- South Korea

- /

- Auto Components

- /

- KOSE:A000240

Three Hidden Gems with Promising Potential

Reviewed by Simply Wall St

In the current global market landscape, U.S. stocks have experienced a decline amid cautious commentary from the Federal Reserve and political uncertainty surrounding potential government shutdowns. Smaller-cap indexes have been particularly impacted, reflecting broader investor concerns over economic stability and interest rate forecasts. In such an environment, identifying stocks with strong fundamentals and growth potential can be crucial for investors seeking opportunities in overlooked segments of the market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Brillian Network & Automation Integrated System | 8.39% | 20.15% | 19.93% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Saison Technology | NA | 0.66% | -13.83% | ★★★★★★ |

| IFE Elevators | NA | 12.67% | 17.10% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Moury Construct | 2.93% | 10.28% | 30.93% | ★★★★★☆ |

| Nanjing Well Pharmaceutical GroupLtd | 25.29% | 10.45% | 0.43% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 45.47% | 3.47% | -1.67% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Hankook (KOSE:A000240)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hankook & Company Co., Ltd. is engaged in the manufacturing and sale of storage batteries, with a market capitalization of ₩1.67 trillion.

Operations: Hankook & Company Co., Ltd. generates revenue primarily from its Battery Sector, contributing ₩978.76 billion, followed by the Investment Business Division at ₩433.30 billion.

