- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6961

High Insider Ownership Growth Companies To Watch In January 2025

Reviewed by Simply Wall St

As 2024 comes to a close, global markets have experienced a mixed performance, with major U.S. stock indexes posting moderate gains despite declining consumer confidence and manufacturing activity. In this environment of cautious optimism, investors often look for growth companies with high insider ownership as these stocks can indicate strong internal confidence in the business's potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 25.6% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 79.6% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

Let's dive into some prime choices out of the screener.

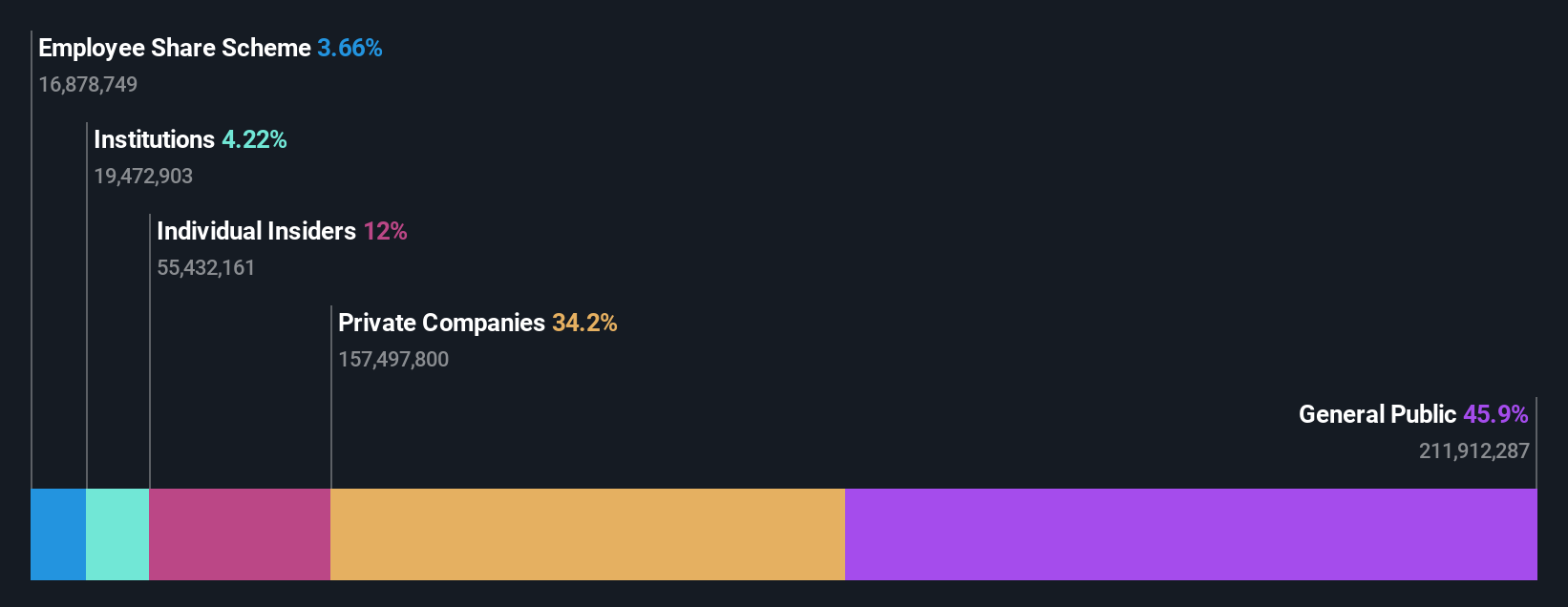

Zanyu Technology Group (SZSE:002637)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zanyu Technology Group Co., Ltd. is involved in the research, development, manufacture, and sale of surfactants and oleo chemicals both in China and internationally, with a market cap of CN¥4.56 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 12.3%

Zanyu Technology Group, with substantial insider ownership, is experiencing significant growth prospects. Its earnings are forecast to grow at 55.4% annually, outpacing the Chinese market average of 25.2%. However, its return on equity is expected to be low at 10.5% in three years, and interest payments are not well covered by earnings. Recent buyback activities include a plan to repurchase up to CNY 200 million worth of shares for employee stock plans or cancellation if unutilized.

- Click here to discover the nuances of Zanyu Technology Group with our detailed analytical future growth report.

- Our expertly prepared valuation report Zanyu Technology Group implies its share price may be too high.

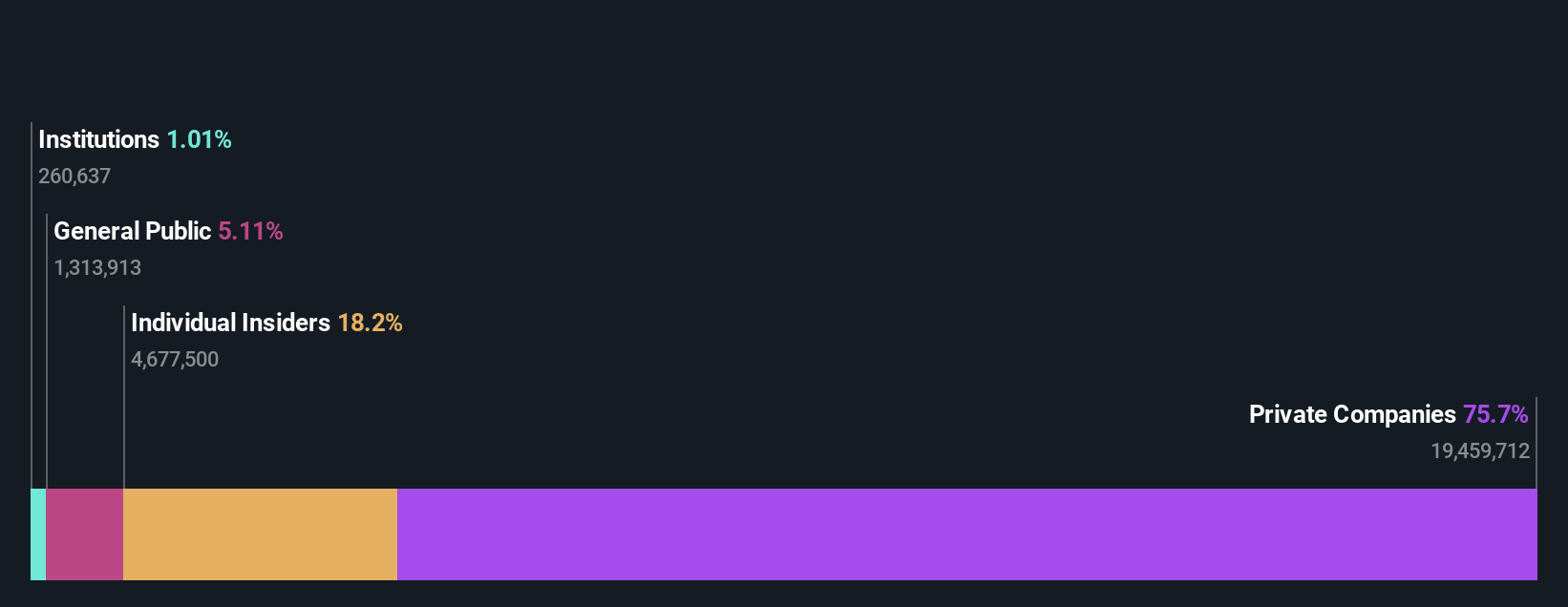

JTOWER (TSE:4485)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JTOWER Inc. offers infrastructure sharing services in Japan and has a market cap of ¥92.31 billion.

Operations: The company generates revenue of ¥14.45 billion from its Telecommunications Infrastructure Sharing Business in Japan.

Insider Ownership: 18.2%

JTOWER is poised for significant growth, with revenue expected to grow at 15.8% annually, surpassing the JP market average. Despite recent shareholder dilution and a low forecasted return on equity of 0.4%, JTOWER's earnings are projected to increase by 78.27% per year as it transitions to profitability within three years. The company will be delisted from the Tokyo Stock Exchange following a majority acquisition by DigitalBridge Group and Chief Executive Officer Atsushi Tanaka's Cultive.

- Unlock comprehensive insights into our analysis of JTOWER stock in this growth report.

- Our valuation report here indicates JTOWER may be overvalued.

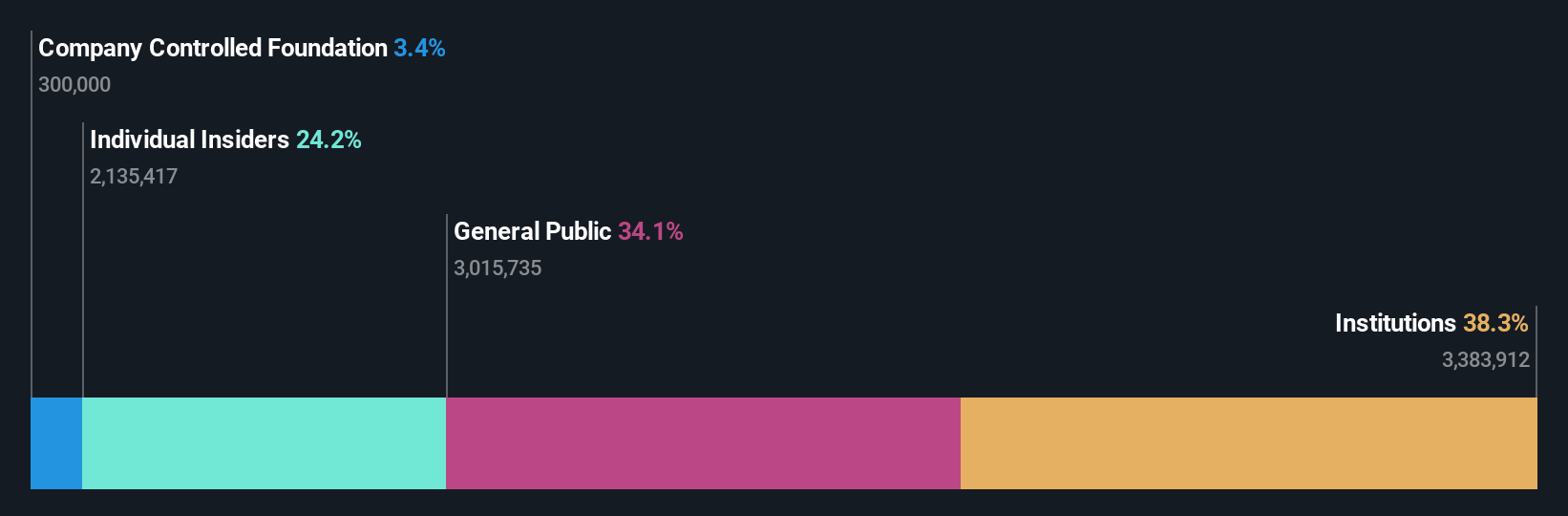

Enplas (TSE:6961)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Enplas Corporation is a manufacturer and seller of semiconductor, automobile parts, optical communication devices, and life science products with a market cap of ¥43.07 billion.

Operations: The company's revenue segments include the Semiconductor Business at ¥16.25 billion, Energy Saving Solutions Business at ¥13.84 billion, Digital Communication Business at ¥5.64 billion, and Life Science Business at ¥2.58 billion.

Insider Ownership: 24.2%

Enplas is projected to experience significant earnings growth of 21.18% annually over the next three years, outpacing the JP market's average. Despite a highly volatile share price recently, it trades at a substantial discount to its estimated fair value and offers good relative value compared to peers. Revenue growth is expected at 7.9% per year, exceeding the market average but not reaching high-growth thresholds. No recent insider trading activity was reported.

- Click here and access our complete growth analysis report to understand the dynamics of Enplas.

- Our comprehensive valuation report raises the possibility that Enplas is priced lower than what may be justified by its financials.

Where To Now?

- Investigate our full lineup of 1502 Fast Growing Companies With High Insider Ownership right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Enplas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6961

Enplas

Manufactures and sells semiconductor, automobile parts, optical communication devices, and life science related products in Japan and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives