- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2327

Prominent Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets experience a resurgence, driven by easing core inflation in the U.S. and strong bank earnings, investors are increasingly turning their attention to dividend stocks as a potential source of steady income amidst fluctuating economic conditions. In this environment, a good dividend stock is characterized by its ability to maintain consistent payouts and demonstrate resilience across various market cycles.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.07% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.97% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.48% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.59% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.91% | ★★★★★★ |

Click here to see the full list of 1978 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

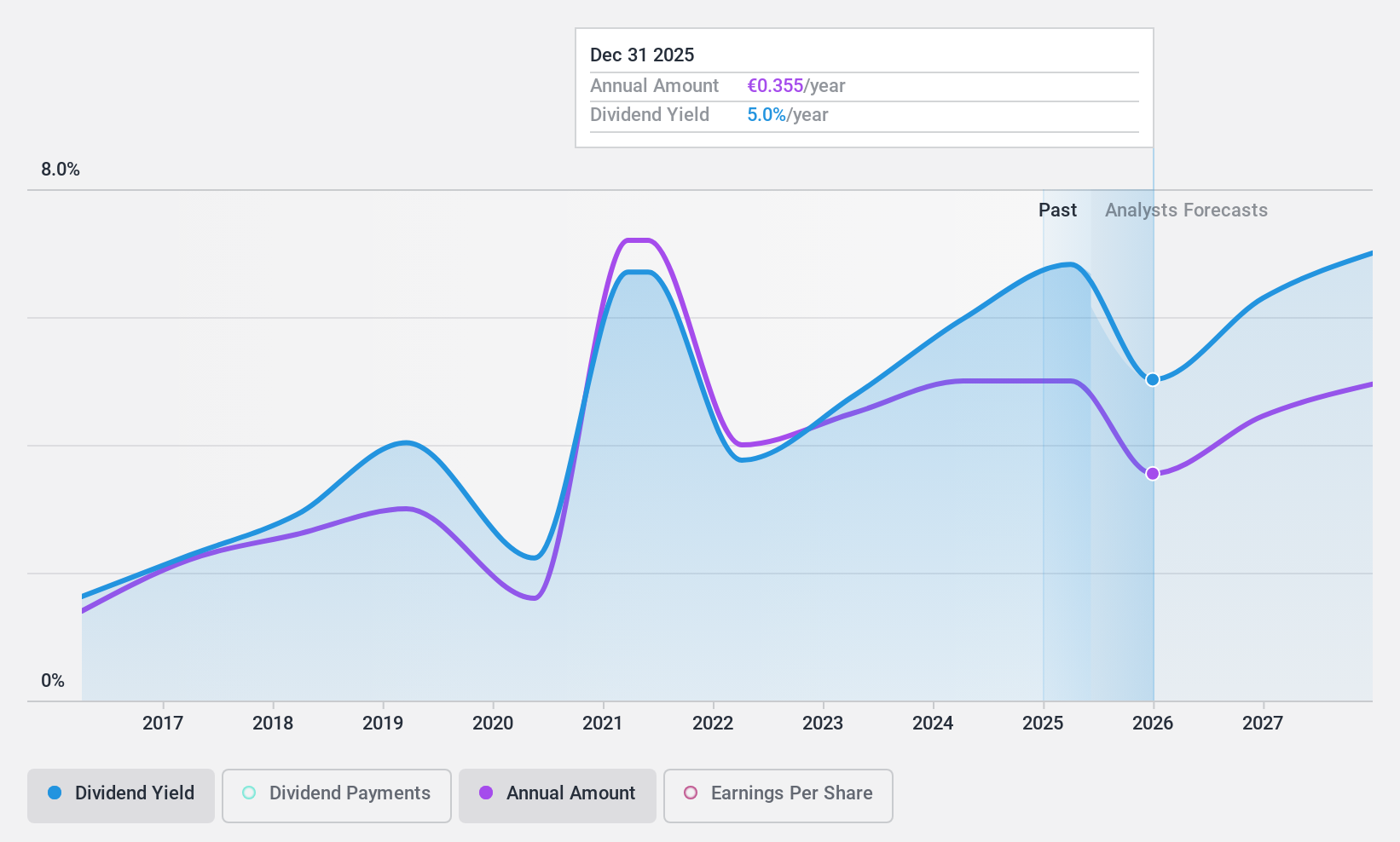

Taaleri Oyj (HLSE:TAALA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taaleri Oyj is a publicly owned asset management holding company with a market cap of €221.34 million.

Operations: Taaleri Oyj generates revenue primarily from its Private Asset Management segment, with €35.89 million coming from Renewable Energy and €4.32 million from Other Private Asset Management activities.

Dividend Yield: 6.3%

Taaleri Oyj offers a high dividend yield of 6.31%, placing it among the top 25% in Finland, yet its dividends are not well covered by free cash flow, raising sustainability concerns. Despite reasonable earnings coverage with a payout ratio of 55.3%, cash flow coverage remains weak with a high cash payout ratio of 343.1%. Recent executive changes, including appointing Ilkka Laurila as CEO and Elina Lintuala as Interim CFO, may impact future financial strategies and dividend reliability.

- Delve into the full analysis dividend report here for a deeper understanding of Taaleri Oyj.

- Upon reviewing our latest valuation report, Taaleri Oyj's share price might be too pessimistic.

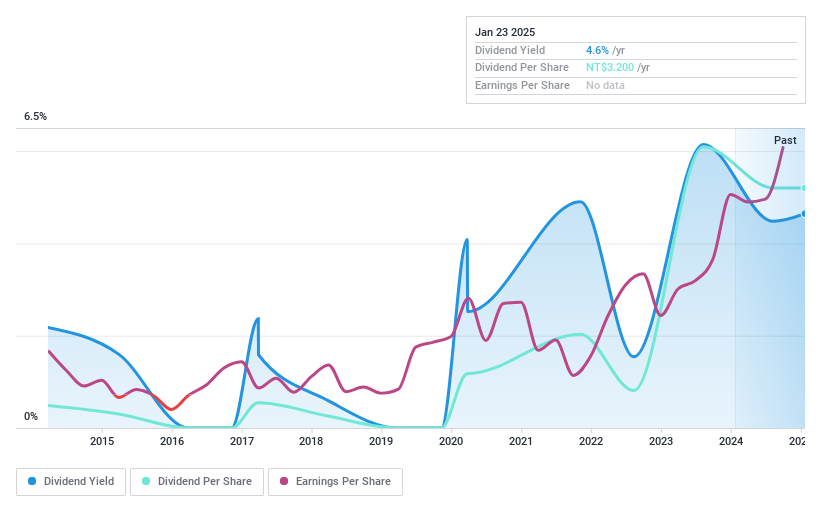

Yageo (TWSE:2327)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yageo Corporation manufactures and sells passive components across China, Europe, the United States, and other parts of Asia with a market cap of NT$276.05 billion.

Operations: Yageo Corporation's revenue from its electronic components and parts segment amounts to NT$119.02 billion.

Dividend Yield: 3.1%

Yageo's dividend yield of 3.11% is below Taiwan's top 25% threshold, but its dividends are well-covered by earnings and cash flows, with payout ratios of 41% and 37.2%, respectively. Despite a volatile dividend history, Yageo shows potential for growth with forecasted earnings increases of 10.53% annually. Recent sales figures indicate solid year-over-year growth, reaching TWD 121.67 billion in 2024, suggesting a stable revenue base to support future dividends.

- Click here to discover the nuances of Yageo with our detailed analytical dividend report.

- Our valuation report unveils the possibility Yageo's shares may be trading at a discount.

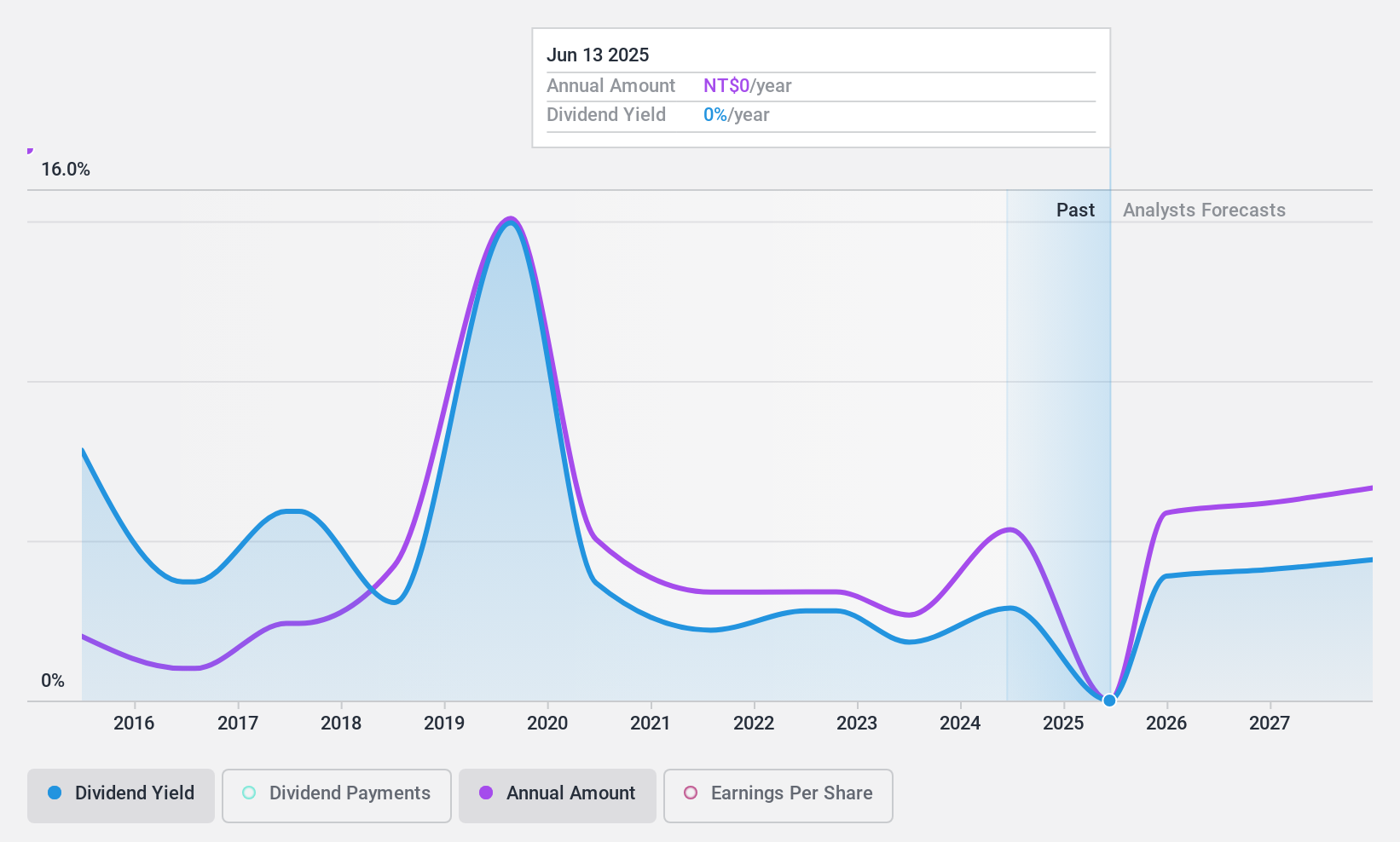

Loop Telecommunication InternationalInc (TWSE:3025)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Loop Telecommunication International Inc (TWSE:3025) operates in the telecommunications sector and has a market cap of approximately NT$3.91 billion.

Operations: Loop Telecommunication International Inc's revenue primarily comes from its Communications Equipment segment, which generated NT$733.18 million.

Dividend Yield: 4.6%

Loop Telecommunication International, Inc. has seen significant earnings growth, with net income rising to TWD 87.74 million in Q3 2024 from TWD 33.78 million a year prior. Despite a high dividend yield of 4.64%, its payout ratio of 86.3% raises concerns about sustainability, as dividends are not fully covered by cash flows and have been volatile over the past decade. The stock's P/E ratio of 15.7x suggests it is undervalued compared to the broader market in Taiwan.

- Get an in-depth perspective on Loop Telecommunication InternationalInc's performance by reading our dividend report here.

- According our valuation report, there's an indication that Loop Telecommunication InternationalInc's share price might be on the expensive side.

Seize The Opportunity

- Navigate through the entire inventory of 1978 Top Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2327

Yageo

Engages in the manufacture and sale of passive components in China, Europe, the United States, and rest of Asia.

Very undervalued with solid track record and pays a dividend.