- Taiwan

- /

- Communications

- /

- TWSE:4977

Exploring High Growth Tech Stocks with Exciting Potential

Reviewed by Simply Wall St

As global markets experience fluctuations, with major stock indexes posting moderate gains despite a dip in consumer confidence and mixed economic indicators, the technology sector continues to capture investor interest, driven by its potential for innovation and growth. In this context of shifting market dynamics, identifying high-growth tech stocks involves considering factors such as a company's adaptability to changing conditions, its ability to leverage technological advancements, and its potential for sustainable expansion amidst economic challenges.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| TG Therapeutics | 30.06% | 45.28% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1261 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

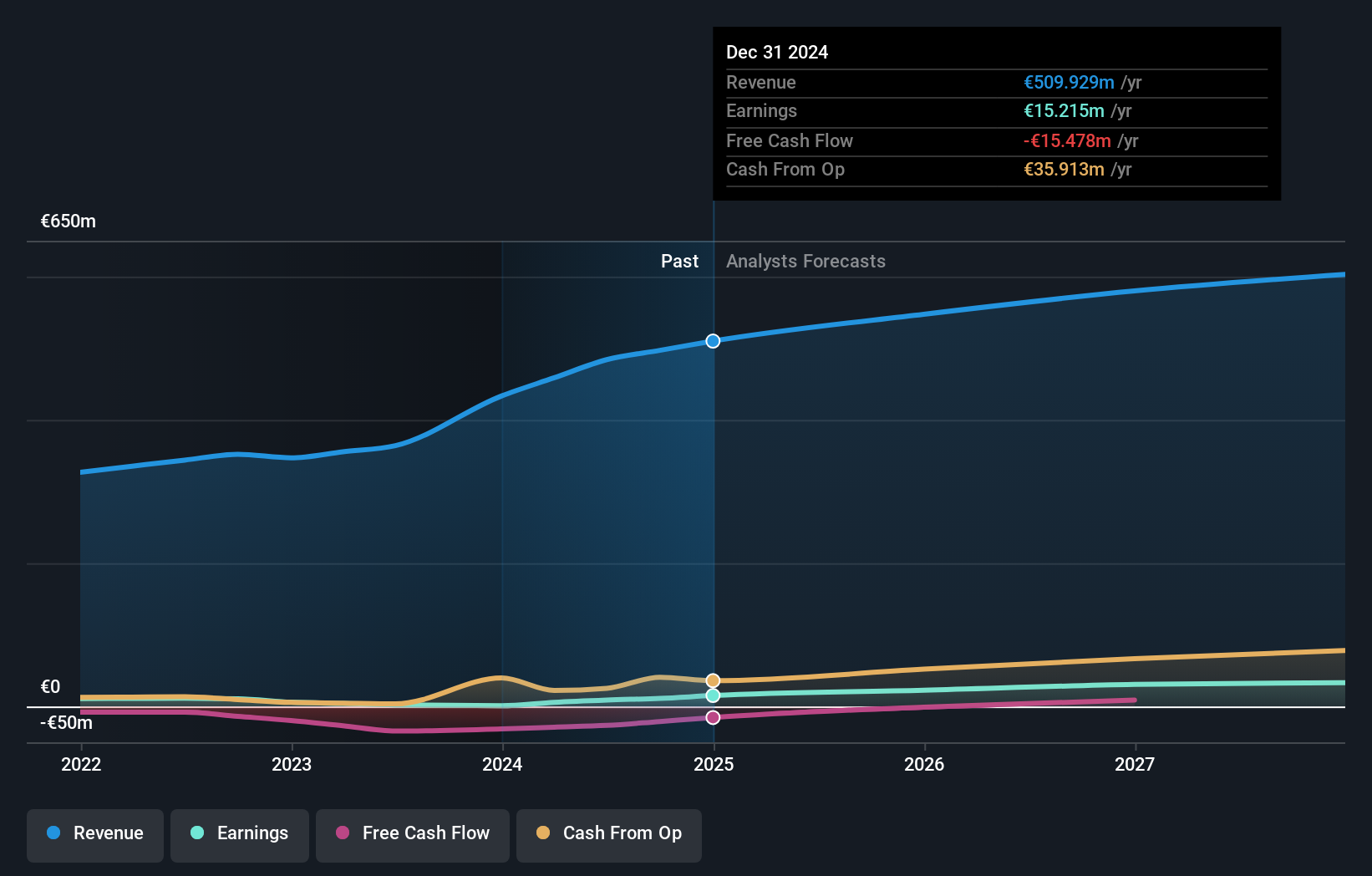

GPI (BIT:GPI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GPI S.p.A. provides social-healthcare IT and hi-tech services to healthcare markets both in Italy and internationally, with a market cap of €315.19 million.

Operations: GPI S.p.A. generates revenue primarily from its Software segment, contributing €283.27 million, and the Care segment, which adds €161.11 million to its earnings.

GPI S.p.A.'s recent participation in high-profile conferences and a special shareholders meeting underscores its active engagement in the industry and strategic communication. Despite a modest revenue growth forecast of 5.3% annually, GPI's earnings are expected to surge by 35.2% per year, significantly outpacing the Italian market's average. This remarkable earnings growth, which has recently soared by 280.3%, highlights GPI’s potential in leveraging operational efficiencies or market innovations that eclipse broader industry performance metrics of just 3.6%. However, it's crucial to note that GPI struggles with free cash flow generation and faces challenges in covering interest payments with its earnings, indicating potential risks in liquidity and financial flexibility moving forward.

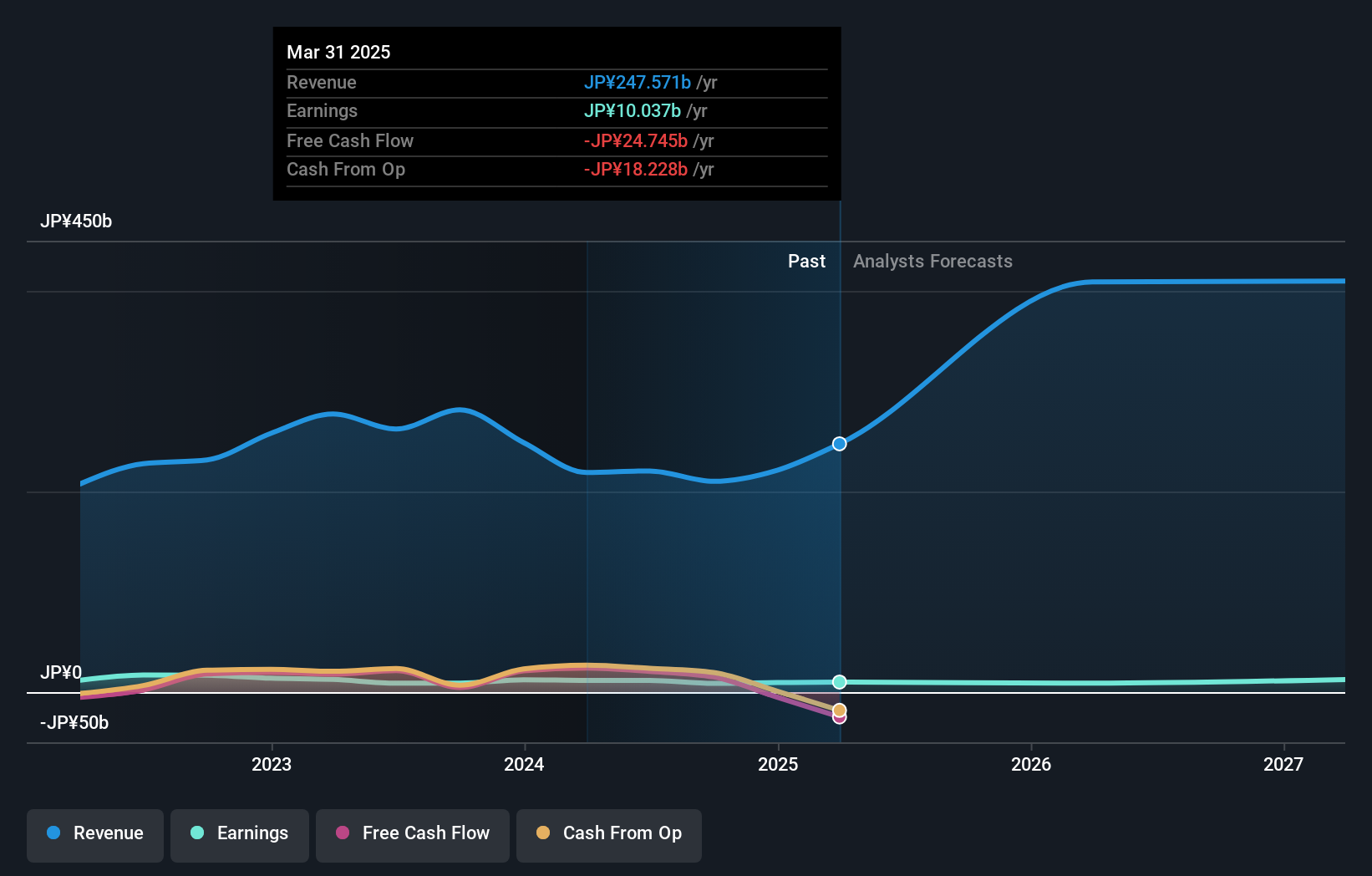

Hosiden (TSE:6804)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hosiden Corporation is engaged in the development, manufacturing, and sale of electronic components both domestically in Japan and internationally, with a market capitalization of approximately ¥120.53 billion.

Operations: The company generates revenue primarily from mechanical parts, which contribute significantly to its sales, followed by audio parts. Display parts and composite parts also form part of the revenue streams.

Hosiden has demonstrated a robust commitment to enhancing shareholder value, evidenced by its recent share repurchase program where 1.25 million shares were bought back for ¥3 billion. This move aligns with strategies to mitigate market fluctuations post-Euro-yen bond issues and underscores financial agility in capital management. With a projected annual revenue growth of 19.9% and earnings expected to surge by 32.7%, Hosiden is positioning itself strongly within the tech sector, outpacing the Japanese market's average growth rates significantly. Moreover, its substantial investment in R&D, which remains undisclosed but is pivotal for sustaining innovation and competitive edge, signals a forward-looking approach crucial for long-term success in the dynamic tech landscape.

- Unlock comprehensive insights into our analysis of Hosiden stock in this health report.

Examine Hosiden's past performance report to understand how it has performed in the past.

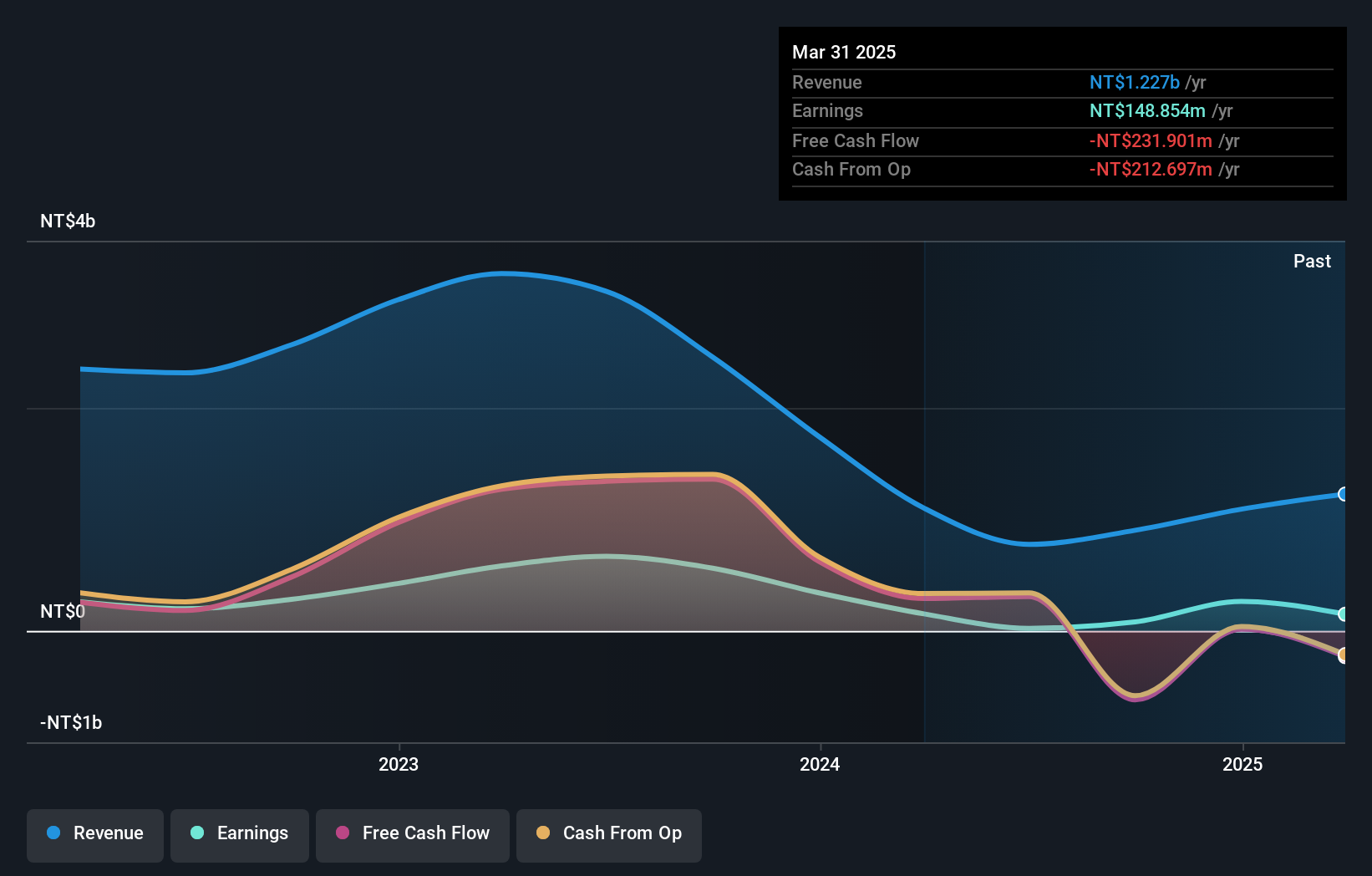

PCL Technologies (TWSE:4977)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PCL Technologies, Inc. and its subsidiaries are involved in the research, manufacturing, and sale of optical transceiver products both in Taiwan and internationally, with a market cap of NT$11.99 billion.

Operations: The company focuses on the research, development, production, and sales of light mine devices, generating revenue of NT$902.33 million.

PCL Technologies has demonstrated remarkable growth, with a projected annual revenue increase of 47.1% and earnings expected to surge by 90.5%. This performance is underpinned by strategic R&D investments, which are crucial for maintaining its competitive edge in the tech sector. Recently, the company announced a share repurchase program aimed at transferring shares to employees, reflecting confidence in its financial health and commitment to value creation. Additionally, significant earnings results reported for Q3 2024 indicate robust operational efficiency and market adaptability, positioning PCL well within its industry landscape.

- Click here and access our complete health analysis report to understand the dynamics of PCL Technologies.

Review our historical performance report to gain insights into PCL Technologies''s past performance.

Next Steps

- Take a closer look at our High Growth Tech and AI Stocks list of 1261 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:4977

PCL Technologies

Researches, manufactures, and sells optical transceiver products in Taiwan and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion