3 Prominent Growth Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

In the final week of December, global markets experienced a mix of gains and setbacks, with major U.S. stock indexes showing moderate increases before retreating slightly after the Christmas break. Amidst fluctuating consumer confidence and economic indicators, growth stocks have played a pivotal role in driving market movements, particularly those with significant insider ownership which often signals strong alignment between company leadership and shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 25.6% |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Plejd (NGM:PLEJD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Plejd AB (publ) is a technology company that develops smart lighting control products and services across several countries, including Sweden, Norway, Finland, the Netherlands, and Germany, with a market cap of SEK4.14 billion.

Operations: The company's revenue is primarily derived from its Electronic Security Devices segment, which generated SEK726.23 million.

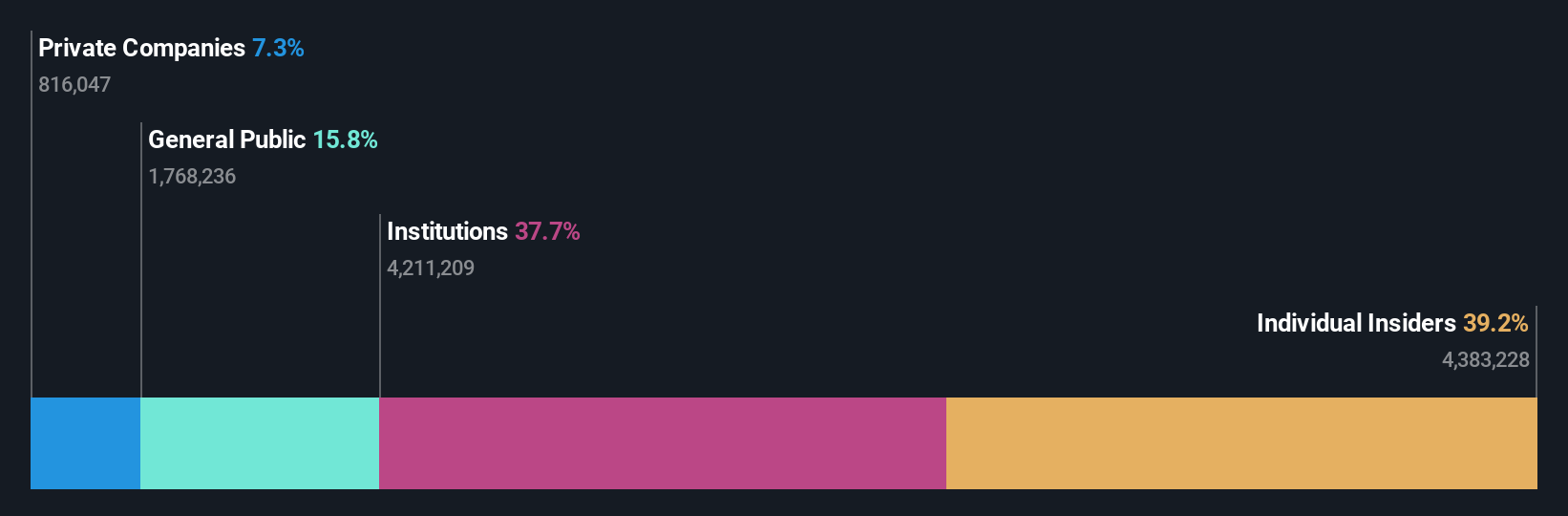

Insider Ownership: 38.1%

Plejd has demonstrated robust growth, with earnings increasing by 104.4% over the past year and revenue expected to grow at 17.9% annually, outpacing the Swedish market's 1.2%. However, insider activity shows significant selling in recent months despite high insider ownership, which may concern investors. The company's earnings are forecast to grow significantly at 37.5% per year compared to the market's 14.8%, supported by strong recent financial performance, including a net income rise from SEK 4.38 million to SEK 20.32 million for Q3 of 2024.

- Navigate through the intricacies of Plejd with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Plejd's share price might be too optimistic.

Shanghai Luoman Technologies (SHSE:605289)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Luoman Technologies Inc. offers urban and rural landscape lighting solutions in China with a market cap of CN¥2.75 billion.

Operations: The company generates revenue primarily from providing landscape lighting solutions across urban and rural areas in China.

