As global markets navigate a landscape of fluctuating consumer confidence and economic indicators, investors are increasingly looking for stable income sources amidst the volatility. In such environments, dividend stocks can offer appealing opportunities by providing regular income streams and potential capital appreciation, making them a compelling choice for those seeking to balance growth with income stability.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.33% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.36% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.26% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

Click here to see the full list of 1940 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Nordea Bank Abp (HLSE:NDA FI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nordea Bank Abp provides a range of banking products and services across Sweden, Finland, Norway, Denmark, and internationally with a market cap of €36.66 billion.

Operations: Nordea Bank Abp generates revenue from several segments, including Business Banking (€3.58 billion), Personal Banking (€4.79 billion), Asset and Wealth Management (€1.46 billion), and Large Corporates & Institutions (€2.50 billion).

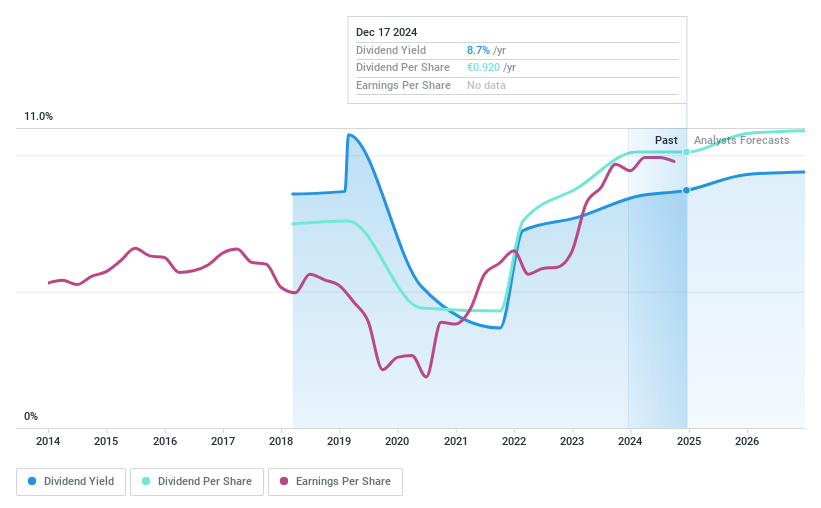

Dividend Yield: 8.8%

Nordea Bank Abp's dividend appeal is marked by a high yield, positioning it in the top 25% of Finnish dividend payers. Despite this, its seven-year track record reveals volatility and unreliability in payments. The payout ratio of 64.7% suggests dividends are currently covered by earnings, but future earnings are forecasted to decline slightly. Recent business reorganizations aim for long-term technological advantages, potentially impacting future financial stability and dividend sustainability.

- Navigate through the intricacies of Nordea Bank Abp with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Nordea Bank Abp shares in the market.

SYN-TECH Chem. & Pharm (TPEX:1777)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SYN-TECH Chem. & Pharm. Co., Ltd. is a company that manufactures and sells active pharmaceutical ingredients (APIs) both in Taiwan and internationally, with a market cap of NT$4.20 billion.

Operations: SYN-TECH Chem. & Pharm. Co., Ltd.'s revenue primarily comes from its Drugs Manufacture segment, totaling NT$1.22 billion.

Dividend Yield: 3.7%

SYN-TECH Chem. & Pharm.'s dividend is well-covered with a payout ratio of 47.7% and a cash payout ratio of 40.1%, indicating sustainability from both earnings and cash flow perspectives. Despite a decade-long increase in dividends, the track record remains unstable, with volatility noted in past payments. The current yield of 3.72% is below market leaders, while its price-to-earnings ratio of 12.8x suggests good value compared to the TW market average of 20.8x. Recent earnings growth supports this outlook, though historical dividend reliability issues persist.

- Click to explore a detailed breakdown of our findings in SYN-TECH Chem. & Pharm's dividend report.

- According our valuation report, there's an indication that SYN-TECH Chem. & Pharm's share price might be on the expensive side.

JINUSHILtd (TSE:3252)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JINUSHI Co., Ltd. operates in the real estate investment sector in Japan and has a market capitalization of ¥44.36 billion.

Operations: JINUSHI Co., Ltd. generates revenue primarily from its Real Estate Investment Business, which accounts for ¥52.23 billion.

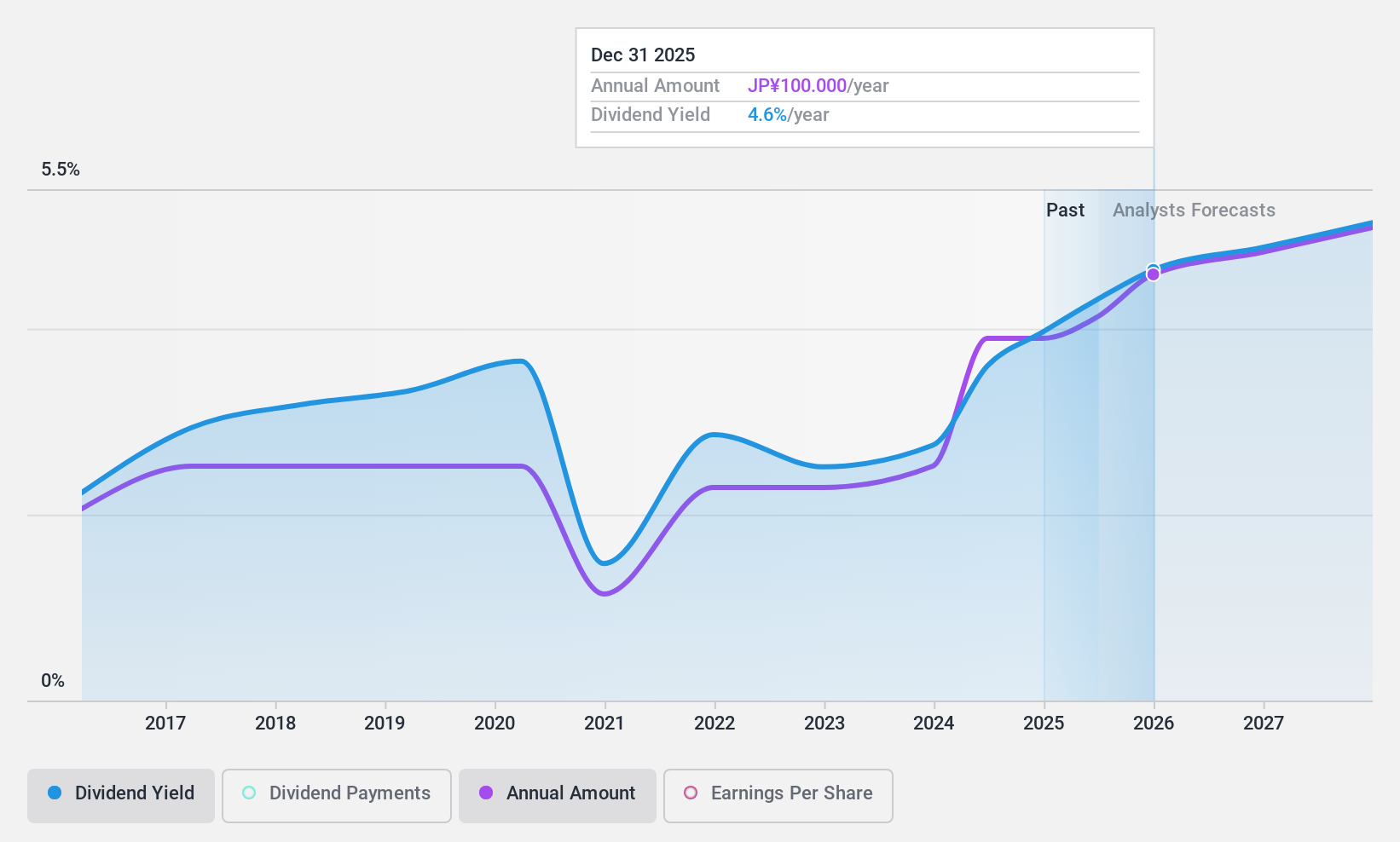

Dividend Yield: 3.9%

JINUSHI Ltd.'s dividend yield of 3.94% ranks in the top 25% of JP market payers, though it's not well covered by free cash flow and has been volatile over the past decade. Despite a low payout ratio of 34.2%, indicating coverage by earnings, profit margins have declined from last year. The company recently raised its earnings guidance for 2024, suggesting potential stability improvements, but debt remains inadequately covered by operating cash flow.

- Dive into the specifics of JINUSHILtd here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that JINUSHILtd is trading behind its estimated value.

Turning Ideas Into Actions

- Click here to access our complete index of 1940 Top Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:1777

SYN-TECH Chem. & Pharm

Manufactures and sells active pharmaceutical ingredients (APIs) in Taiwan and internationally.

Flawless balance sheet with proven track record and pays a dividend.