- Taiwan

- /

- Semiconductors

- /

- TPEX:3675

Unearthing Undiscovered Gems With Potential In January 2025

Reviewed by Simply Wall St

As 2025 begins, global markets are experiencing a period of optimism, with easing core inflation in the U.S. and robust bank earnings driving major indices higher. Amid this backdrop, small-cap stocks could present intriguing opportunities for investors seeking growth potential, especially as value shares outperform and economic indicators show signs of stability. Identifying promising stocks involves looking for companies with strong fundamentals that can thrive even as market dynamics shift.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| L&K Engineering | 14.36% | 37.26% | 54.49% | ★★★★★★ |

| Sesoda | 71.33% | 11.54% | 15.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Voltamp Energy SAOG | 35.98% | -1.56% | 50.16% | ★★★★★★ |

| Pakistan National Shipping | 2.77% | 30.93% | 51.80% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| China Electric Mfg | 13.74% | -13.57% | -32.70% | ★★★★★★ |

| ASRock Rack Incorporation | NA | 45.76% | 269.05% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Nestlé Pakistan | 40.95% | 14.04% | 17.18% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Eris Technology (TPEX:3675)

Simply Wall St Value Rating: ★★★★★★

Overview: Eris Technology Corporation is an original design manufacturer specializing in providing support services for the design, manufacturing, and after-marketing of diode products, with a market capitalization of NT$11.32 billion.

Operations: Eris Technology generates revenue primarily from its segments, including Yea Shin Technology and Dewei Technology and Jiecheng, contributing NT$1.42 billion and NT$1.75 billion respectively. The company's financials reflect adjustments and write-offs amounting to approximately -NT$1.05 billion.

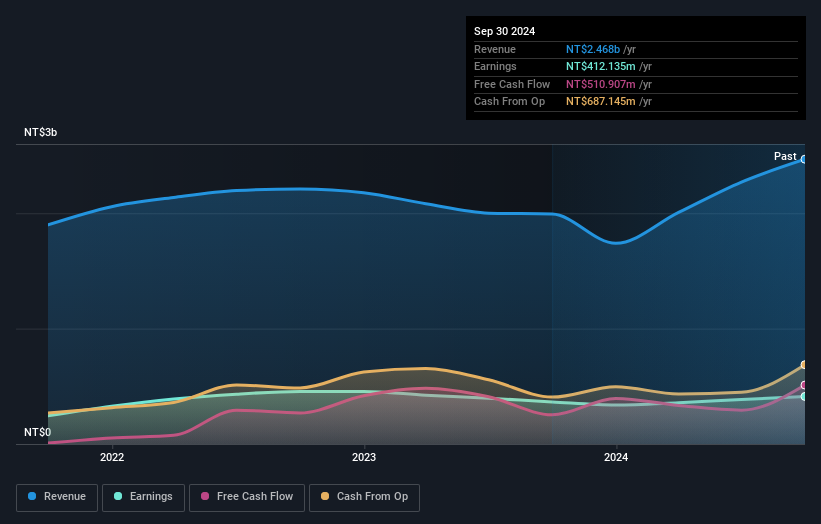

Eris Technology, a small cap player in the semiconductor industry, has shown impressive growth with earnings rising by 13% over the past year, outpacing the industry's 5.9%. Their net debt to equity ratio stands at a satisfactory 15.8%, having decreased from 100.2% five years ago, indicating prudent financial management. Recent third-quarter results highlight robust performance with sales reaching TWD 744 million and net income at TWD 115 million, up from TWD 89 million last year. Basic earnings per share improved to TWD 2.1 from TWD 1.77, reflecting strong operational efficiency and market positioning.

- Get an in-depth perspective on Eris Technology's performance by reading our health report here.

Explore historical data to track Eris Technology's performance over time in our Past section.

Nippon Densetsu Kogyo (TSE:1950)

Simply Wall St Value Rating: ★★★★★★

Overview: Nippon Densetsu Kogyo Co., Ltd. is a Japanese company specializing in railway electronics equipment construction, with a market capitalization of ¥113.82 billion.

Operations: Nippon Densetsu Kogyo generates revenue primarily from its Facility Installation Work segment, amounting to ¥198.62 billion.