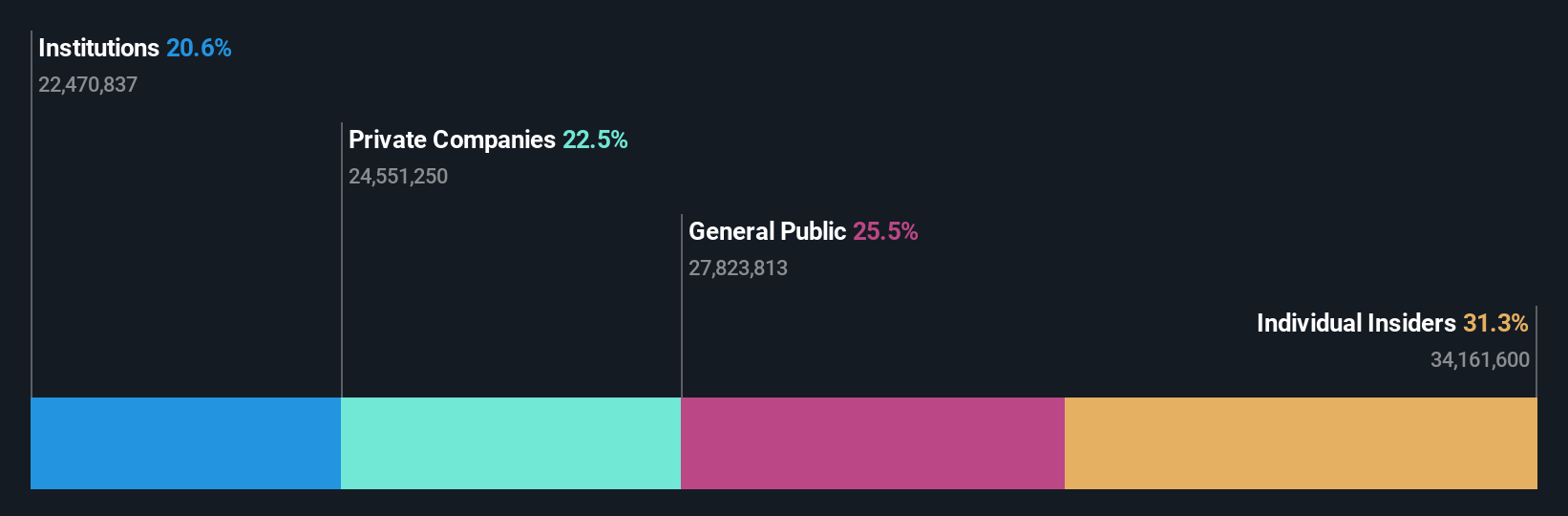

Insider Ownership: 29.8%

Shanghai Luoman Technologies is poised for substantial growth, with earnings projected to increase by 49.8% annually, outpacing the Chinese market's 25.4%. Revenue is expected to grow at 28.5% per year, surpassing the market's 13.7%. Despite a decline in net profit margin from 8.7% to 3.2%, there has been no significant insider trading activity recently. However, the dividend yield of 1% remains inadequately covered by earnings or free cash flows, which may be a concern for some investors.

- Get an in-depth perspective on Shanghai Luoman Technologies' performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Shanghai Luoman Technologies implies its share price may be too high.

Nan Juen International (TPEX:6584)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nan Juen International Co., Ltd. focuses on the research and development, manufacture, and trading of steel ball guide rails in Taiwan, with a market cap of NT$11.21 billion.

Operations: The company's revenue segment primarily comprises the manufacture and sale of steel ball rails, generating NT$1.79 billion.

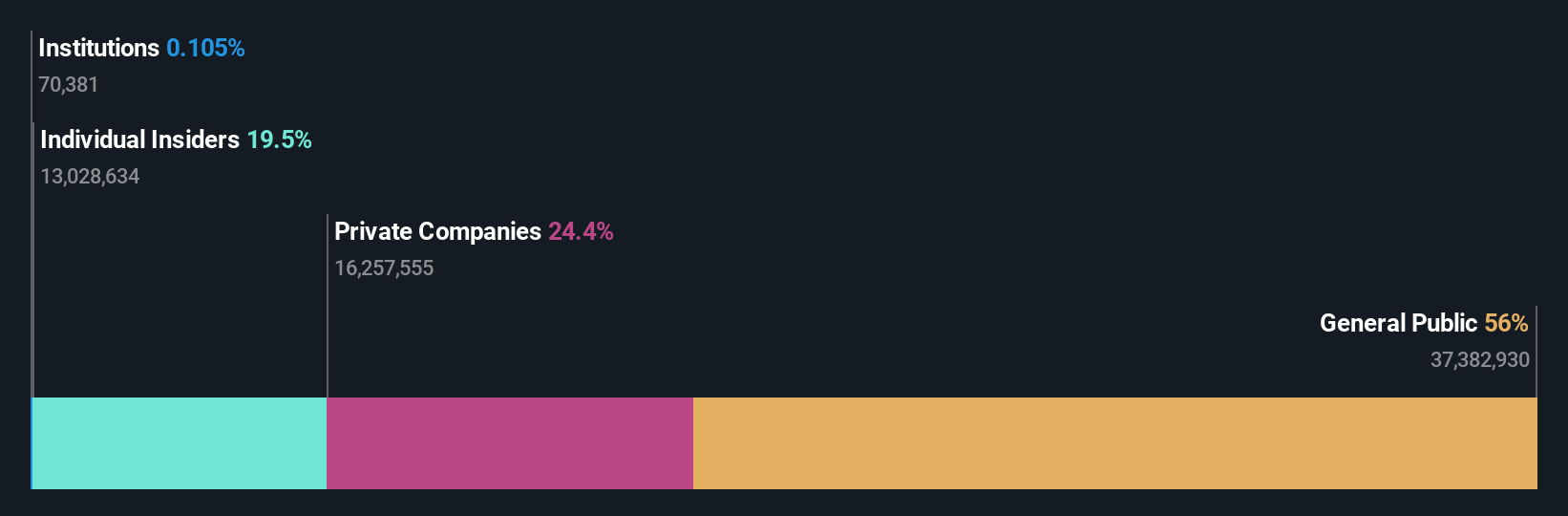

Insider Ownership: 19.7%

Nan Juen International shows strong growth potential, with earnings expected to grow significantly at 105% annually, surpassing Taiwan's market average. Revenue is forecasted to rise by 39.4% per year, also outpacing the market. Recent financials highlight a turnaround with net income of TWD 140.85 million for nine months ending September 2024, compared to a loss previously. Despite trading below estimated fair value and no recent insider trading activity, debt coverage remains a concern due to insufficient operating cash flow.

- Click here to discover the nuances of Nan Juen International with our detailed analytical future growth report.

- Our expertly prepared valuation report Nan Juen International implies its share price may be lower than expected.

Seize The Opportunity

- Investigate our full lineup of 1501 Fast Growing Companies With High Insider Ownership right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Nan Juen International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6584

Nan Juen International

Engages in the research, development, manufacturing, and trading of steel ball guide rails in the United States, Asia, Europe, Africa, and internationally.

High growth potential with solid track record.

Market Insights

Community Narratives