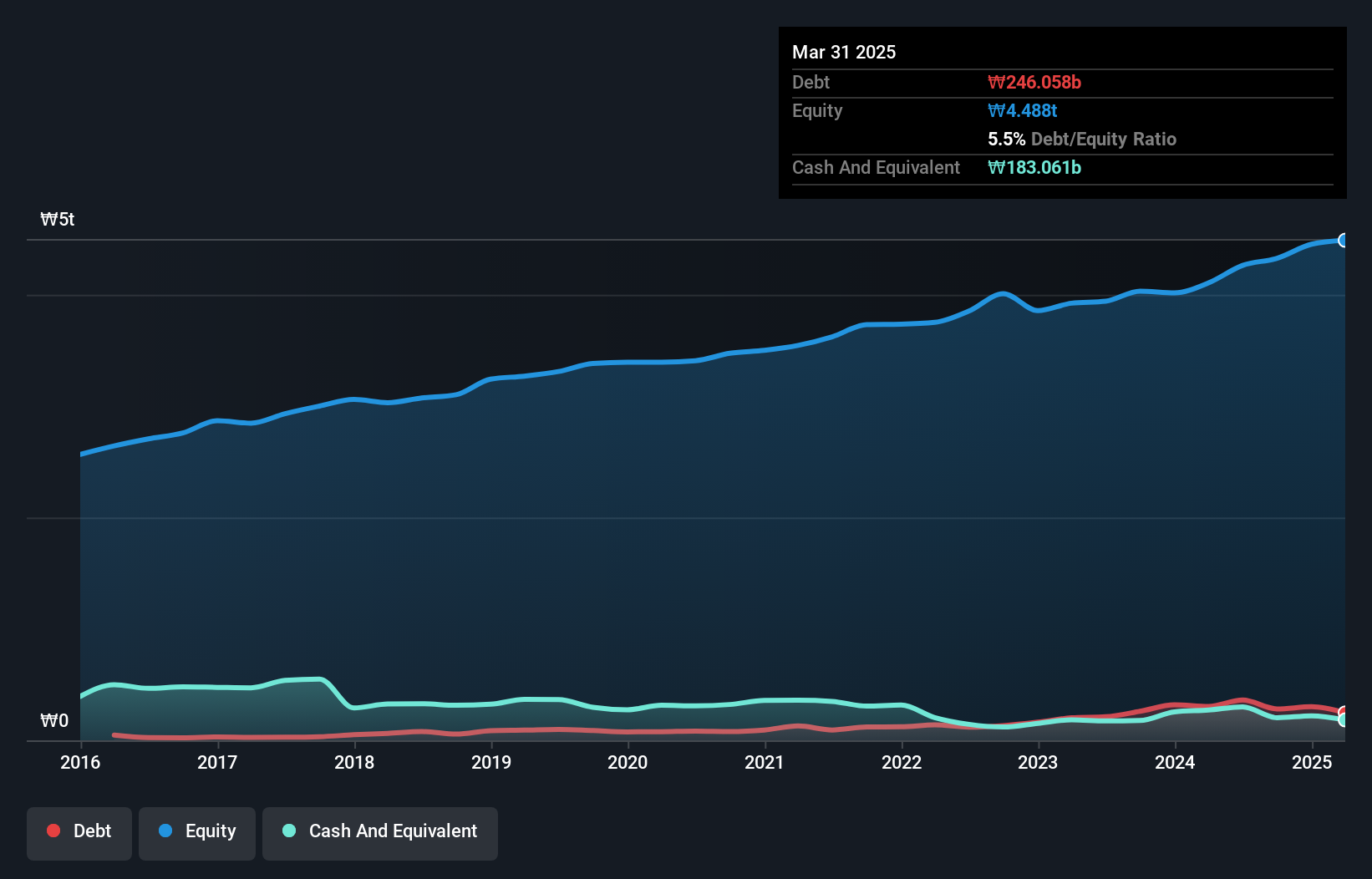

Hankook, a relatively smaller player in the auto components industry, has shown impressive financial strides recently. Earnings growth over the past year surged by 240%, surpassing the industry's 10%. The company's interest payments are well-covered with an EBIT coverage of 41x, indicating strong operational efficiency. Despite a net debt to equity ratio increase from 2.6% to 6.5% over five years, it remains satisfactory at 1.8%. Recent reports highlight significant sales and net income growth for Q3 and nine months ending September 2024, with sales reaching KRW 5,946 million and net income at KRW 343 billion respectively.

- Delve into the full analysis health report here for a deeper understanding of Hankook.

Review our historical performance report to gain insights into Hankook's's past performance.

Carote (SEHK:2549)

Simply Wall St Value Rating: ★★★★★☆

Overview: Carote Ltd is an investment holding company that offers a variety of kitchenware products to brand-owners and retailers under the CAROTE brand, with a market capitalization of HK$2.86 billion.

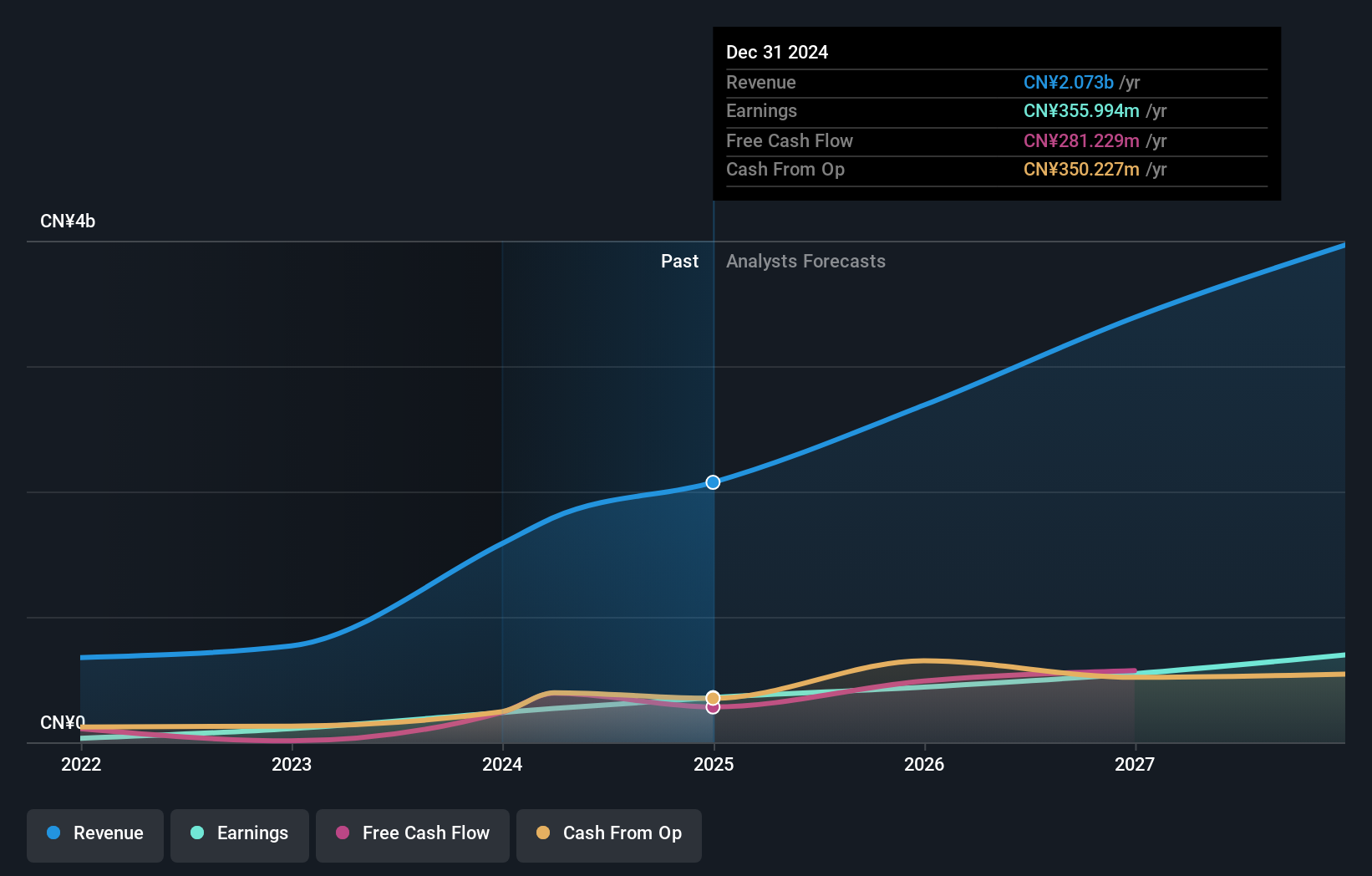

Operations: Carote Ltd generates revenue primarily from its Branded Business segment, contributing CN¥1.58 billion, while the ODM Business adds CN¥210.8 million.

Carote stands out with its recent IPO, raising HKD 750.62 million through the issuance of over 64 million ordinary shares at a price of HKD 5.78 each. This move likely bolsters its financial foundation, allowing for strategic growth in the Consumer Durables sector where it already boasts an impressive earnings growth of 92.1% over the past year, far surpassing industry averages. Trading at a significant discount to estimated fair value by 71.4%, Carote's high-quality earnings and profitability suggest promising potential despite recent share price volatility and limited debt reduction data over five years.

- Navigate through the intricacies of Carote with our comprehensive health report here.

Explore historical data to track Carote's performance over time in our Past section.

Test Research (TWSE:3030)

Simply Wall St Value Rating: ★★★★★★

Overview: Test Research, Inc. operates globally in the design, assembly, manufacture, sale, and maintenance of automated inspection and testing equipment with a market cap of NT$28.58 billion.

