As global markets navigate a mixed economic landscape with fluctuating consumer confidence and modest gains in major stock indexes, investors are increasingly seeking stability through dividend stocks. In the current environment, characterized by cautious optimism and economic uncertainties, dividend-paying stocks can offer a reliable income stream while potentially enhancing portfolio resilience.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.33% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.36% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.26% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

Click here to see the full list of 1940 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

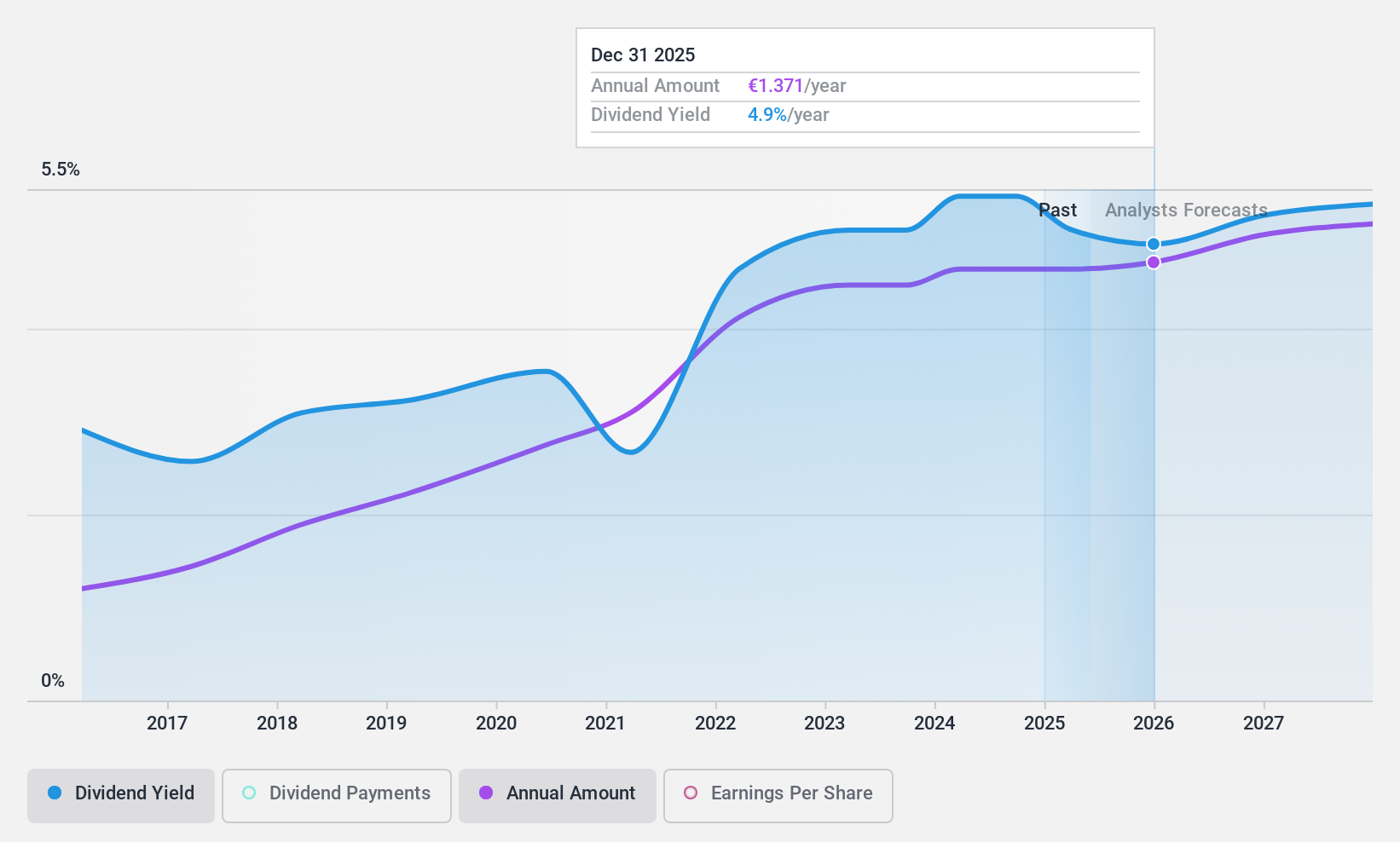

Valmet Oyj (HLSE:VALMT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Valmet Oyj is a company that develops and supplies process technologies, automation, and services for the pulp, paper, and energy industries across various global regions, with a market cap of €4.30 billion.

Operations: Valmet Oyj's revenue segments include Services (€1.84 billion), Automation (€1.39 billion), and Process Technologies (€2.10 billion).

Dividend Yield: 5.7%

Valmet Oyj's dividend payments have been reliable and stable over the past decade, but their current yield of 5.74% is below the top tier in Finland. The dividend is not well-covered by earnings due to a high payout ratio of 130.5%, though cash flows sufficiently cover it with a cash payout ratio of 63.9%. Recent executive changes and significant orders, including a €1 billion contract in Brazil, may impact future performance and investor sentiment.

- Click here to discover the nuances of Valmet Oyj with our detailed analytical dividend report.

- Our valuation report here indicates Valmet Oyj may be undervalued.

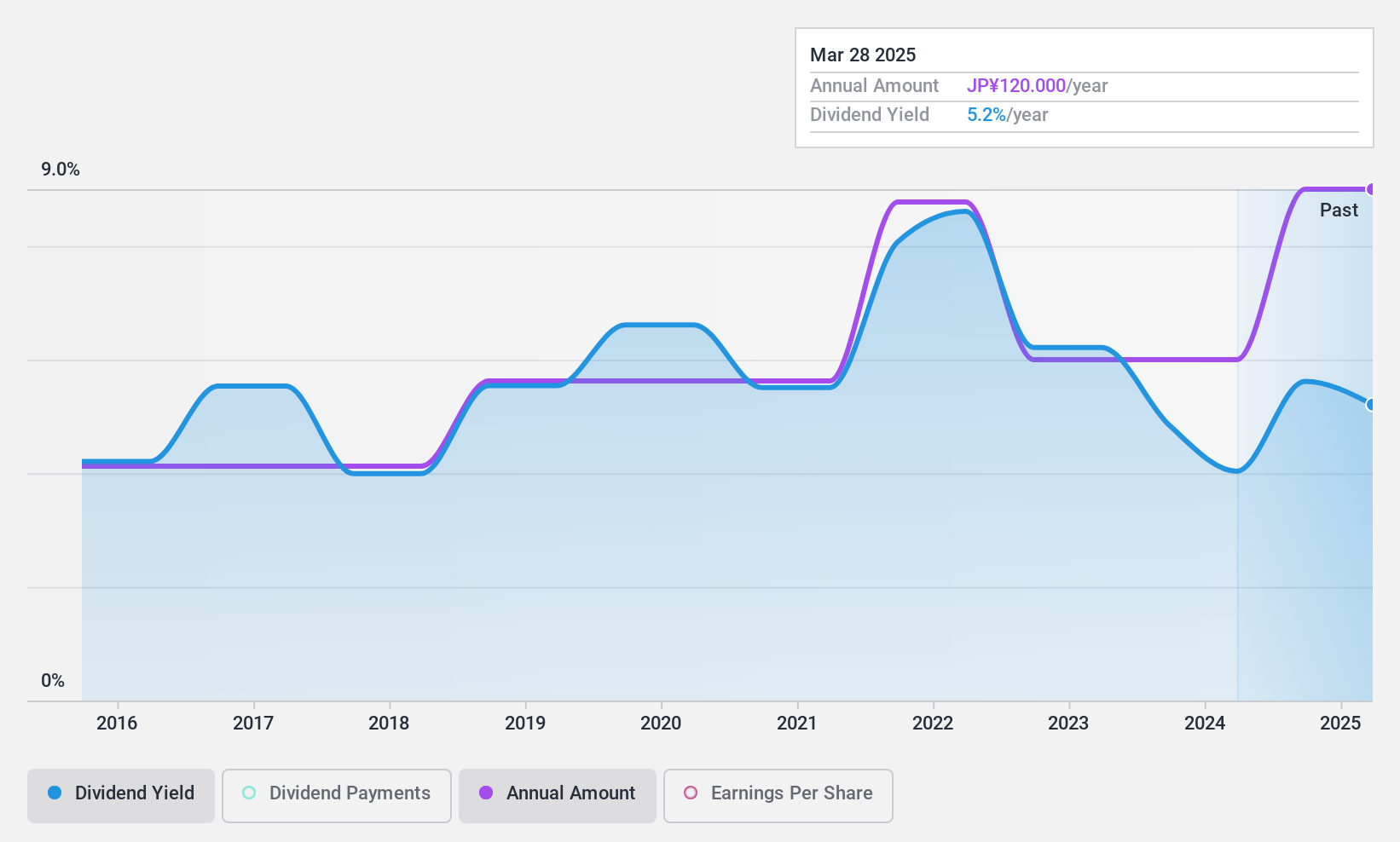

IwaiCosmo Holdings (TSE:8707)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IwaiCosmo Holdings, Inc., along with its subsidiaries, offers financial services utilizing information technology in Japan and has a market capitalization of ¥54.54 billion.

Operations: IwaiCosmo Holdings, Inc. generates revenue through its financial services operations in Japan, leveraging information technology to deliver these services.

Dividend Yield: 5.2%

IwaiCosmo Holdings offers a dividend yield of 5.17%, placing it in the top 25% of JP market payers, but its dividend reliability is questionable due to volatility over the past decade. Although dividends have grown, they are not well-covered by free cash flows with a high cash payout ratio of 113.2%. The company trades at good value, below estimated fair value, and earnings are well-covered by a low payout ratio of 37.6%.

- Click here and access our complete dividend analysis report to understand the dynamics of IwaiCosmo Holdings.

- The analysis detailed in our IwaiCosmo Holdings valuation report hints at an deflated share price compared to its estimated value.

WW Holding (TWSE:8442)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: WW Holding Inc. and its subsidiaries produce and market sports equipment, clothing, accessories, handbags, belts, suitcases, and leather items across the United States, Mainland China, Belgium, France, Germany, and globally; it has a market cap of NT$7.11 billion.

Operations: WW Holding Inc.'s revenue is primarily derived from its Sports Gear Business Group, which generates NT$3.23 billion, and its Boutique Bags Business Group, contributing NT$4.97 billion.

Dividend Yield: 5%

WW Holding's dividend yield of 4.96% ranks in the top 25% of the TW market, yet its reliability is undermined by volatility over eight years. Dividends are well-covered, with a payout ratio of 50% and a cash payout ratio of 57.1%. Despite recent earnings growth, net income for Q3 decreased to TWD 140.4 million from TWD 226.46 million year-over-year, reflecting potential challenges ahead amidst shareholder dilution last year.

- Navigate through the intricacies of WW Holding with our comprehensive dividend report here.

- Our valuation report unveils the possibility WW Holding's shares may be trading at a discount.

Make It Happen

- Get an in-depth perspective on all 1940 Top Dividend Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WW Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8442

WW Holding

Manufactures and sells sports equipment, clothing, and accessories; handbags; belts; suitcases; and leather accessories in the United States, Mainland China, Belgium, France, Germany, and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives