- Taiwan

- /

- Tech Hardware

- /

- TWSE:6414

Exploring None's High Growth Tech Stocks With Promising Potential

Reviewed by Simply Wall St

In the final week of December 2024, global markets experienced moderate gains driven by large-cap growth stocks, with the tech-heavy Nasdaq Composite leading the charge before a mid-week reversal. Despite fluctuations in consumer confidence and economic indicators such as durable goods orders and new home sales, these shifts underscore the importance of identifying high-growth tech stocks that can navigate such dynamic market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1261 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Chengdu KSW TechnologiesLtd (SHSE:688283)

Simply Wall St Growth Rating: ★★★★★☆

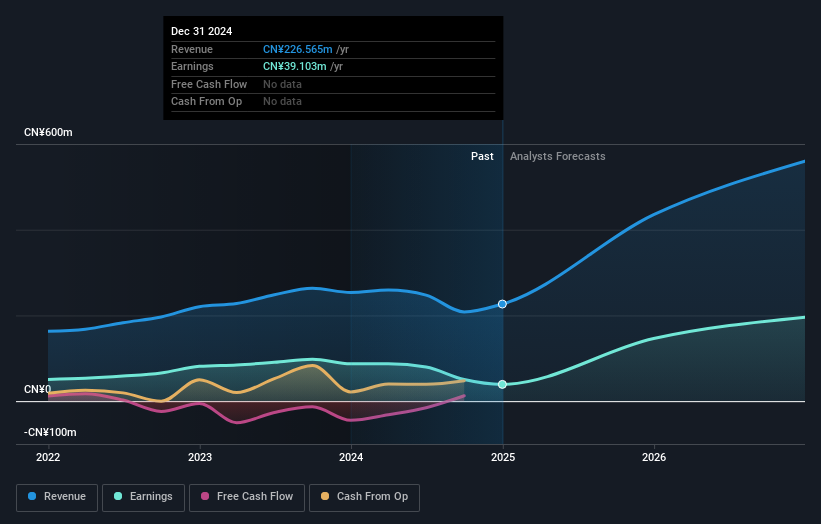

Overview: Chengdu KSW Technologies Co., Ltd. focuses on the R&D, manufacturing, and sale of wireless channel emulators and RF microwave signal generators in China, with a market cap of CN¥2.98 billion.

Operations: KSW Technologies generates revenue primarily from its communications equipment segment, totaling CN¥208.19 million. The company is involved in the development and production of wireless channel emulators and RF microwave signal generators within China.

Chengdu KSW TechnologiesLtd., amidst a challenging fiscal environment, has demonstrated robust growth trajectories with revenue and earnings forecast to outpace the CN market significantly. With an annualized revenue growth of 36.8% and earnings surge at 44.4%, the company is navigating well above industry norms. However, recent quarters have seen a dip in net income from CN¥53.37 million to CN¥16.59 million year-over-year, reflecting volatility in its financial performance despite aggressive share repurchase activities totaling CN¥16.3 million for 0.7% of outstanding shares. The firm's commitment to innovation is evident from its R&D investments which are crucial for sustaining long-term competitiveness in tech-intensive sectors like software and AI where Chengdu KSW operates. This strategic focus not only fuels future prospects but also aligns with industry shifts towards more sustainable and advanced technological solutions, setting a solid foundation for potential market leadership amid evolving global tech landscapes.

Ennoconn (TWSE:6414)

Simply Wall St Growth Rating: ★★★★☆☆

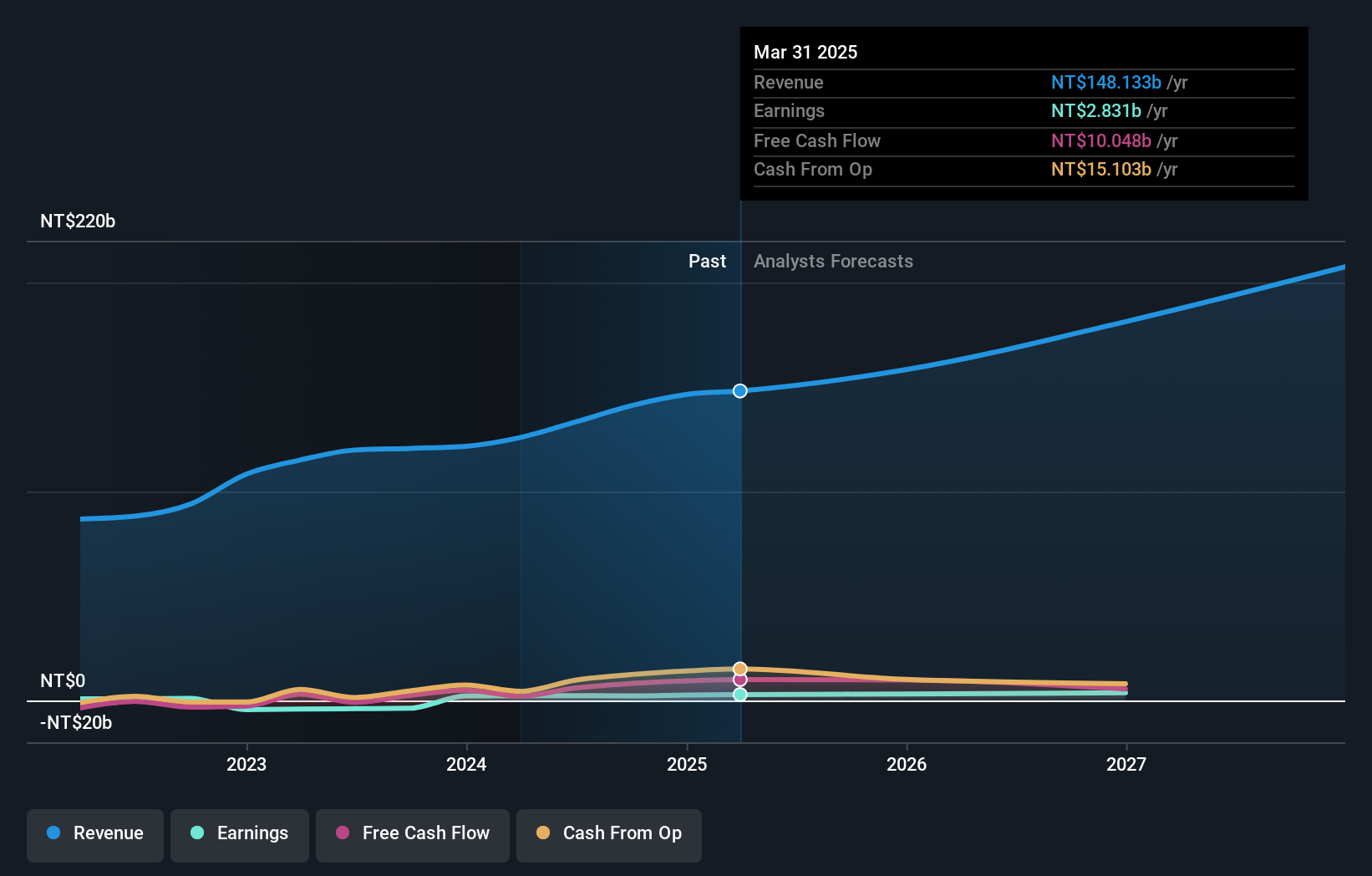

Overview: Ennoconn Corporation, with a market cap of NT$40.05 billion, engages in the research, design, development, manufacturing, and sales of data storage and processing equipment as well as industrial motherboards and network communication products across Taiwan, China, Europe, and internationally.

Operations: Ennoconn Corporation generates revenue primarily from its Factory System and Electromechanical System Service Business Department, contributing NT$60.85 billion, and the Information Systems Department, adding NT$54.61 billion. The company also derives income from its Industrial Computer Software and Hardware Sales Department with NT$26.93 billion in revenue, while the Network Communications Production and Sales department contributes NT$4.16 billion.

Ennoconn Corporation, amidst a competitive tech landscape, has shown resilience with a 14.1% annual revenue growth and an impressive 22.5% spike in earnings growth per year, outpacing the TW market averages of 12.2% and 19%, respectively. At the forefront of innovation, Ennoconn's commitment to R&D is reflected in its substantial investment figures which are pivotal for maintaining its edge in AI and software sectors. Recent financial reports indicate robust sales reaching TWD 106.75 billion over nine months, despite a slight dip in net income from TWD 1.83 billion last year to TWD 1.82 billion this year, underscoring the challenges even high-growth firms face in sustaining profit margins amidst rapid expansion and market fluctuations.

- Click here and access our complete health analysis report to understand the dynamics of Ennoconn.

Understand Ennoconn's track record by examining our Past report.

Chenbro Micom (TWSE:8210)

Simply Wall St Growth Rating: ★★★★☆☆

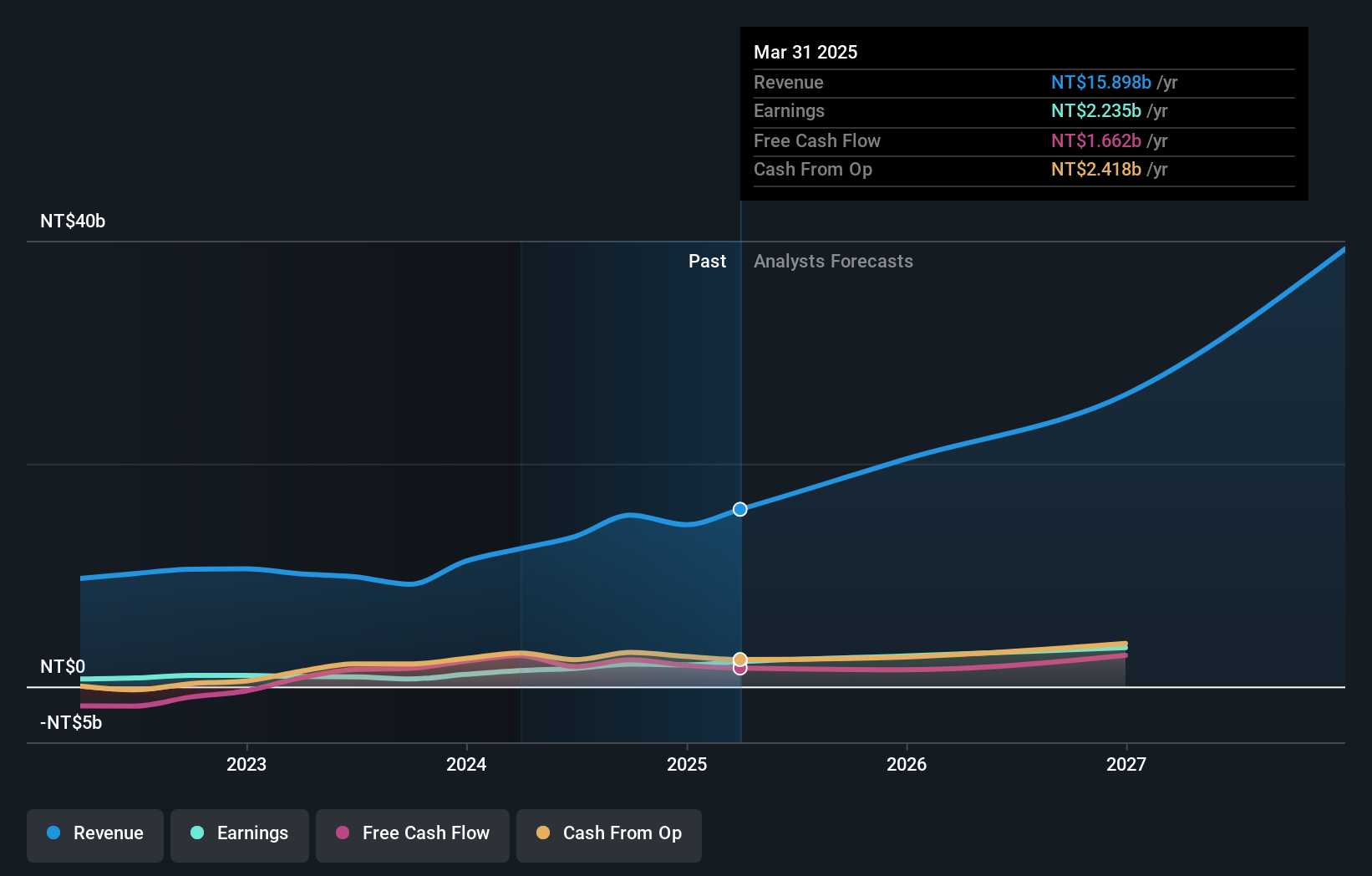

Overview: Chenbro Micom Co., Ltd. is involved in the research, design, manufacturing, processing, and trading of computer peripherals and expendable systems across the United States, China, Taiwan, Singapore, and other international markets with a market cap of NT$32.24 billion.

Operations: The company focuses on the computer peripherals segment, generating NT$15.38 billion in revenue.

Chenbro Micom has demonstrated significant growth, with its Q3 2024 earnings revealing a surge in sales to TWD 4.27 billion from TWD 2.36 billion year-over-year and net income jumping to TWD 643.77 million from TWD 250.4 million. These figures underscore a robust annual revenue growth of 20.6% and earnings growth of an impressive 195.3%, significantly outpacing the industry average of 11.4%. At the recent OCP Summit, Chenbro showcased advanced AI and server solutions, highlighting its deep dive into innovative technologies that support high-performance computing and data centers—a strategic move that not only aligns with current tech trends but also positions it well for sustained future growth in the tech sector.

- Click here to discover the nuances of Chenbro Micom with our detailed analytical health report.

Review our historical performance report to gain insights into Chenbro Micom's's past performance.

Turning Ideas Into Actions

- Click this link to deep-dive into the 1261 companies within our High Growth Tech and AI Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ennoconn might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6414

Ennoconn

Researches, designs, develops, manufactures, and sells data storage, processing equipment and industrial motherboard, and network communication in Taiwan, China, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.