- Taiwan

- /

- Tech Hardware

- /

- TWSE:2382

Results: Quanta Computer Inc. Exceeded Expectations And The Consensus Has Updated Its Estimates

Quanta Computer Inc. (TWSE:2382) defied analyst predictions to release its quarterly results, which were ahead of market expectations. Quanta Computer beat earnings, with revenues hitting NT$425b, ahead of expectations, and statutory earnings per share outperforming analyst reckonings by a solid 12%. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

See our latest analysis for Quanta Computer

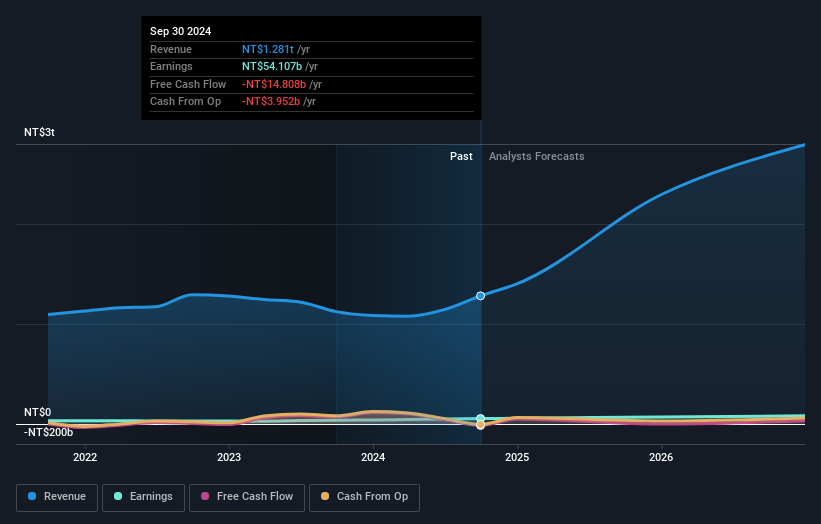

Taking into account the latest results, the most recent consensus for Quanta Computer from 19 analysts is for revenues of NT$2.29t in 2025. If met, it would imply a sizeable 79% increase on its revenue over the past 12 months. Statutory earnings per share are predicted to jump 31% to NT$18.40. In the lead-up to this report, the analysts had been modelling revenues of NT$2.27t and earnings per share (EPS) of NT$18.38 in 2025. The consensus analysts don't seem to have seen anything in these results that would have changed their view on the business, given there's been no major change to their estimates.

There were no changes to revenue or earnings estimates or the price target of NT$374, suggesting that the company has met expectations in its recent result. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values Quanta Computer at NT$425 per share, while the most bearish prices it at NT$240. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's clear from the latest estimates that Quanta Computer's rate of growth is expected to accelerate meaningfully, with the forecast 59% annualised revenue growth to the end of 2025 noticeably faster than its historical growth of 2.9% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 21% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Quanta Computer is expected to grow much faster than its industry.

The Bottom Line

The most obvious conclusion is that there's been no major change in the business' prospects in recent times, with the analysts holding their earnings forecasts steady, in line with previous estimates. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. The consensus price target held steady at NT$374, with the latest estimates not enough to have an impact on their price targets.

With that in mind, we wouldn't be too quick to come to a conclusion on Quanta Computer. Long-term earnings power is much more important than next year's profits. We have forecasts for Quanta Computer going out to 2026, and you can see them free on our platform here.

You should always think about risks though. Case in point, we've spotted 2 warning signs for Quanta Computer you should be aware of, and 1 of them is potentially serious.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Quanta Computer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2382

Quanta Computer

Manufactures, processes, and sells laptop computers and telecommunication products in the United States, Mainland China, the Netherlands, Japan, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)