- Japan

- /

- Capital Markets

- /

- TSE:8613

Undiscovered Gems With Promising Potential In January 2025

Reviewed by Simply Wall St

As 2024 comes to a close, global markets have experienced mixed signals with major indices showing moderate gains despite declining consumer confidence and manufacturing indicators in the U.S. The recent fluctuations highlight the importance of identifying stocks that exhibit resilience and potential for growth amidst broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| BSP Financial Group | 7.53% | 7.31% | 4.10% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

D.M. Wenceslao & Associates (PSE:DMW)

Simply Wall St Value Rating: ★★★★★☆

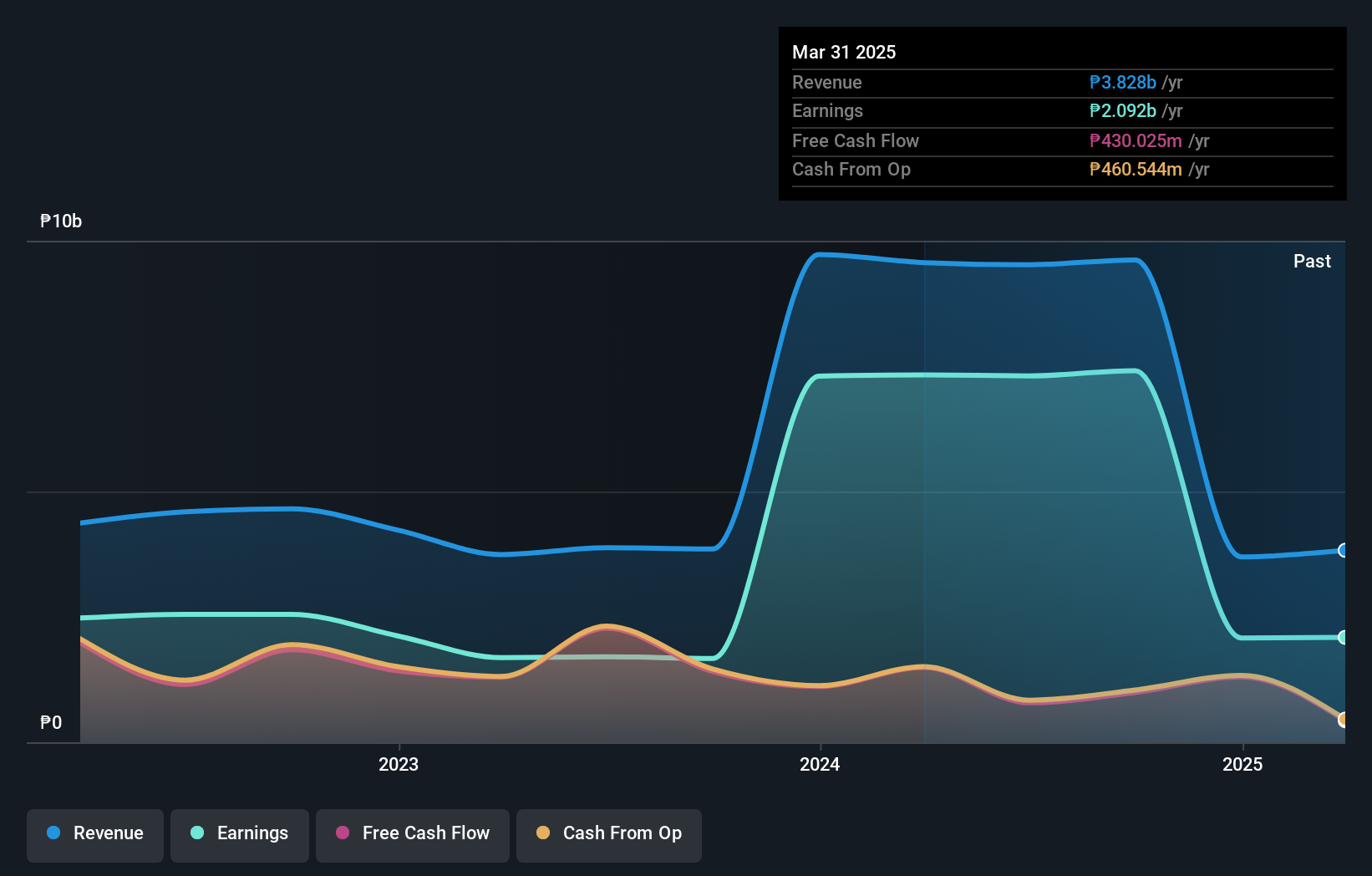

Overview: D.M. Wenceslao & Associates, Incorporated is a real estate development and construction company in the Philippines with a market capitalization of ₱18.75 billion.

Operations: D.M. Wenceslao's primary revenue streams are from rentals, generating ₱3.43 billion, and the sale of land and condominium units, contributing ₱804.15 million. The construction segment adds a smaller portion with ₱41.89 million in revenue.

D.M. Wenceslao & Associates, a notable player in the real estate sector, has demonstrated robust performance with a 343% earnings growth over the past year, significantly outpacing the industry's 11.5%. Their net debt to equity ratio stands at a satisfactory 5.2%, reflecting prudent financial management as it decreased from 31.7% to 16.9% over five years. Recent earnings reports show sales of PHP 857 million for Q3 and PHP 2,430 million for nine months in 2024, alongside net incomes of PHP 450 million and PHP 1,368 million respectively. With a price-to-earnings ratio of just 2.5x against the PH market's average of 9.3x, DMW appears undervalued relative to its peers.

Shanghai Bloom Technology (SHSE:603325)

