- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3037

High Growth Tech Stocks To Watch This November 2024

Reviewed by Simply Wall St

In the wake of a significant rally in U.S. stocks driven by expectations of faster earnings growth and regulatory changes following the recent election, major indices such as the Russell 2000 and S&P 500 have seen notable gains, reflecting investor optimism. As we explore high-growth tech stocks to watch this November, it's crucial to consider companies that can leverage current economic conditions—such as potential tax reforms and deregulatory measures—to enhance their growth trajectories amidst evolving market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.65% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1271 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Info Edge (India) (NSEI:NAUKRI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Info Edge (India) Limited is an online classifieds company providing services in recruitment, matrimony, real estate, and education both domestically and internationally, with a market cap of ₹1.01 trillion.

Operations: Info Edge (India) Limited generates revenue primarily from its recruitment solutions, which contribute significantly to its overall income, followed by real estate services under 99acres. Recruitment Solutions brought in ₹19.52 billion, while 99acres for Real Estate accounted for ₹3.82 billion in revenue.

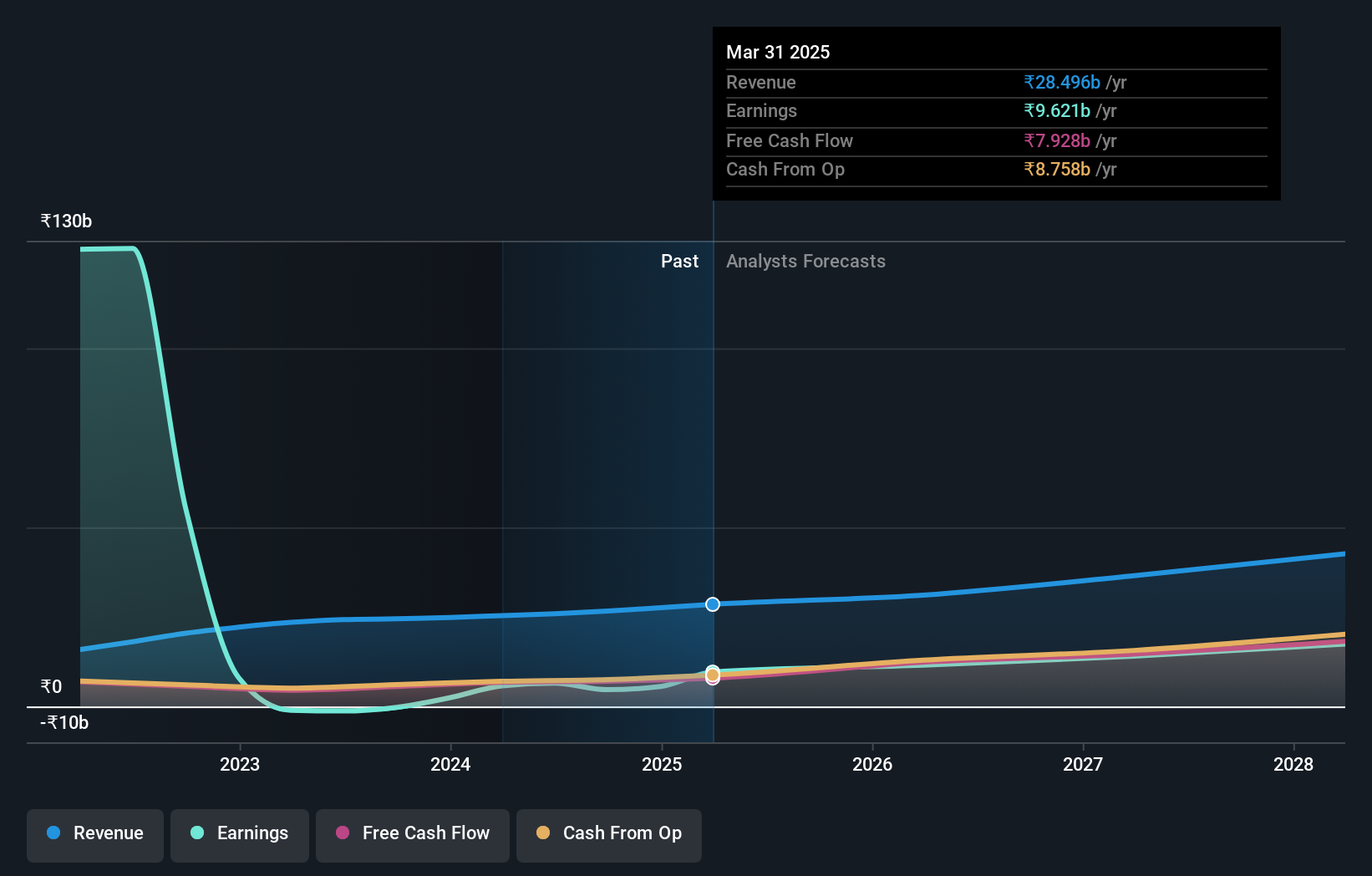

Info Edge (India) recently declared an interim dividend, underscoring its financial stability amidst a challenging quarter. Despite a dip in net income to INR 232.59 million from INR 2,051.25 million year-over-year for Q2, the company's commitment to growth is evident with significant investments in R&D and strategic acquisitions like Vyuti Systems and Nexstem India. These moves align with its revenue trajectory, projected to increase by 13.8% annually, outpacing the Indian market's growth rate of 10.5%. Furthermore, earnings are expected to surge by 38.1% per year, highlighting Info Edge’s potential in leveraging technological innovations for sustained long-term growth within the competitive tech landscape.

- Click to explore a detailed breakdown of our findings in Info Edge (India)'s health report.

Explore historical data to track Info Edge (India)'s performance over time in our Past section.

Constellation Software (TSX:CSU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Constellation Software Inc., along with its subsidiaries, focuses on acquiring, building, and managing vertical market software businesses globally, with a market cap of CA$94.40 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, which accounts for $9.68 billion. Its business model revolves around acquiring and managing vertical market software businesses across various regions, including Canada, the United States, and Europe.

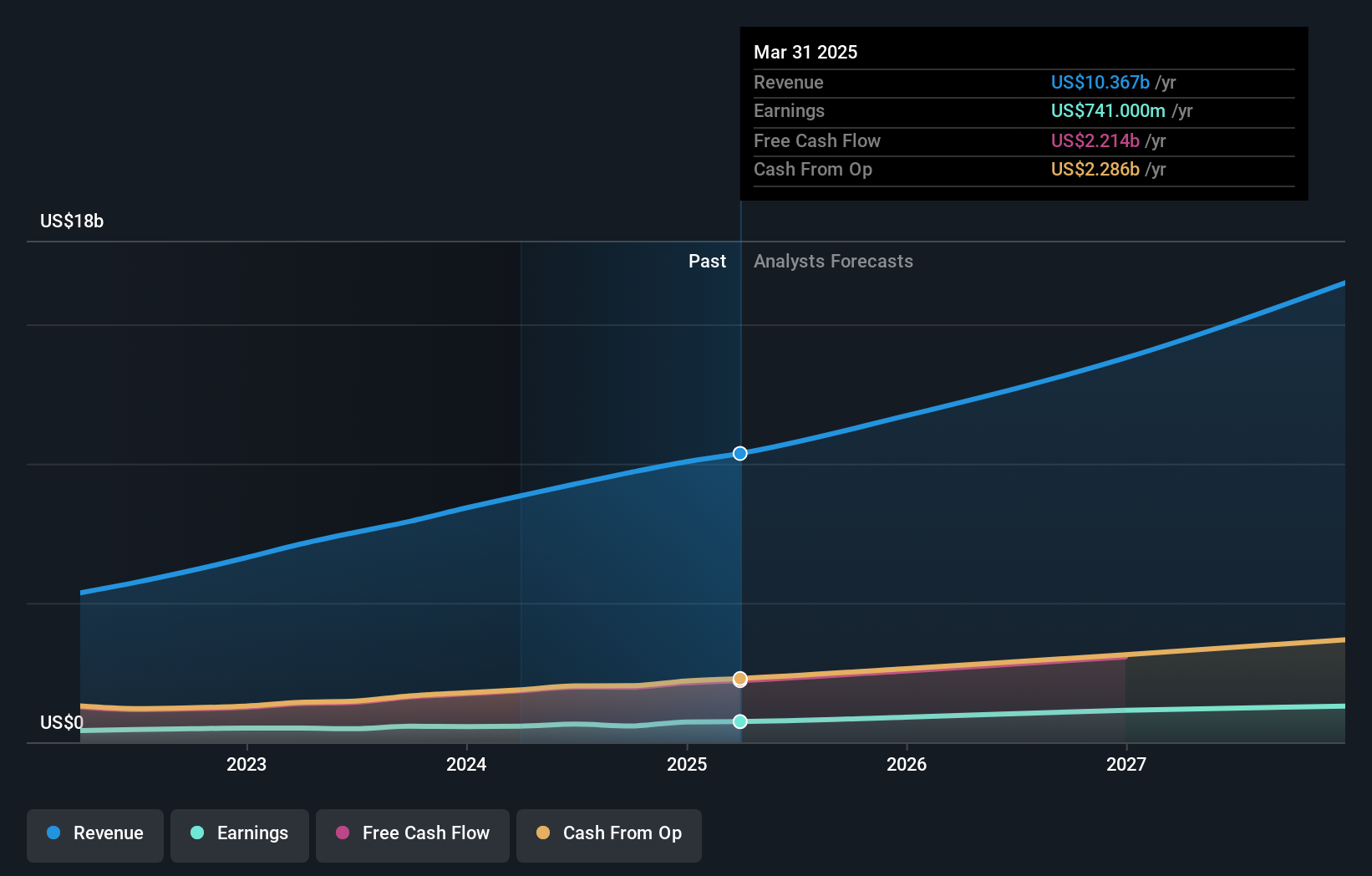

Constellation Software demonstrates a robust commitment to innovation with R&D expenses reaching $1.2 billion, reflecting its strategic focus on long-term technological advancements. This investment is crucial as it supports the company's revenue growth at 16.1% annually, slightly below the high-growth threshold but notable in a competitive sector. Despite earnings growth last year lagging behind the industry average at 1.9%, forecasts show an impressive rebound with expected annual earnings growth of 26.8%, outpacing the Canadian market projection of 16.6%. Additionally, recent dividend affirmations underscore financial stability and shareholder value, positioning Constellation Software uniquely within its niche in tech landscapes.

- Navigate through the intricacies of Constellation Software with our comprehensive health report here.

Assess Constellation Software's past performance with our detailed historical performance reports.

Unimicron Technology (TWSE:3037)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Unimicron Technology Corp. is involved in the development, manufacturing, processing, and sale of printed circuit boards and electronic products globally, with a market cap of NT$255.24 billion.

Operations: Unimicron Technology Corp. specializes in producing printed circuit boards, electrical equipment, and testing systems for integrated circuits on a global scale. The company generates revenue through these diverse product lines, catering to various sectors within the electronics industry.

Unimicron Technology, amid a challenging quarter with net income dropping to TWD 997.14 million from TWD 2,589.23 million year-over-year, still showcases resilience in sales growth, up to TWD 31.7 billion from TWD 26.5 billion previously reported. This performance is underpinned by substantial R&D investments that foster innovation and competitiveness in the tech sector; however, earnings per share have seen a reduction to TWD 0.66 from TWD 1.7 last year. Looking ahead, the company's anticipated earnings growth of 62.2% annually positions it for potential recovery and aligns with strategic expansions in high-demand tech areas.

- Unlock comprehensive insights into our analysis of Unimicron Technology stock in this health report.

Summing It All Up

- Click through to start exploring the rest of the 1268 High Growth Tech and AI Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3037

Unimicron Technology

Engages in the development, manufacturing, processing, and sale of printed circuit boards, electrical equipment, electronic products, and testing and burn-in systems for integrated circuit products worldwide.

Flawless balance sheet with high growth potential.