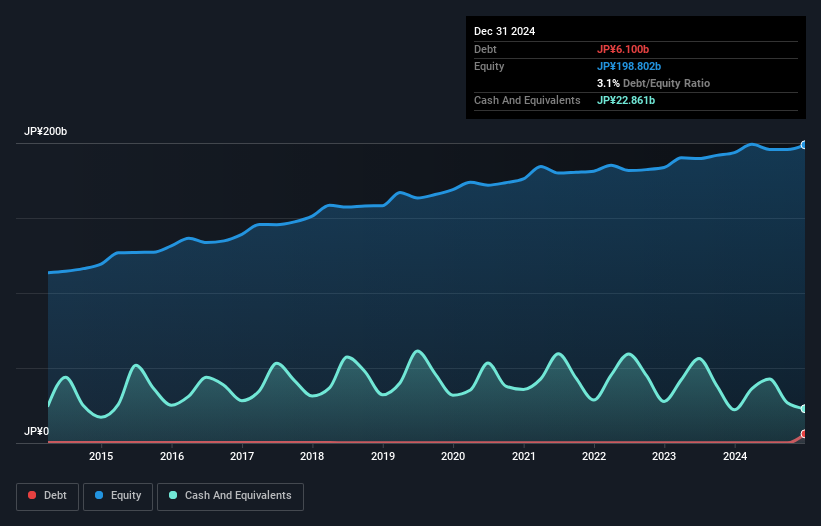

Nippon Densetsu Kogyo, a relatively small player in its field, has shown impressive earnings growth of 20.9% over the past year, outpacing the broader construction industry. The company's financial health appears solid with a debt-to-equity ratio reduction from 0.06 to 0.05 over five years and more cash than total debt on hand. Despite recent negative free cash flow figures like -A$2.86 million as of September 2024, its price-to-earnings ratio stands attractively at 11.6x compared to the Japanese market's average of 13.5x, suggesting potential value for investors seeking opportunities in smaller firms within this sector.

FocalTech Systems (TWSE:3545)

Simply Wall St Value Rating: ★★★★★☆

Overview: FocalTech Systems Co., Ltd. specializes in the research, design, development, manufacturing, and sale of human-machine interface solutions across Taiwan, China, and international markets with a market capitalization of NT$16.68 billion.

Operations: FocalTech generates revenue primarily from selling and developing portable device-related ICs, amounting to NT$13.98 billion.

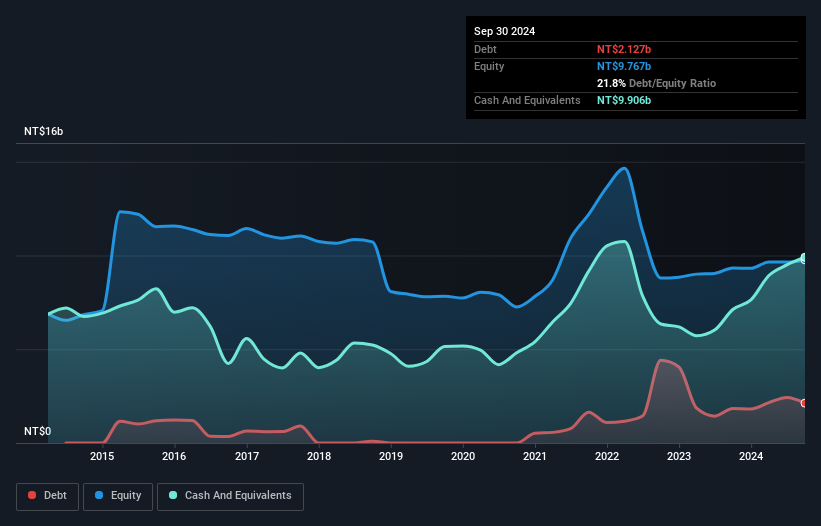

FocalTech Systems, a nimble player in the semiconductor industry, has shown robust earnings growth of 49.8% over the past year, outpacing the industry's 5.9%. The company's debt to equity ratio rose from 0% to 21.8% in five years but remains manageable with more cash than total debt. Recent financials highlight sales reaching TWD 3.81 billion for Q3 2024, up from TWD 3.60 billion last year, and net income climbing to TWD 168 million from TWD 127 million previously. With earnings per share increasing to TWD 0.79 from TWD 0.61, FocalTech seems poised for continued growth despite rising leverage.

- Navigate through the intricacies of FocalTech Systems with our comprehensive health report here.

Evaluate FocalTech Systems' historical performance by accessing our past performance report.

Summing It All Up

- Discover the full array of 4647 Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eris Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3675

Eris Technology

An original design manufacturer, provides various support services to design, manufacturing, and after-marketing services for diode products in Taiwan, Asia, Europe, and North America.

Flawless balance sheet with low risk.

Market Insights

Community Narratives