- Taiwan

- /

- Communications

- /

- TPEX:6546

High Growth Tech Stocks to Watch in January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets have experienced a mixed performance with U.S. indices showing moderate gains despite a decline in consumer confidence and manufacturing orders, while European stocks saw slight increases amid economic growth concerns. In this environment, high growth tech stocks continue to capture attention as investors look for opportunities that can potentially outperform in sectors driven by innovation and technological advancements.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| TG Therapeutics | 30.06% | 45.28% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1261 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Kinepolis Group (ENXTBR:KIN)

Simply Wall St Growth Rating: ★★★★☆☆

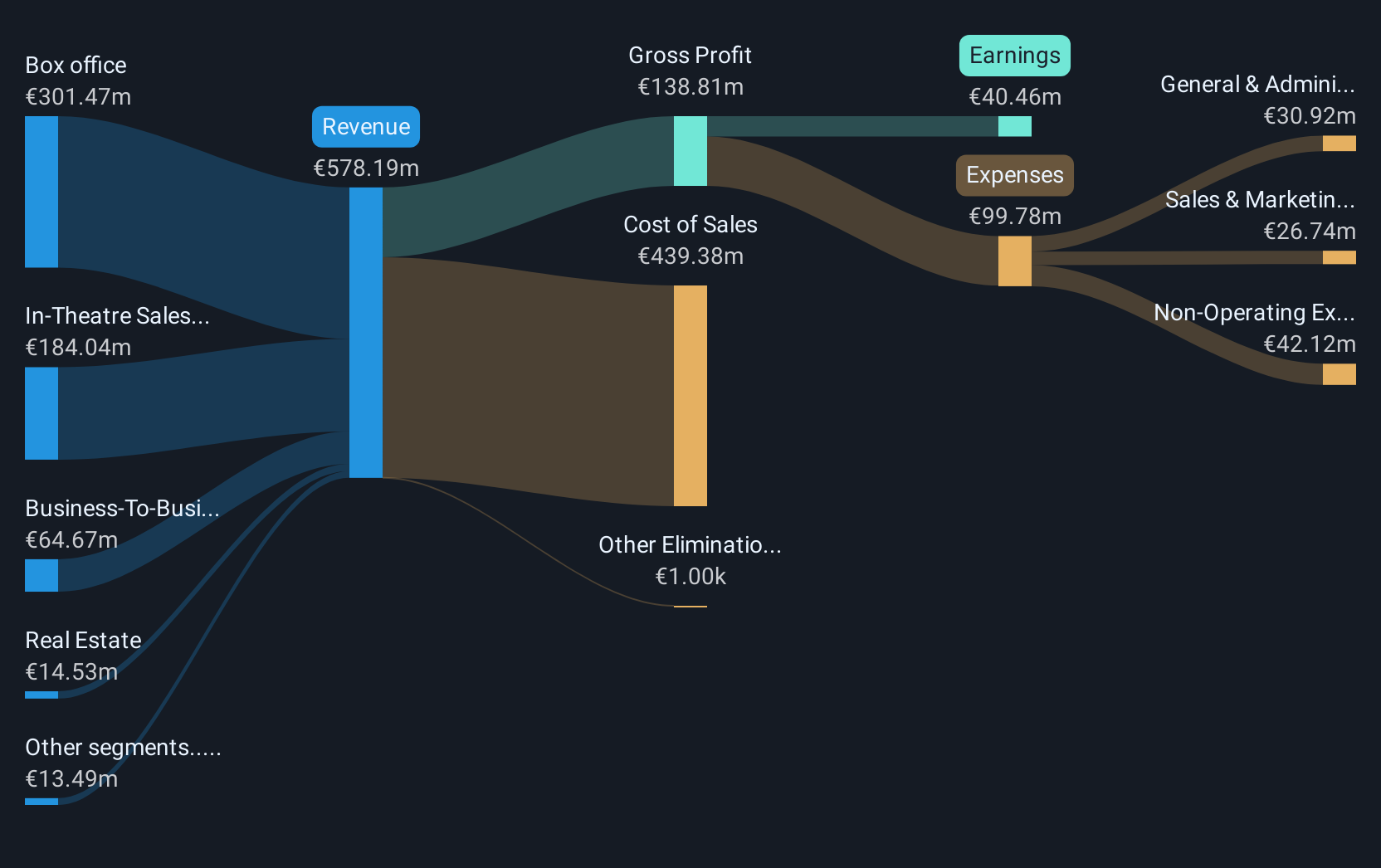

Overview: Kinepolis Group NV operates cinema complexes across several countries including Belgium, the Netherlands, France, Spain, Luxembourg, Switzerland, Poland, Canada, and the United States with a market cap of approximately €1.05 billion.

Operations: Kinepolis Group generates revenue primarily from box office sales (€294.05 million) and in-theatre sales (€177.61 million), while also engaging in real estate activities (€13.88 million) and film distribution (€4.07 million).

Despite a challenging backdrop with a 4.6% projected annual revenue growth trailing the Belgian market's 7.4%, Kinepolis Group stands out for its robust earnings forecast, expected to surge by 25.5% annually, outpacing the local market prediction of 21%. This stark contrast in performance metrics underscores Kinepolis's potential resilience and adaptability in the entertainment sector. Notably, while the industry saw an average earnings growth of 7.1%, Kinepolis experienced a downturn last year with earnings shrinking by 9.8%. However, with high-quality past earnings and positive free cash flow, the company is strategically positioned to leverage its financial health for future endeavors, potentially enhancing its competitive edge in an evolving industry landscape.

- Dive into the specifics of Kinepolis Group here with our thorough health report.

Evaluate Kinepolis Group's historical performance by accessing our past performance report.

Universal Microwave Technology (TPEX:3491)

Simply Wall St Growth Rating: ★★★★★☆

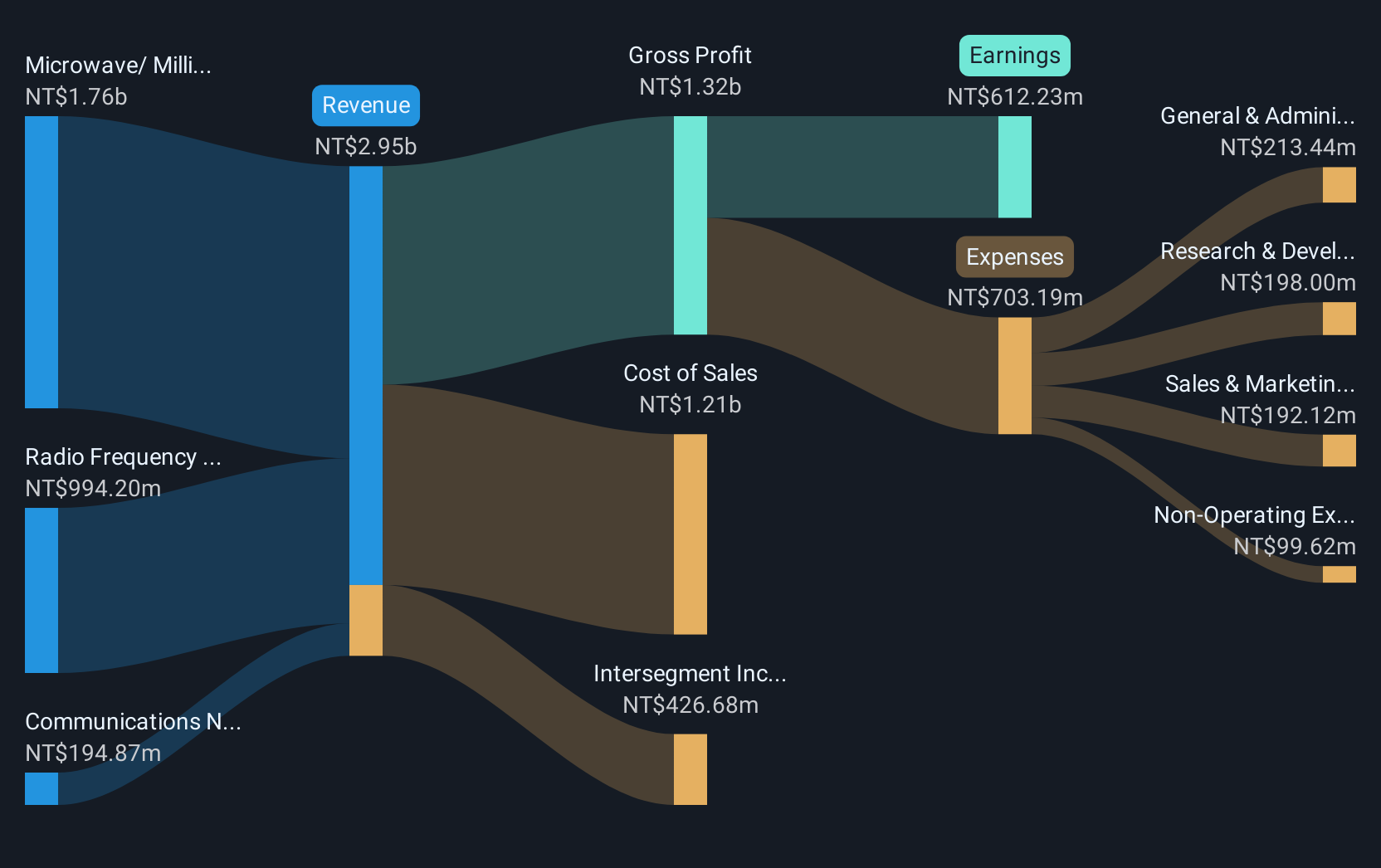

Overview: Universal Microwave Technology, Inc. is engaged in the microwave and millimeter wave wireless communication industry across various regions including Taiwan, China, Asia, Europe, the United States, and Oceania with a market capitalization of NT$20.94 billion.

Operations: The company generates revenue primarily through its Microwave/Millimeter Wave Products and Radio Frequency Products, contributing NT$1.26 billion and NT$1.06 billion respectively. Additionally, it offers Communications Network Engineering Services, which add NT$214.58 million to its revenue stream.

Universal Microwave Technology has demonstrated robust financial performance, with a notable increase in both sales and net income. In the third quarter of 2024 alone, sales surged to TWD 639.64 million from TWD 375.53 million the previous year, while net income more than doubled to TWD 132.43 million from TWD 45.94 million, reflecting an aggressive expansion in its market presence and operational efficiency. This growth trajectory is underscored by a remarkable annual revenue growth rate of 33.8% and earnings growth of 53.7%. The company's commitment to innovation is evident in its R&D investments, which have strategically positioned it for sustained future growth within the competitive tech landscape.

AMPAK Technology (TPEX:6546)

Simply Wall St Growth Rating: ★★★★★☆

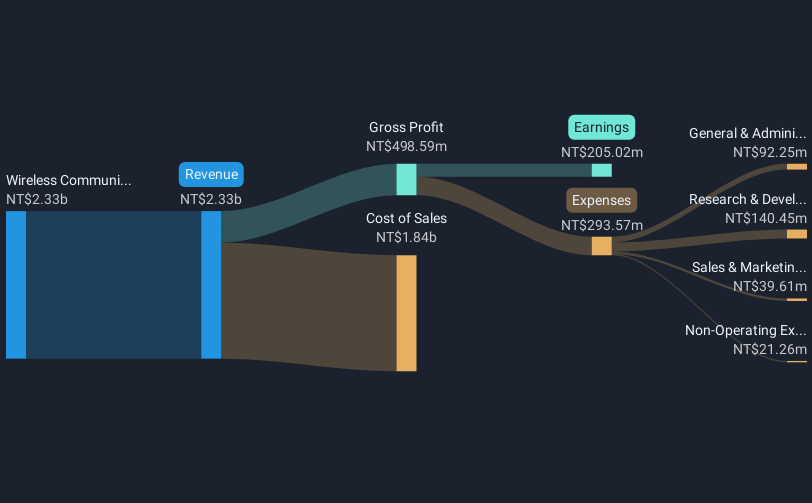

Overview: AMPAK Technology Inc. is involved in the research, design, development, production, marketing, and sale of wireless modules in Taiwan with a market capitalization of NT$9.97 billion.

Operations: AMPAK Technology generates revenue primarily from its wireless communication products, amounting to NT$2.33 billion. The company focuses on various stages of wireless module production and marketing within Taiwan.

AMPAK Technology, amidst a competitive tech landscape, has demonstrated a robust growth trajectory with its revenue and earnings expanding at annual rates of 41.7% and 83.2%, respectively. This performance surpasses the broader Taiwanese market averages significantly, highlighting the company's effective strategy and market positioning. Despite recent fluctuations in net income as reported in Q3 2024, AMPAK continues to invest heavily in R&D, committing TWD 169.09 million over nine months to fuel innovation and future growth—a strategic move that underscores its commitment to maintaining technological leadership and enhancing product offerings in a rapidly evolving industry.

Taking Advantage

- Get an in-depth perspective on all 1261 High Growth Tech and AI Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6546

AMPAK Technology

Engages in the research, design, development, production, market, and sale of wireless module in Taiwan.

Flawless balance sheet with high growth potential.