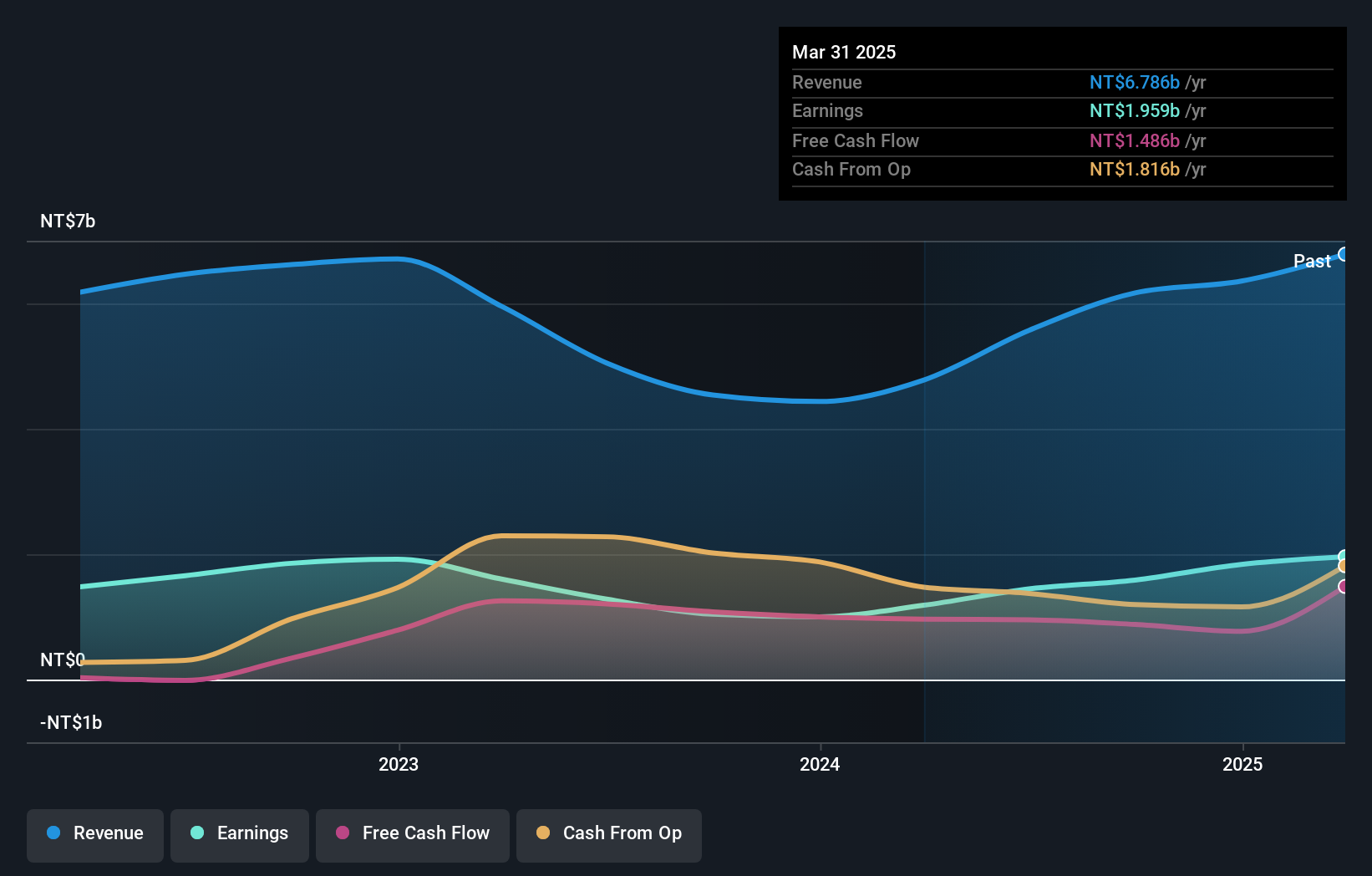

Operations: With revenue of NT$6.17 billion from its automated inspection and testing equipment segment, Test Research, Inc. focuses on generating income through the design, assembly, manufacture, sale, and maintenance of these products worldwide.

Test Research, with its nimble market presence, has shown impressive financial resilience. Over the past year, earnings surged by 52%, outpacing the electronic industry’s modest 6.6% growth. The company reported third-quarter sales of TWD 1.63 billion and net income of TWD 388 million, both up from last year’s figures. Its price-to-earnings ratio of 18x remains attractive compared to the broader TW market's average of 21x. Despite a highly volatile share price recently, Test Research boasts high-quality earnings and has remained debt-free for five years, showcasing robust fiscal health without concerns over interest coverage or cash runway issues.

- Get an in-depth perspective on Test Research's performance by reading our health report here.

Understand Test Research's track record by examining our Past report.

Key Takeaways

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4609 more companies for you to explore.Click here to unveil our expertly curated list of 4612 Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hankook might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000240

Undervalued with solid track record.