Simply Wall St Value Rating: ★★★★★☆

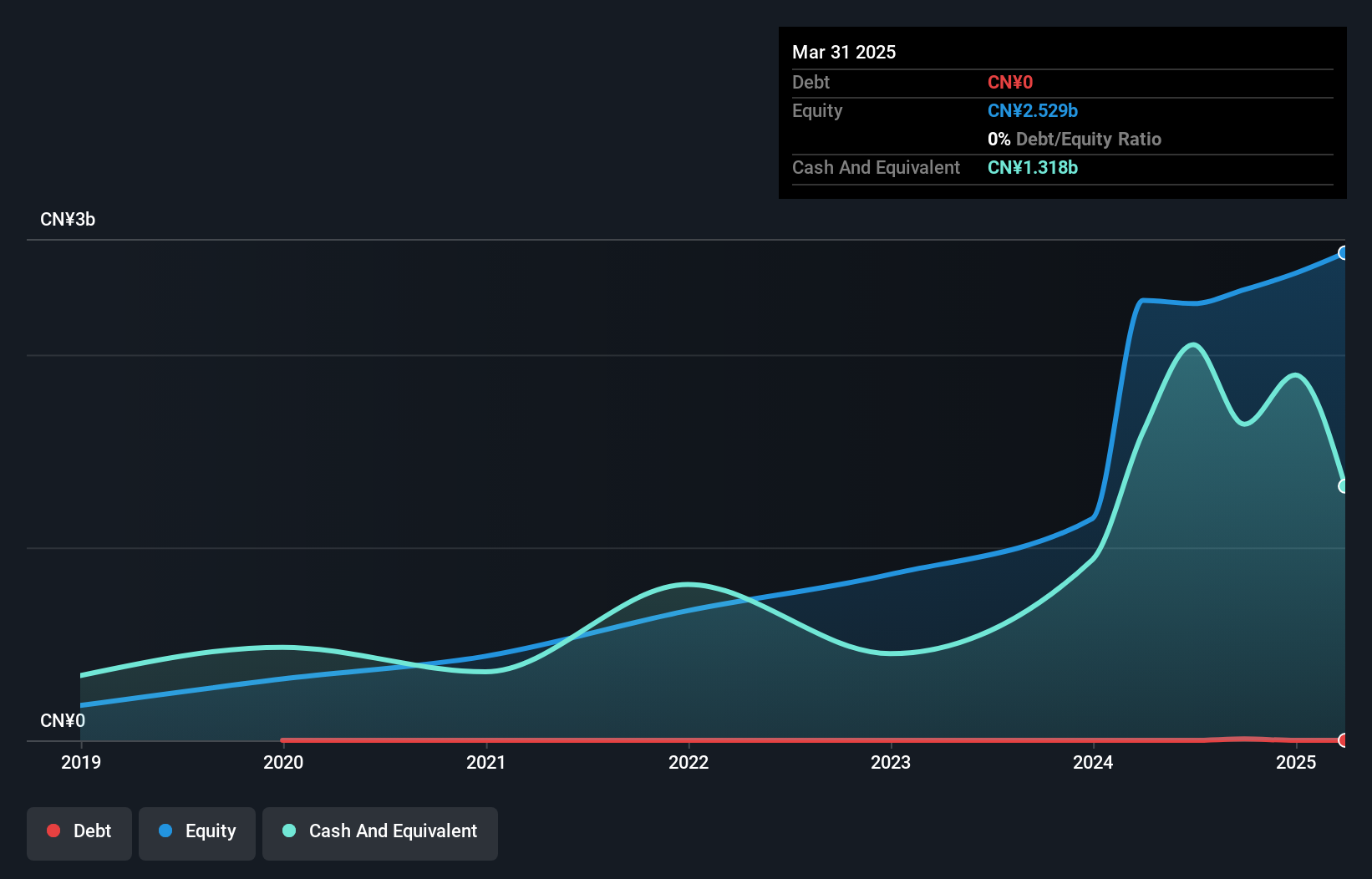

Overview: Shanghai Bloom Technology Inc. specializes in providing pneumatic conveying and processing equipment for powder materials in China, with a market cap of CN¥5.27 billion.

Operations: Shanghai Bloom Technology generates revenue primarily through the sale of pneumatic conveying and processing equipment for powder materials. The company has a market capitalization of CN¥5.27 billion.

Shanghai Bloom Technology, a promising player in its sector, has seen its earnings grow by 1.8% over the past year, outpacing the Machinery industry average of -0.06%. Despite a dip in revenue to CNY 581.33 million from CNY 760.06 million year-over-year, it remains profitable with high-quality earnings and is trading at an attractive valuation—73.9% below estimated fair value. The company's debt to equity ratio has slightly increased to 0.3% over five years but still maintains more cash than total debt, ensuring interest coverage isn't an issue and supporting future growth prospects at a forecasted rate of 11.24% annually.

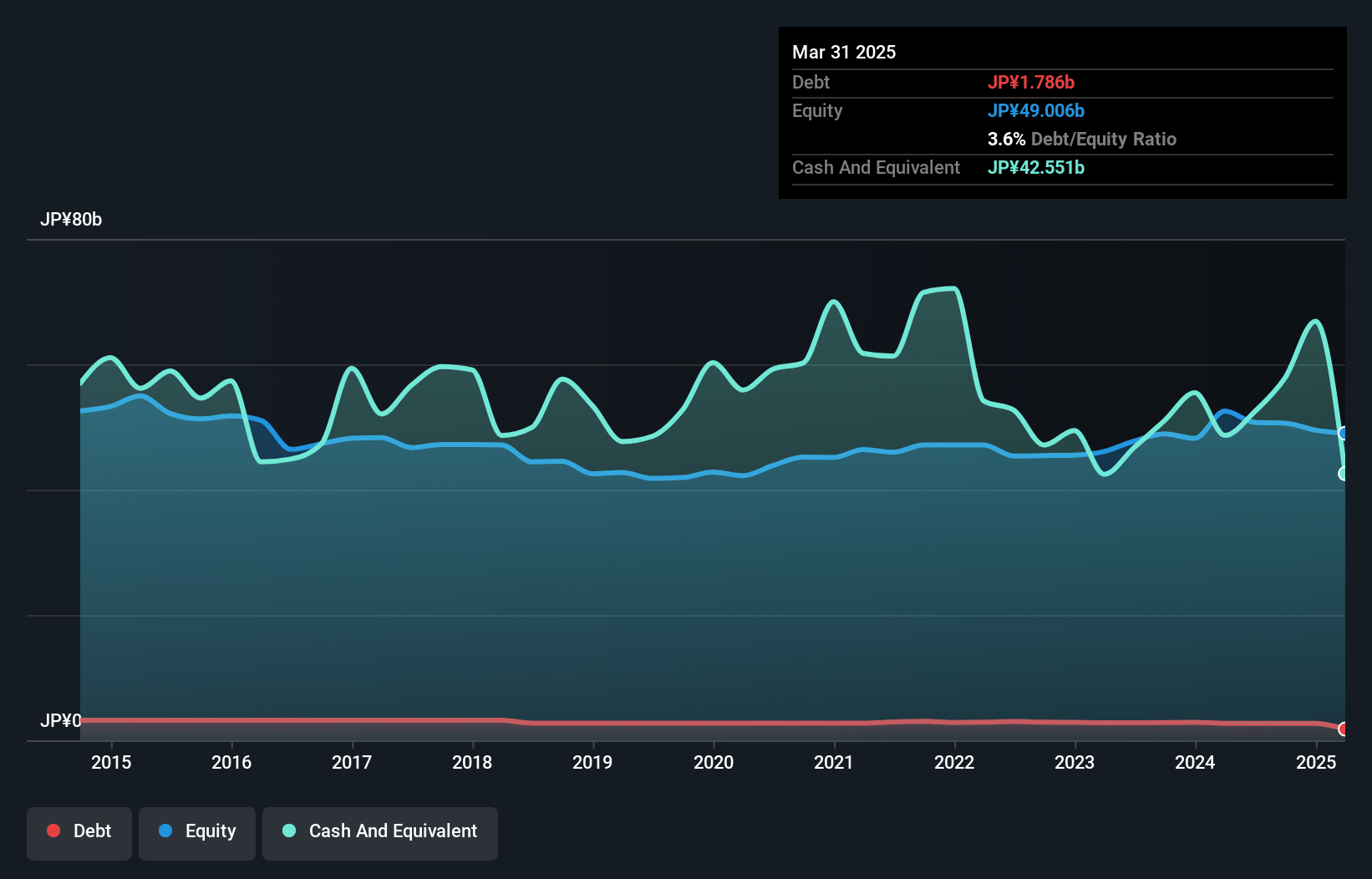

Marusan Securities (TSE:8613)

Simply Wall St Value Rating: ★★★★★☆

Overview: Marusan Securities Co., Ltd. operates in the financial products trading sector in Japan with a market cap of ¥66.26 billion.

Operations: Marusan Securities generates revenue primarily from financial products trading in Japan. The company has a market capitalization of ¥66.26 billion.

Marusan Securities, a small but intriguing player in the financial sector, has shown impressive earnings growth of 74.3% over the past year, outpacing its industry peers significantly. The company boasts high-quality earnings and maintains a healthy balance sheet with more cash than total debt, indicating robust financial health. Over the last five years, Marusan's debt to equity ratio has improved from 6.6% to 5.3%, reflecting prudent financial management. Additionally, it is free cash flow positive, which suggests effective operational efficiency and potential for reinvestment or expansion opportunities in the future.

Seize The Opportunity

- Embark on your investment journey to our 4638 Undiscovered Gems With Strong Fundamentals selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8613

Marusan Securities

Engages in the financial products trading business in Japan.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives