- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3209

Alltek Technology's (TWSE:3209) Weak Earnings May Only Reveal A Part Of The Whole Picture

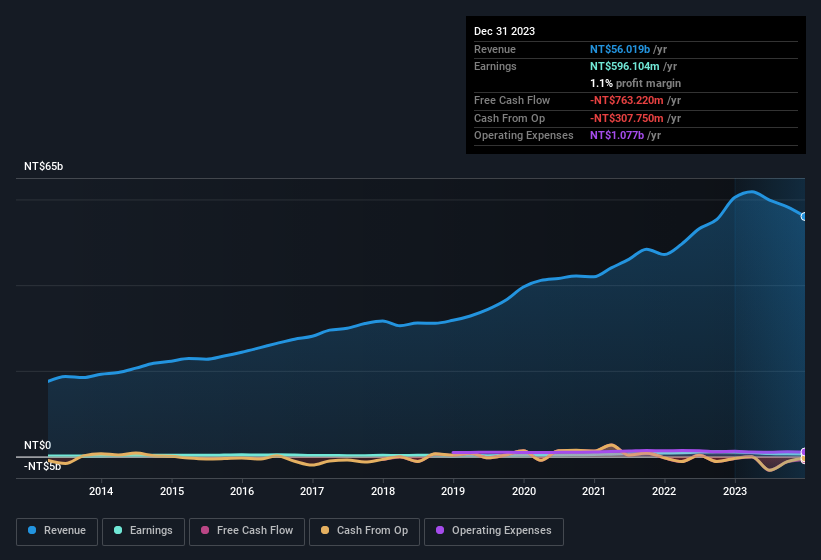

A lackluster earnings announcement from Alltek Technology Corporation (TWSE:3209) last week didn't sink the stock price. However, we believe that investors should be aware of some underlying factors which may be of concern.

View our latest analysis for Alltek Technology

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. As it happens, Alltek Technology issued 6.6% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Alltek Technology's EPS by clicking here.

A Look At The Impact Of Alltek Technology's Dilution On Its Earnings Per Share (EPS)

As you can see above, Alltek Technology has been growing its net income over the last few years, with an annualized gain of 29% over three years. In comparison, earnings per share only gained 19% over the same period. Net profit actually dropped by 45% in the last year. But the EPS result was even worse, with the company recording a decline of 48%. So you can see that the dilution has had a bit of an impact on shareholders.

In the long term, if Alltek Technology's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Alltek Technology.

Our Take On Alltek Technology's Profit Performance

Over the last year Alltek Technology issued new shares and so, there's a noteworthy divergence between EPS and net income growth. Because of this, we think that it may be that Alltek Technology's statutory profits are better than its underlying earnings power. But at least holders can take some solace from the 19% per annum growth in EPS for the last three. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For example, we've found that Alltek Technology has 4 warning signs (2 don't sit too well with us!) that deserve your attention before going any further with your analysis.

This note has only looked at a single factor that sheds light on the nature of Alltek Technology's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3209

Alltek Technology

Operates as a communication components distributor and solution provider in Taiwan, China, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)