- Mexico

- /

- Wireless Telecom

- /

- BMV:AMX B

3 Growth Stocks With High Insider Ownership Seeing Up To 63% Earnings Growth

Reviewed by Simply Wall St

As global markets show signs of recovery and investors celebrate positive news on inflation and growth, the spotlight is increasingly turning to growth stocks. In this environment, companies with high insider ownership can be particularly attractive, as they often indicate strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.2% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.7% |

| Gaming Innovation Group (OB:GIG) | 26.7% | 37.4% |

| On Holding (NYSE:ONON) | 28.4% | 24.7% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Calliditas Therapeutics (OM:CALTX) | 12.7% | 51.9% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.3% | 60.9% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Vow (OB:VOW) | 31.7% | 97.7% |

| HANA Micron (KOSDAQ:A067310) | 20.2% | 97.4% |

Let's explore several standout options from the results in the screener.

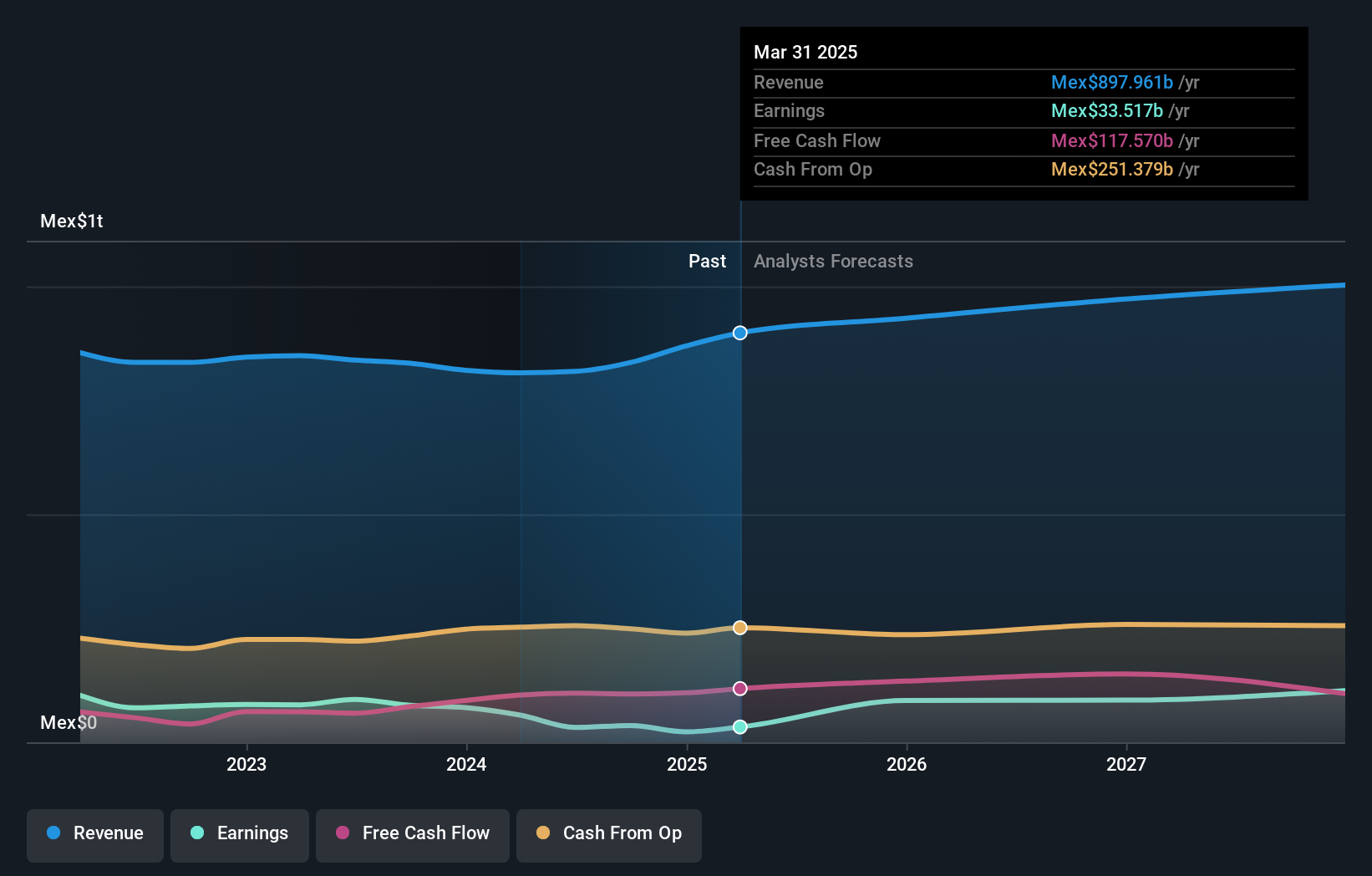

América Móvil. de (BMV:AMX B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: América Móvil, S.A.B. de C.V. provides telecommunications services in Latin America and internationally, with a market cap of MX$1.01 trillion.

Operations: The company generates revenue primarily from Cellular Services, amounting to MX$813.38 billion.

Insider Ownership: 22.4%

Earnings Growth Forecast: 22.8% p.a.

América Móvil shows a mixed picture for growth investors. Although its earnings are forecast to grow significantly at 22.8% per year, revenue growth is expected to lag behind the market at 4.5%. Recent financials reveal a net loss of MXN 1,093 million in Q2 2024 despite high insider ownership and ongoing share buybacks totaling billions of pesos. Profit margins have decreased from last year, and the company carries substantial debt.

- Navigate through the intricacies of América Móvil. de with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that América Móvil. de is trading behind its estimated value.

Chroma ATE (TWSE:2360)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chroma ATE Inc. designs, manufactures, sells, and services software/hardware for computers and peripherals, automatic test systems, electronic test instruments, signal generators, power supplies, and telecom power supplies globally with a market cap of NT$135.59 billion.

Operations: The company's revenue segments include NT$29.52 billion from the Measuring Instruments Business and NT$1.58 billion from Automated Transport Engineering.

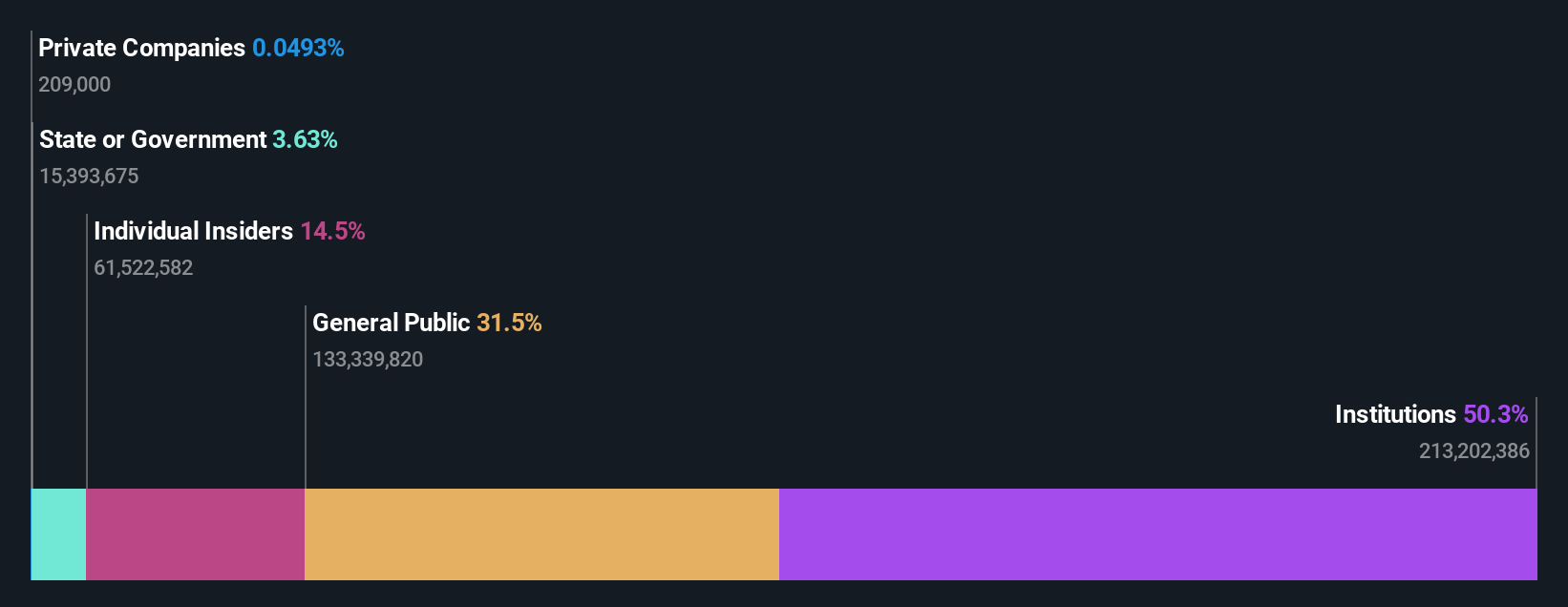

Insider Ownership: 14.5%

Earnings Growth Forecast: 21.3% p.a.

Chroma ATE's earnings are forecast to grow significantly at 21.33% annually, outpacing the TW market's 18.8%. Revenue is also expected to grow faster than the market at 14.1% per year. Recent Q2 results show robust performance with revenue reaching TWD 5,515 million and net income of TWD 1,407 million, both up from last year. Despite this growth potential and insider ownership, the stock has been highly volatile recently and has an unstable dividend track record.

- Unlock comprehensive insights into our analysis of Chroma ATE stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Chroma ATE shares in the market.

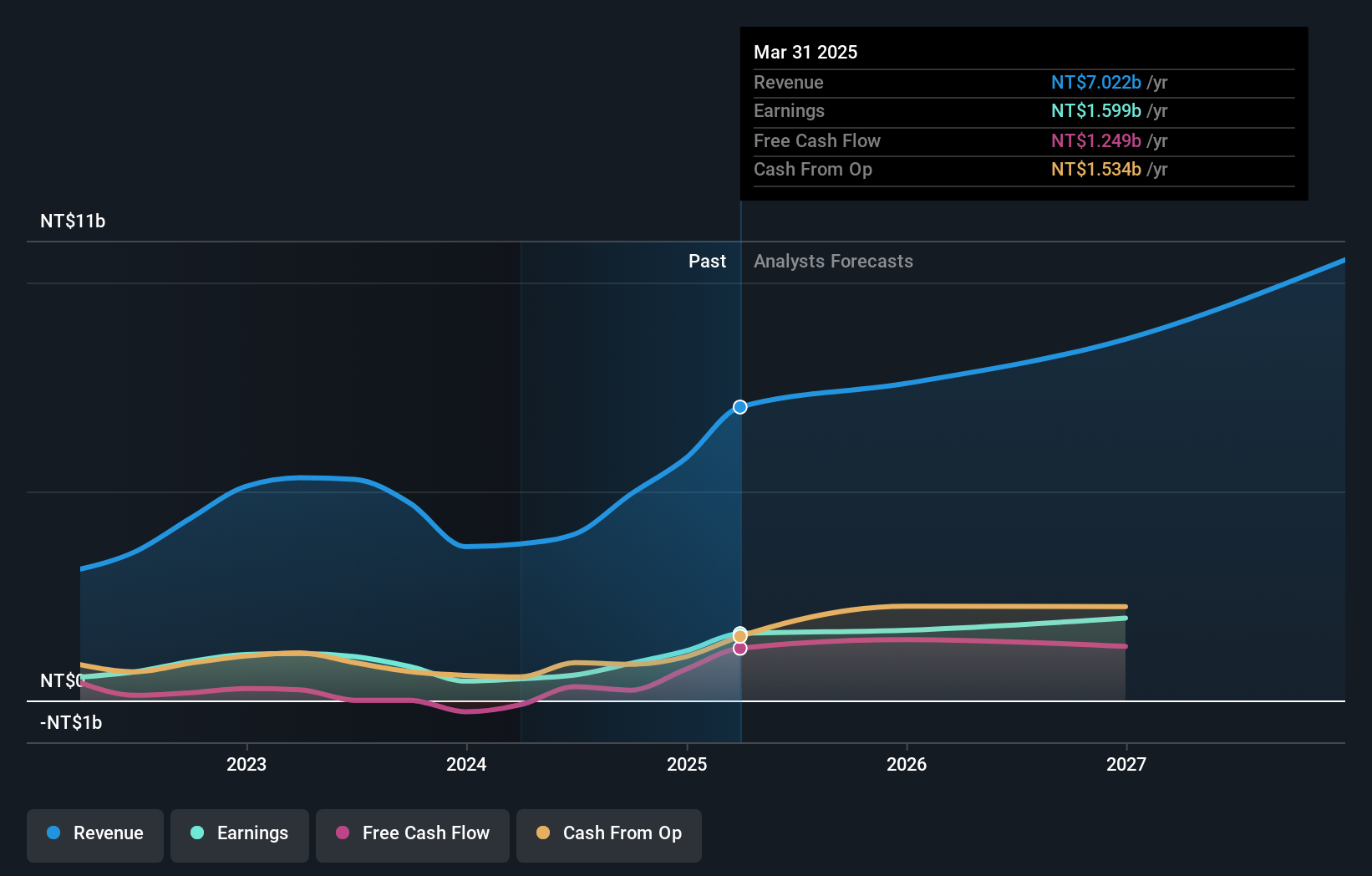

WinWay Technology (TWSE:6515)

Simply Wall St Growth Rating: ★★★★★☆

Overview: WinWay Technology Co., Ltd. designs, processes, and sells optoelectronic product test fixtures and integrated circuit test interfaces globally, with a market cap of NT$37.72 billion.

Operations: The company's revenue segments include NT$3.99 billion from the manufacture and sales of photoelectric product testing tools.

Insider Ownership: 22.9%

Earnings Growth Forecast: 63.4% p.a.

WinWay Technology's earnings are forecast to grow significantly at 63.35% annually, with revenue expected to increase by 41.3% per year, both outpacing the TW market. Recent Q2 results show strong performance with sales of TWD 1.26 billion and net income of TWD 224.12 million, up from last year. However, ongoing lawsuits for trade secret infringements present potential risks despite high insider ownership and growth prospects.

- Click here to discover the nuances of WinWay Technology with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that WinWay Technology is trading beyond its estimated value.

Seize The Opportunity

- Click this link to deep-dive into the 1483 companies within our Fast Growing Companies With High Insider Ownership screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade América Móvil. de, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:AMX B

América Móvil. de

Provides telecommunications services in Latin America and internationally.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives