- Taiwan

- /

- Hospitality

- /

- TWSE:2753

Dividend Stocks To Consider For January 2025

Reviewed by Simply Wall St

As global markets respond to easing inflation and strong earnings reports, major indices in the U.S. and Europe have experienced notable gains, with value stocks outperforming growth shares significantly. In this environment of cautious optimism, dividend stocks can offer a steady income stream and potential for capital appreciation, making them an attractive consideration for investors seeking stability amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.16% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.52% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.62% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.06% | ★★★★★★ |

Click here to see the full list of 1975 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

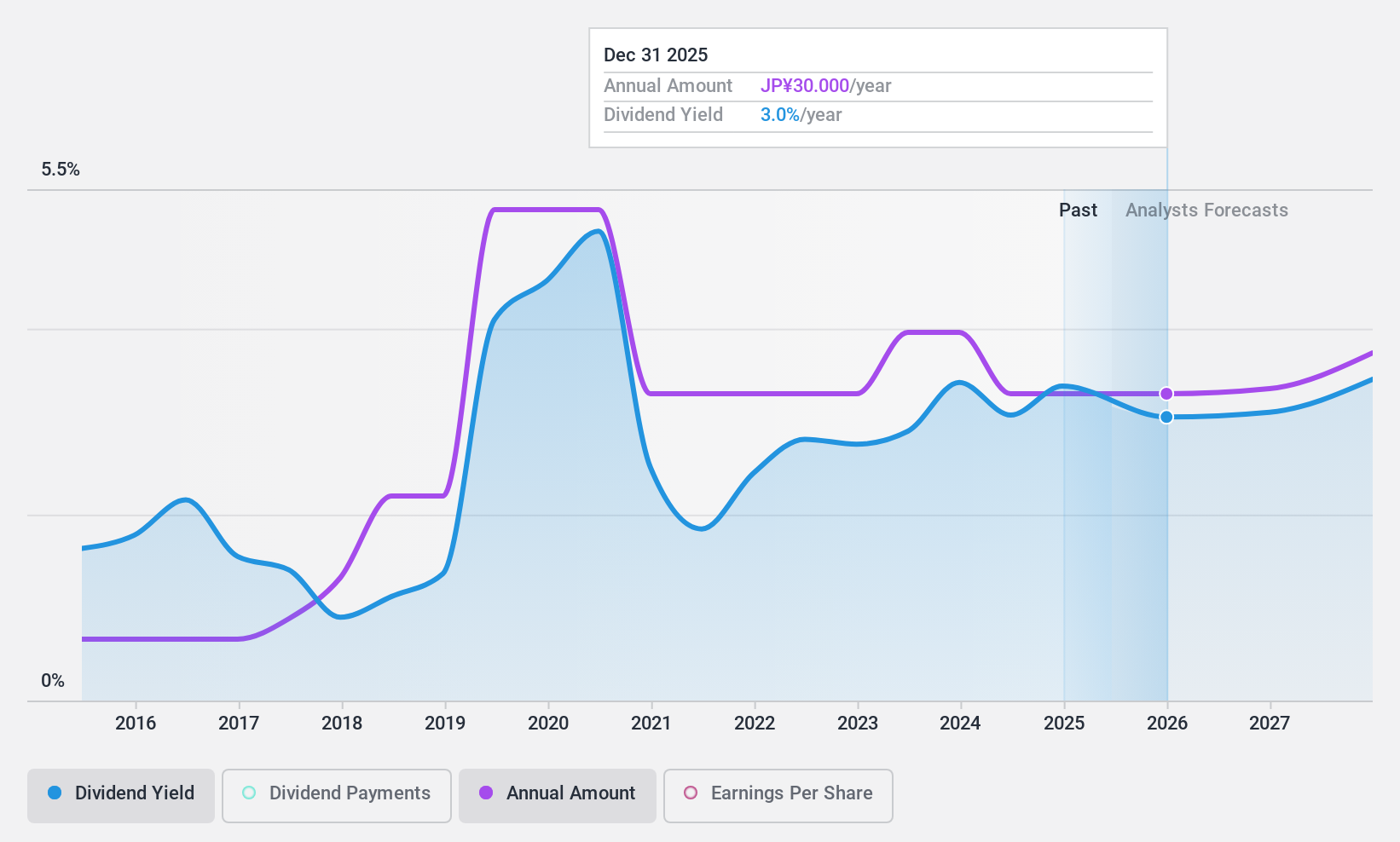

Tokai Carbon (TSE:5301)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tokai Carbon Co., Ltd. is a Japanese company that manufactures and sells carbon-related products and services, with a market cap of approximately ¥188.88 billion.

Operations: Tokai Carbon Co., Ltd. generates revenue through several segments, including Fine Carbon (¥53.71 billion), Graphite Electrodes (¥51.48 billion), Smelting and Lining (¥69.80 billion), Carbon Black Business (¥156.69 billion), and Industrial Furnaces and Related Products (¥14.31 billion).

Dividend Yield: 3.4%

Tokai Carbon's dividend payments, while covered by earnings and cash flows with payout ratios of 72.7% and 78.1% respectively, have been unreliable over the past decade due to volatility. The current dividend yield of 3.39% is below the top quartile in Japan, indicating room for improvement in attractiveness to income-focused investors. Despite a recent decline in profit margins from last year, earnings are projected to grow significantly by nearly 30% annually.

- Dive into the specifics of Tokai Carbon here with our thorough dividend report.

- The valuation report we've compiled suggests that Tokai Carbon's current price could be inflated.

Press Kogyo (TSE:7246)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Press Kogyo Co., Ltd. manufactures and sells automotive and construction machinery parts both in Japan and internationally, with a market cap of ¥55.19 billion.

Operations: Press Kogyo Co., Ltd.'s revenue is primarily derived from its Automotive Related Business, contributing ¥160.17 billion, and its Construction Machinery Related Business, which adds ¥33.33 billion.

Dividend Yield: 5%

Press Kogyo's dividend yield of 5.04% ranks in the top 25% of Japan's market, supported by a low payout ratio of 37.1%, though cash flow coverage is tighter at 83.5%. Despite a decade of volatile dividends, recent increases suggest potential growth, although recent earnings guidance was lowered due to global demand challenges. The company announced a special commemorative dividend, raising the annual payout to JPY 32 per share for fiscal year-end March 2025.

- Click to explore a detailed breakdown of our findings in Press Kogyo's dividend report.

- In light of our recent valuation report, it seems possible that Press Kogyo is trading behind its estimated value.

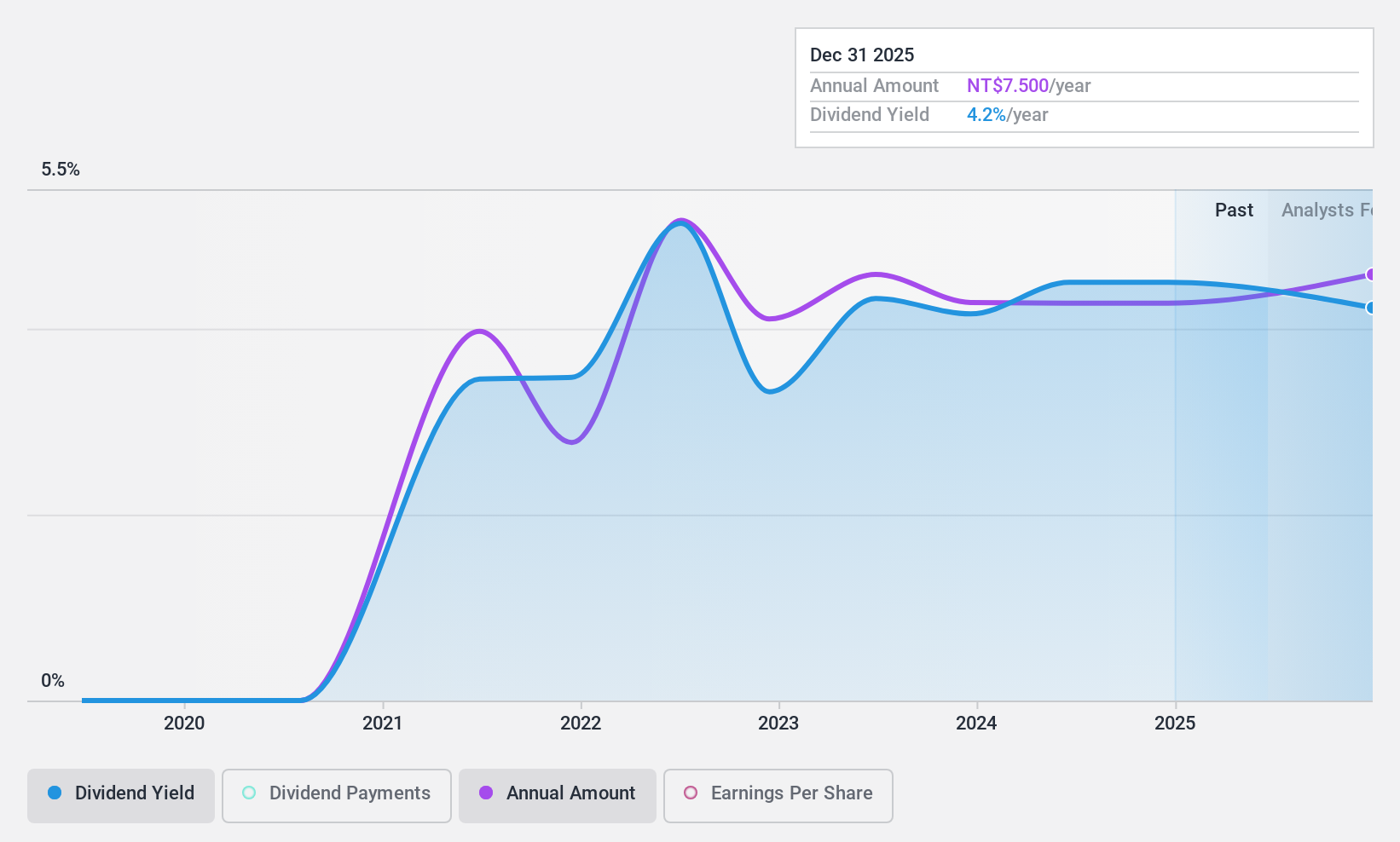

Bafang Yunji International (TWSE:2753)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bafang Yunji International Company Limited operates and franchises Chinese restaurants across Mainland China, Taiwan, Hong Kong, and the United States with a market cap of NT$9.99 billion.

Operations: Bafang Yunji International Company Limited generates its revenue from the Taiwan Area (NT$6.03 billion), the America region (NT$480.33 million), and its trading business in Hong Kong (NT$1.40 billion).

Dividend Yield: 4.7%

Bafang Yunji International's dividend yield is among the top 25% in Taiwan, but its four-year history of payments has been volatile. The payout ratio of 81.6% indicates dividends are covered by earnings and cash flows, with a cash payout ratio at 61.7%. Recent announcements showed a slight adjustment to the dividend per share to TWD 1.99549852, payable on January 16, 2025. Despite growth in sales and net income, dividend stability remains uncertain.

- Unlock comprehensive insights into our analysis of Bafang Yunji International stock in this dividend report.

- The analysis detailed in our Bafang Yunji International valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Delve into our full catalog of 1975 Top Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bafang Yunji International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2753

Bafang Yunji International

Operates and franchises restaurants in Taiwan, Hong Kong, and the United States.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives