- Taiwan

- /

- Medical Equipment

- /

- TWSE:1786

Undiscovered Gems with Strong Fundamentals To Watch This January 2025

Reviewed by Simply Wall St

As global markets navigate through easing inflation and robust bank earnings, major U.S. stock indexes have rebounded, with value stocks notably outperforming growth shares. This positive momentum in the financial sector and cooling core inflation provides a fertile backdrop for investors seeking opportunities in lesser-known small-cap stocks with strong fundamentals. In this environment, identifying stocks with solid financial health and growth potential becomes crucial for those looking to capitalize on market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| L&K Engineering | 14.36% | 37.26% | 54.49% | ★★★★★★ |

| Sesoda | 71.33% | 11.54% | 15.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Voltamp Energy SAOG | 35.98% | -1.56% | 50.16% | ★★★★★★ |

| Pakistan National Shipping | 2.77% | 30.93% | 51.80% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| China Electric Mfg | 13.74% | -13.57% | -32.70% | ★★★★★★ |

| ASRock Rack Incorporation | NA | 45.76% | 269.05% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Nestlé Pakistan | 40.95% | 14.04% | 17.18% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Akastor (OB:AKAST)

Simply Wall St Value Rating: ★★★★★★

Overview: Akastor ASA is an oilfield services investment company operating in Norway and internationally, with a market cap of NOK3.65 billion.

Operations: Akastor ASA generates revenue primarily through its oilfield services investments. The company's net profit margin has varied over recent periods, reflecting fluctuations in operational efficiency and market conditions.

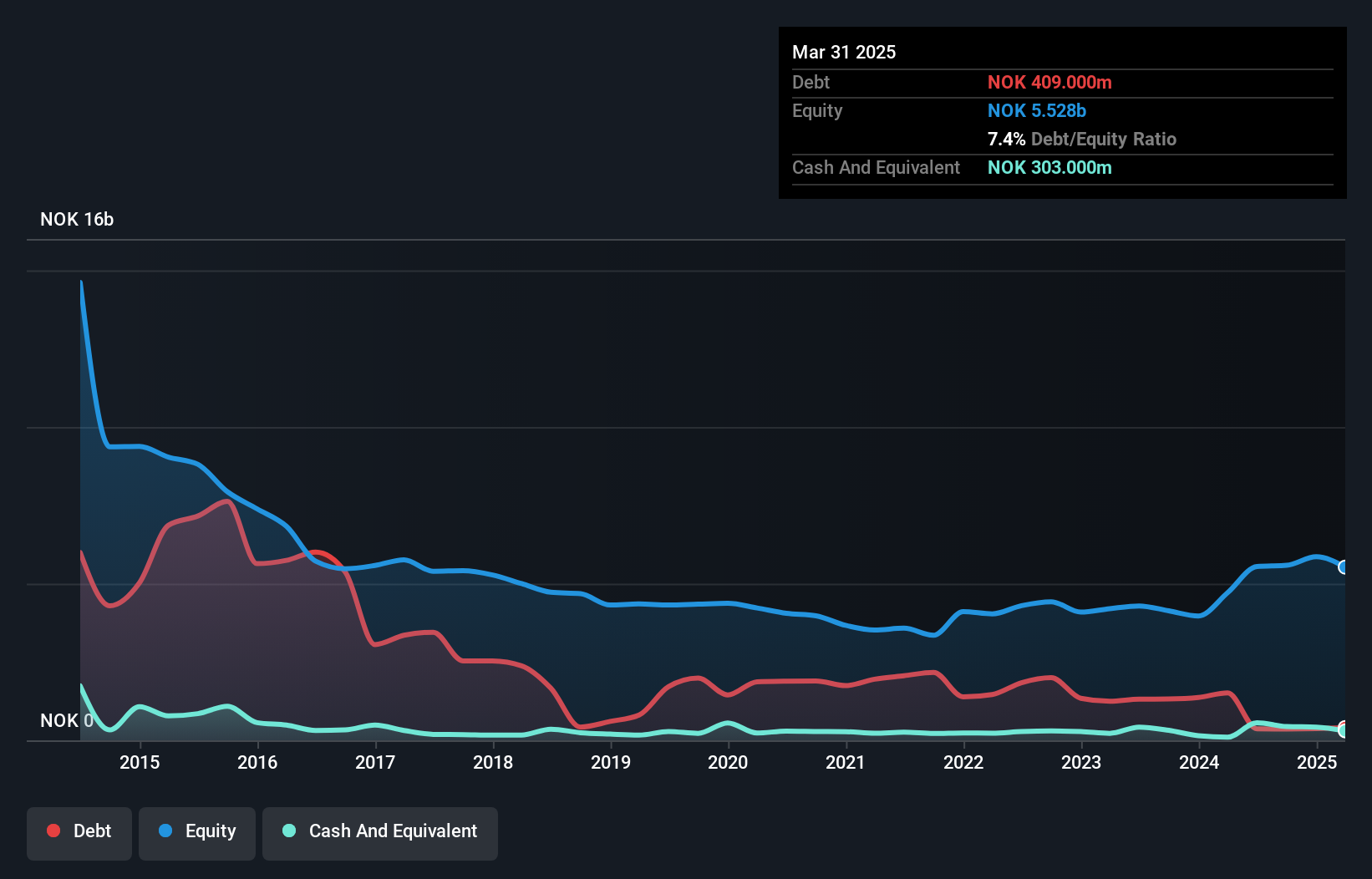

Akastor, a notable player in the energy services sector, has shown significant financial improvement. The company's price-to-earnings ratio stands at 2.9x, considerably lower than the Norwegian market average of 11.6x, indicating potential undervaluation. Over five years, Akastor's debt-to-equity ratio dropped from 45.7% to 6.5%, reflecting better financial health and stability with more cash than total debt on hand. Recently becoming profitable, Akastor reported a net income of NOK 1,503 million for nine months in 2024 versus a previous loss of NOK 114 million last year and expanded its stake in AKOFS Offshore through strategic acquisitions worth US$22.5 million.

- Navigate through the intricacies of Akastor with our comprehensive health report here.

Gain insights into Akastor's historical performance by reviewing our past performance report.

SciVision Biotech (TWSE:1786)

Simply Wall St Value Rating: ★★★★★★

Overview: SciVision Biotech Inc. focuses on the manufacture and sale of hyaluronic acid medical products in Taiwan, with a market capitalization of approximately NT$8.83 billion.

Operations: The company generates revenue primarily from the manufacture and sale of hyaluronic acid products, amounting to NT$831.36 million.

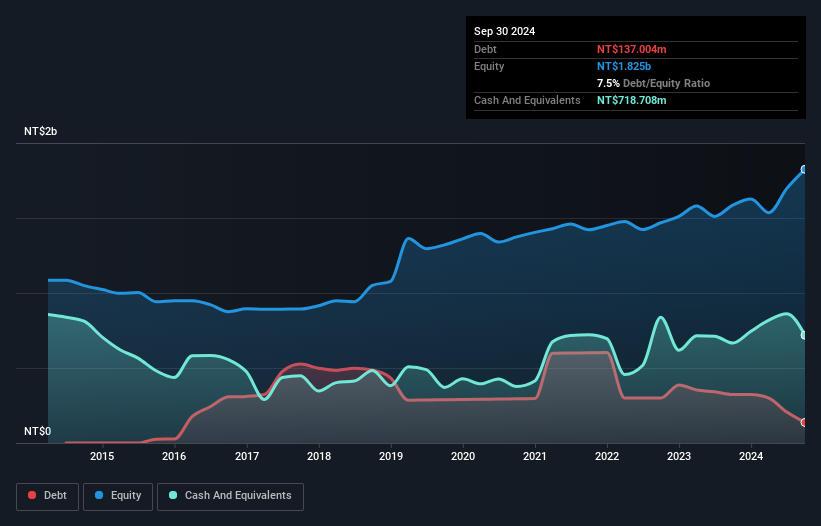

SciVision Biotech, a nimble player in the biotech field, has been making waves with its innovative products like FLEXVISC Plus and JETKNEE, now approved in Honduras. The company's earnings have shown impressive growth, with a 28.5% increase over the past year, outpacing the industry average of 5%. SciVision's financial health is robust; it boasts more cash than total debt and has significantly reduced its debt-to-equity ratio from 21.8% to 7.5% over five years. With high-quality earnings and positive free cash flow, SciVision seems poised for continued success in its niche market.

Vercom (WSE:VRC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Vercom S.A. develops cloud communications platforms and has a market capitalization of PLN2.66 billion.

Operations: Vercom generates revenue primarily from its CPaaS segment, which accounted for PLN462.07 million.

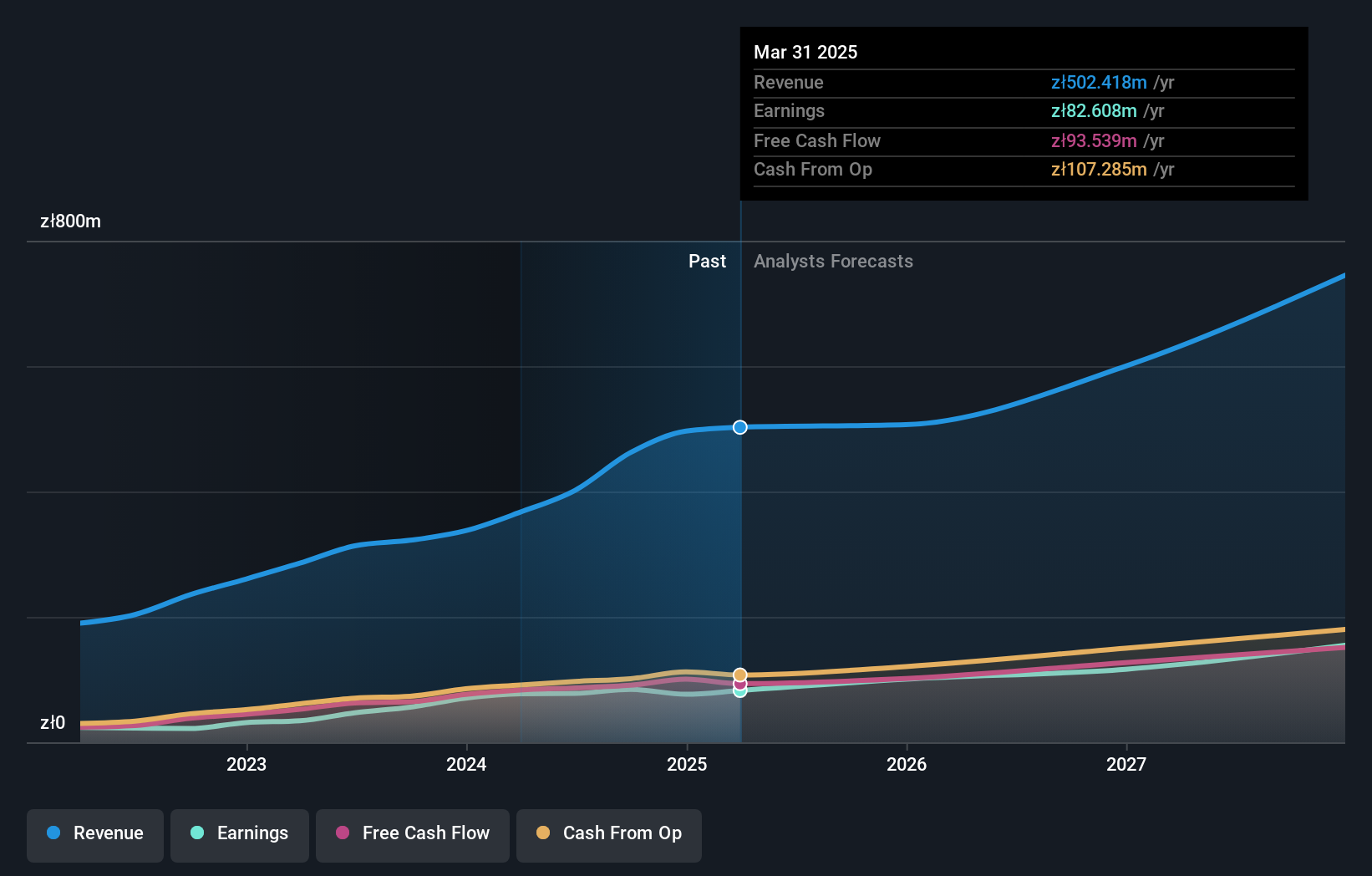

Vercom has shown impressive growth, with earnings rising 50% over the past year, outpacing the Software industry's 15%. The company reported third-quarter sales of PLN 145.11 million, up from PLN 84.93 million a year ago, and net income increased to PLN 19.4 million from PLN 13.05 million. Vercom's earnings per share also improved to PLN 0.88 from PLN 0.59 in the same period last year. Trading at a value below its fair estimate by about 6%, Vercom seems well-positioned with high-quality earnings and satisfactory debt levels, offering potential for continued growth at nearly a projected rate of almost 22% annually.

- Click here to discover the nuances of Vercom with our detailed analytical health report.

Examine Vercom's past performance report to understand how it has performed in the past.

Where To Now?

- Navigate through the entire inventory of 4647 Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1786

SciVision Biotech

Manufactures and sells hyaluronic acid medical products in Taiwan.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives