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.33% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.66% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.26% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1946 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Nisshin Seifun Group (TSE:2002)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nisshin Seifun Group Inc., with a market cap of ¥547.64 billion, operates through its subsidiaries in flour milling, processed foods, health foods, biotechnology, engineering, prepared dishes, and mesh cloth businesses both in Japan and internationally.

Operations: Nisshin Seifun Group's revenue segments include the Food Business generating ¥205.57 billion, the Milling Business contributing ¥478.66 billion, and Prepared Dishes and Other Prepared Foods bringing in ¥158.31 billion.

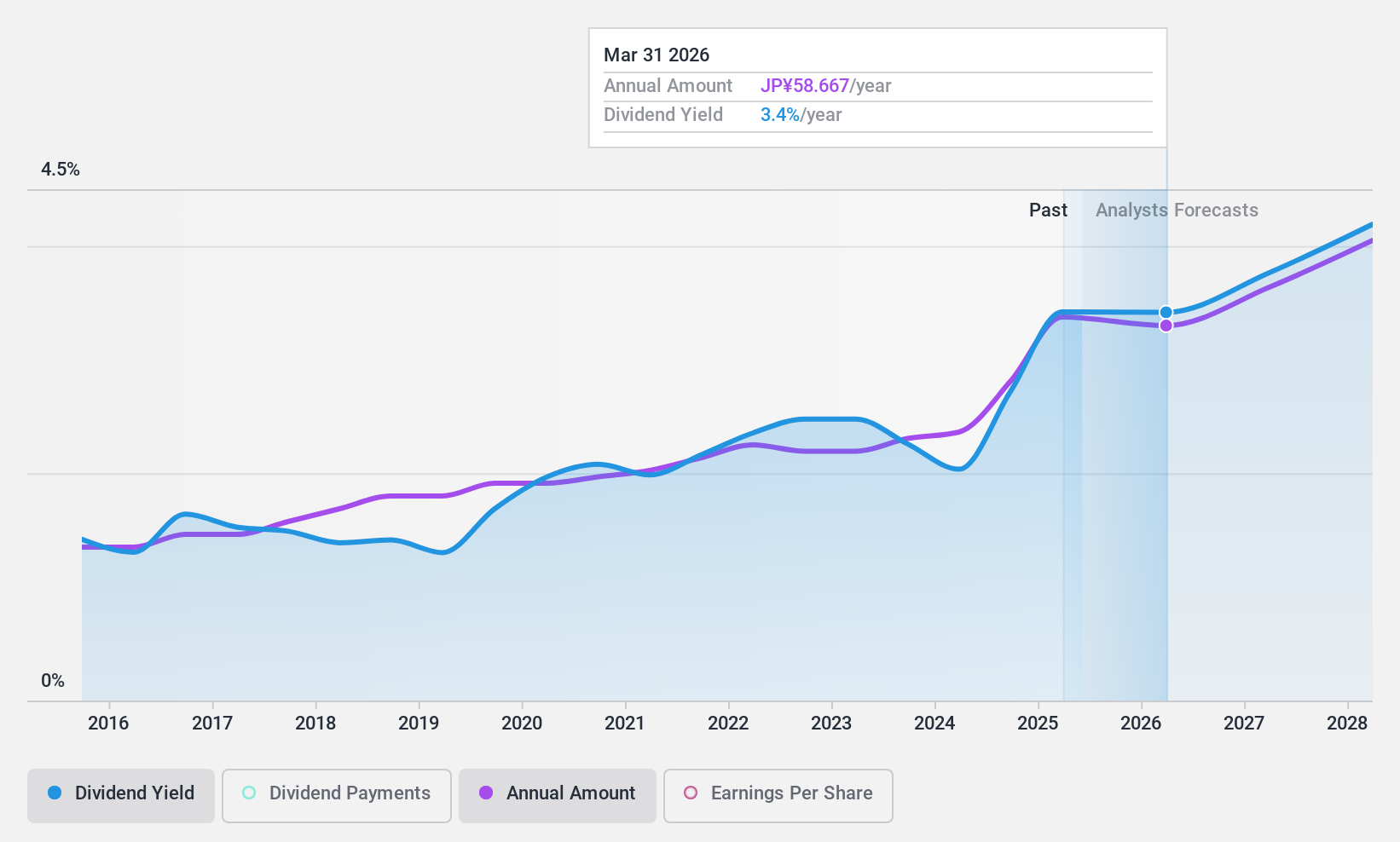

Dividend Yield: 3.3%

Nisshin Seifun Group's dividend payments are well-covered by earnings and cash flows, with a payout ratio of 43.3% and a cash payout ratio of 50.4%. The company has increased its second-quarter dividend to ¥25 per share from ¥21 last year, with an annual expectation of ¥30 per share, up from ¥24. Although the current yield is below Japan's top tier, dividends have been stable and growing over the past decade.

- Take a closer look at Nisshin Seifun Group's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Nisshin Seifun Group is trading behind its estimated value.

Oriental Consultants Holdings (TSE:2498)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Oriental Consultants Holdings Company Limited, with a market cap of ¥28.93 billion, operates through its subsidiaries to provide infrastructure management services both in Japan and internationally.

Operations: Oriental Consultants Holdings Company Limited generates its revenue primarily from Infrastructure Management Service, amounting to ¥70.48 billion, and Environment Management, contributing ¥14.08 billion.

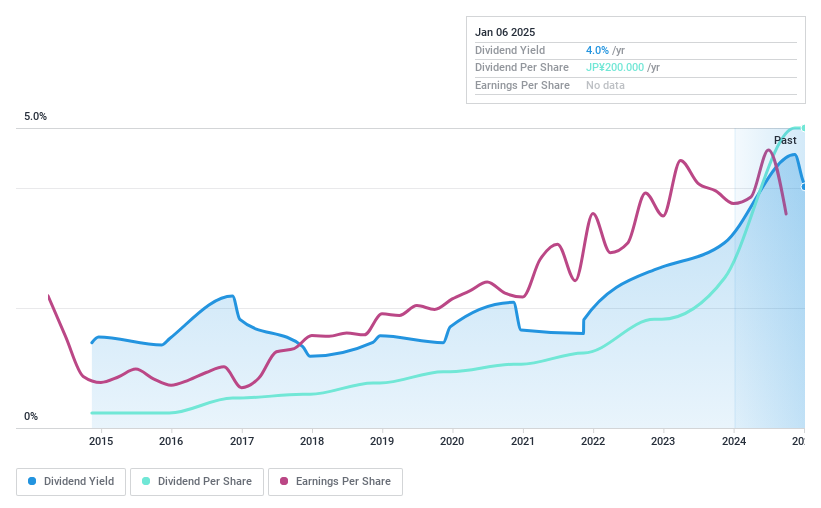

Dividend Yield: 4.1%

Oriental Consultants Holdings offers a high and reliable dividend yield of 4.12%, placing it in the top 25% of Japanese dividend payers. The dividends have been stable and growing over the past decade, supported by a low payout ratio of 40.9% and a cash payout ratio of 68.4%. Recent share buybacks, totaling ¥200.63 million for 47,600 shares, reflect a commitment to shareholder returns through flexible capital management strategies amidst changing business conditions.

- Dive into the specifics of Oriental Consultants Holdings here with our thorough dividend report.

- The valuation report we've compiled suggests that Oriental Consultants Holdings' current price could be quite moderate.

Careerlink (TSE:6070)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Careerlink Co., Ltd. offers human resource services in Japan and has a market cap of ¥29.06 billion.

Operations: Careerlink Co., Ltd.'s revenue is primarily derived from its Administrative Personnel Service (including Sales Personal Services) segment, generating ¥34.52 billion, followed by the Manufacturing Personnel Service Business at ¥7.20 billion.

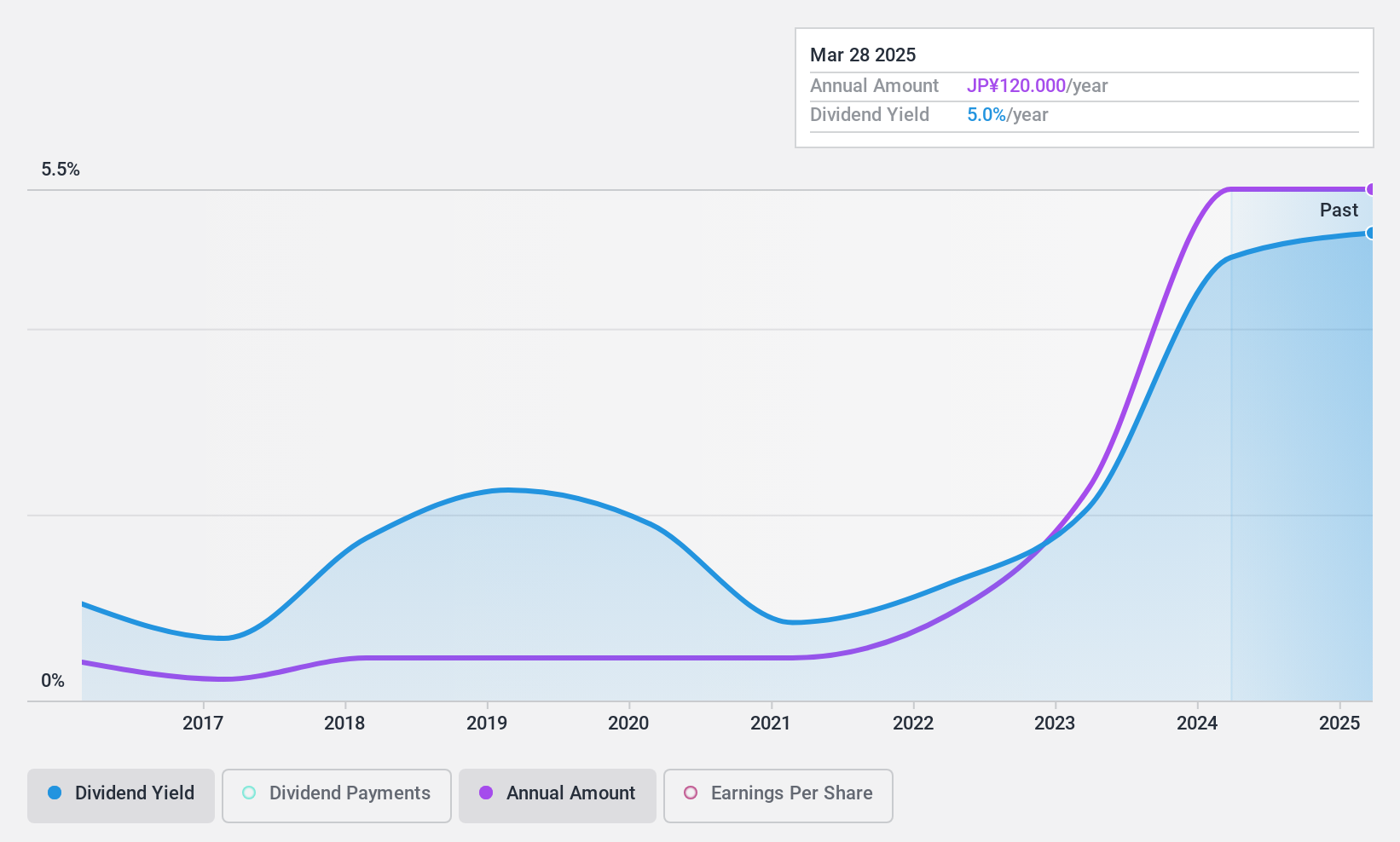

Dividend Yield: 4.9%

Careerlink's dividend yield of 4.9% ranks in the top 25% of Japanese dividend payers, yet its sustainability is questionable due to a high cash payout ratio of 97%. While the payout ratio is reasonable at 62.7%, dividends are not consistently covered by earnings or cash flows and have been volatile over the past decade. Despite a low price-to-earnings ratio of 12.8x, indicating potential value, profit margins have declined from last year’s figures.

- Click here and access our complete dividend analysis report to understand the dynamics of Careerlink.

- According our valuation report, there's an indication that Careerlink's share price might be on the expensive side.

Turning Ideas Into Actions

- Discover the full array of 1946 Top Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Nisshin Seifun Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nisshin Seifun Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2002

Nisshin Seifun Group

Through its subsidiaries, engages in the flour milling, processed foods, health foods, biotechnology, engineering, prepared dishes, and mesh cloth businesses in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives