- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3526

Exploring High Growth Tech Stocks This January 2025

Reviewed by Simply Wall St

As global markets wrapped up the year with moderate gains, driven by large-cap growth stocks and a technology-heavy rally, concerns over falling U.S. consumer confidence and declining durable goods orders have cast a shadow on economic optimism. In this context of mixed economic signals, identifying high-growth tech stocks requires careful consideration of their potential to thrive amidst fluctuating consumer sentiment and broader market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| TG Therapeutics | 30.06% | 45.28% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1261 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Kamada (TASE:KMDA)

Simply Wall St Growth Rating: ★★★★☆☆

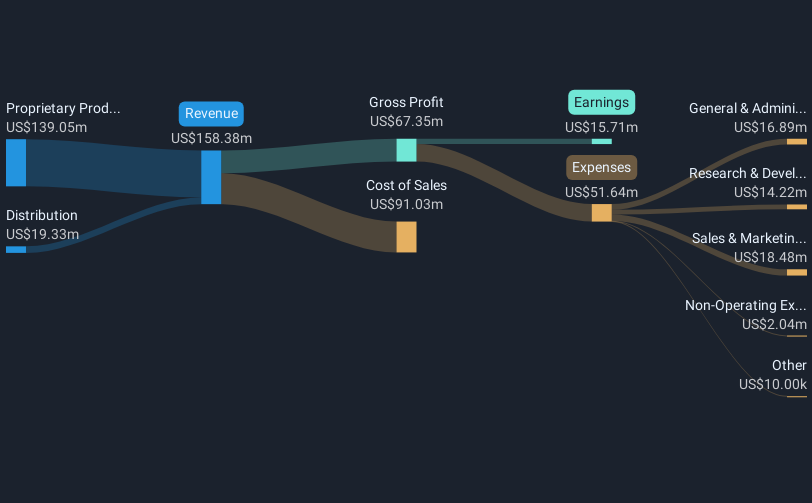

Overview: Kamada Ltd. is a company that manufactures and sells plasma-derived protein therapeutics, with a market cap of ₪1.27 billion.

Operations: Kamada generates revenue primarily from its proprietary products, contributing $139.05 million, and distribution activities, which add $19.33 million.

Kamada Ltd. is actively enhancing its growth trajectory through strategic mergers and acquisitions, with a robust balance sheet supporting these initiatives, evidenced by their $72 million cash reserve as of Q3 2024. The company's recent financial performance underscores this strategy's effectiveness; Q3 revenue rose to $41.74 million from $37.93 million year-over-year, coupled with a net income increase to $3.86 million from $3.22 million in the same period. Moreover, Kamada has raised its full-year earnings outlook while maintaining revenue projections between $158 million and $162 million, reflecting confidence in sustained double-digit growth fueled by both organic advances and potential new business integrations set to impact 2025 onwards.

- Click to explore a detailed breakdown of our findings in Kamada's health report.

Assess Kamada's past performance with our detailed historical performance reports.

Alltop Technology (TPEX:3526)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alltop Technology Co., Ltd. and its subsidiaries focus on the research, design, development, manufacture, and sale of electronic connectors in Taiwan and China with a market capitalization of approximately NT$16.57 billion.

Operations: With a focus on electronic connectors, Alltop Technology generates revenue primarily from its electronic coupling segment, amounting to NT$2.95 billion. The company's operations are concentrated in Taiwan and China.

Alltop Technology has demonstrated robust growth, with its Q3 2024 revenue surging to TWD 907.73 million from TWD 682.38 million year-over-year, an impressive increase that underscores the company's expanding market presence. This growth is complemented by a net income rise to TWD 264.94 million from TWD 209.49 million, reflecting a strong profit trajectory with earnings per share also showing significant improvement. The firm’s commitment to innovation is evident in its R&D spending trends, which have consistently aligned with revenue increases, ensuring sustained advancements in technology and market competitiveness. Moreover, the appointment of a new chief sustainability officer highlights Alltop's strategic focus on long-term value creation through sustainable practices, positioning it well within the tech industry’s evolving landscape.

- Get an in-depth perspective on Alltop Technology's performance by reading our health report here.

Examine Alltop Technology's past performance report to understand how it has performed in the past.

Eson Precision Ind (TWSE:5243)

Simply Wall St Growth Rating: ★★★★★☆

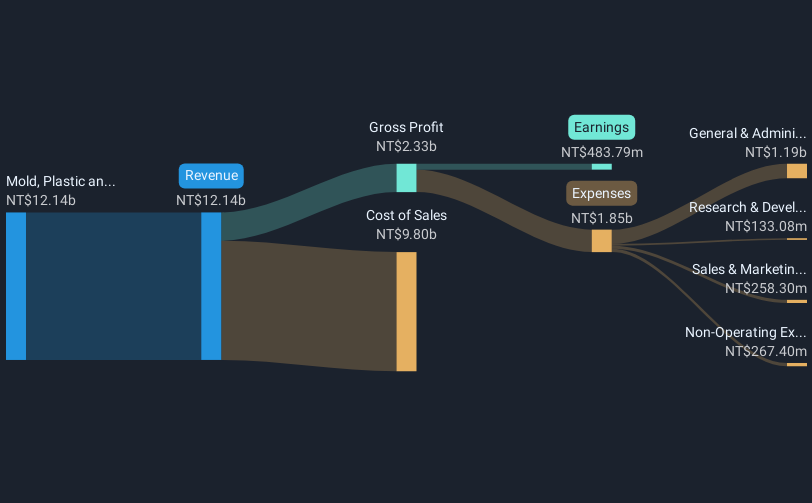

Overview: Eson Precision Ind. Co., Ltd. is engaged in the production and sale of molds and consumer electronic components both in Taiwan and internationally, with a market capitalization of NT$11.81 billion.

Operations: Eson Precision Ind. generates revenue primarily from its Mold, Plastic, and Metal Products segment, which amounts to NT$12.14 billion.

Eson Precision Ind. has made significant strides in high-growth tech, with its third-quarter sales rising to TWD 3.39 billion, a robust increase from TWD 2.73 billion the previous year. This growth is complemented by a net income boost to TWD 162.43 million from TWD 140.75 million, illustrating strong financial health and market adaptability. The establishment of a Committee for Sustainable Development underscores Eson's commitment to long-term value through strategic innovation and governance enhancements, positioning it favorably within the evolving tech landscape despite facing challenges like a highly volatile share price and lower profit margins compared to last year (4% down from 5.8%).

Next Steps

- Embark on your investment journey to our 1261 High Growth Tech and AI Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3526

Alltop Technology

Engages in the research, design, development, manufacture, and sale of electronic connectors in Taiwan and China.

Undervalued with solid track record.

Market Insights

Community Narratives