As the new year unfolds, global markets are experiencing a turbulent start, with small-cap stocks notably underperforming their large-cap counterparts, as evidenced by the Russell 2000 Index dipping into correction territory. Amidst this backdrop of inflation concerns and fluctuating investor sentiment, identifying high growth tech stocks requires a keen focus on companies that demonstrate resilience and innovation in challenging economic climates.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| CD Projekt | 23.18% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| AVITA Medical | 33.33% | 51.81% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| TG Therapeutics | 30.33% | 44.07% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 29.92% | 61.97% | ★★★★★★ |

Click here to see the full list of 1223 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Nordhealth (OB:NORDH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nordhealth AS offers healthcare software solutions across Norway, Finland, Sweden, Denmark, Germany, and internationally with a market capitalization of NOK3.23 billion.

Operations: Nordhealth AS primarily generates revenue through its healthcare software solutions provided across multiple countries, including Norway, Finland, Sweden, Denmark, and Germany. The company operates within the healthcare technology sector with a market capitalization of NOK3.23 billion.

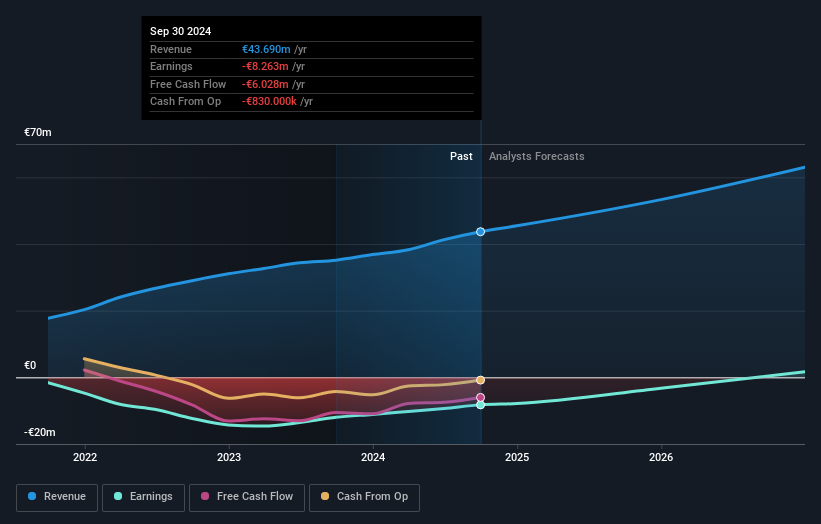

Nordhealth, a player in the healthcare tech sector, is navigating its growth trajectory with notable strategic expansions and financial improvements. Despite being currently unprofitable, the company's revenue is expected to increase by 16.7% annually, outpacing the Norwegian market's growth of 1.5%. This surge is supported by recent ventures like Provet Cloud's pilot program with a major U.S. veterinary group, which could significantly enhance its market presence in North America. Moreover, Nordhealth’s earnings are projected to soar by approximately 85.7% each year over the next three years, indicating robust potential for profitability despite a volatile share price and a low forecast return on equity of 0.6%. These developments suggest that while challenges remain, Nordhealth is making strategic moves that could position it favorably in the evolving tech-driven healthcare landscape.

- Navigate through the intricacies of Nordhealth with our comprehensive health report here.

Review our historical performance report to gain insights into Nordhealth's's past performance.

China Resources Boya Bio-pharmaceutical GroupLtd (SZSE:300294)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Resources Boya Bio-pharmaceutical Group Co., Ltd operates in the blood product industry in China with a market capitalization of CN¥14.74 billion.

Operations: China Resources Boya Bio-pharmaceutical Group Co., Ltd focuses on the blood product sector in China, generating revenue through the production and sale of plasma-derived products. The company's operations are supported by its market presence within this specialized industry.

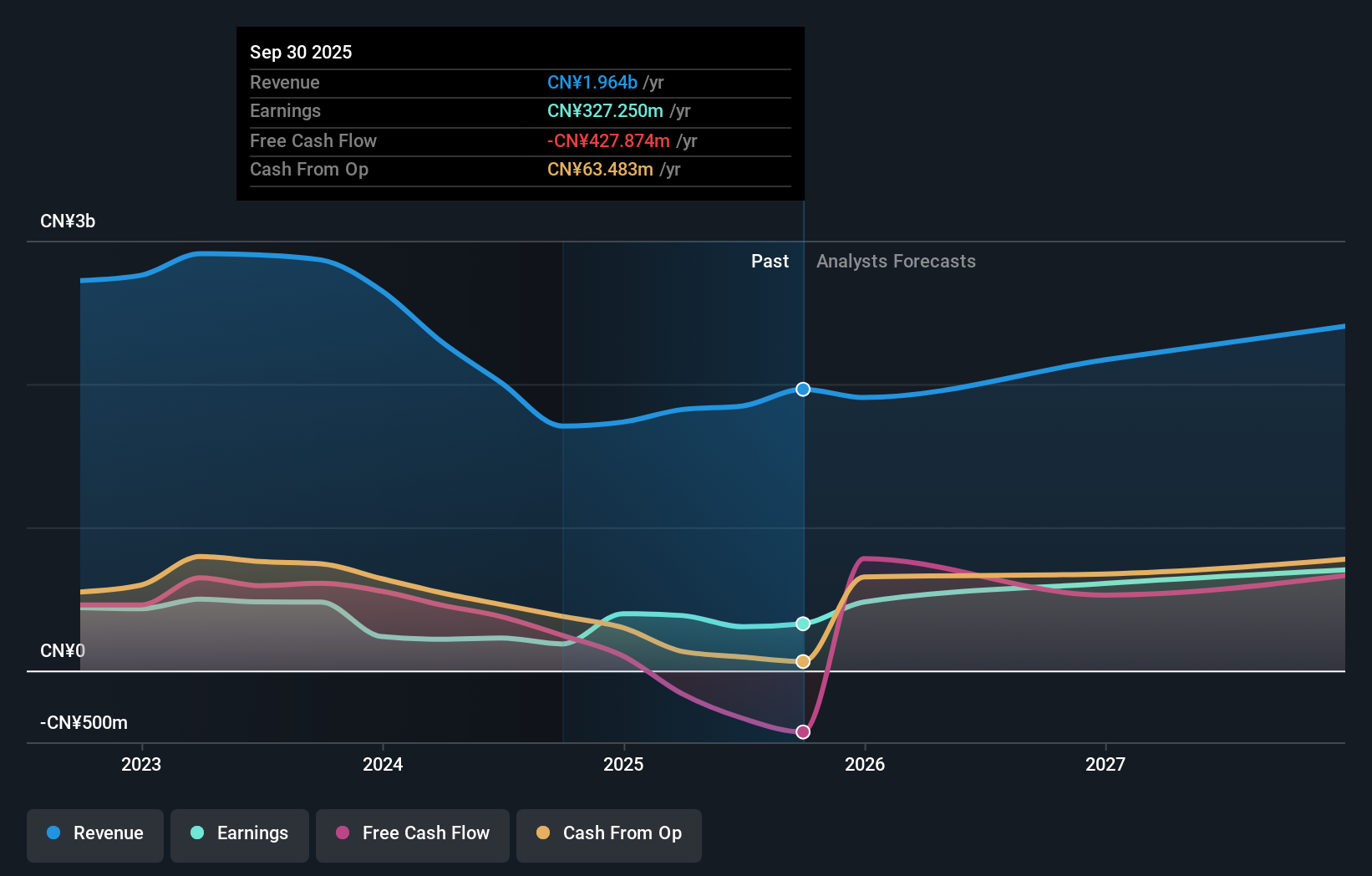

China Resources Boya Bio-pharmaceutical GroupLtd, navigating a complex biotech landscape, reported a significant dip in sales to CNY 1.25 billion from last year's CNY 2.19 billion but maintained robust net income at CNY 412.7 million. Despite this revenue contraction, the firm is poised for substantial earnings growth, projected at an impressive annual rate of 44.4%. This growth trajectory is bolstered by a recent dividend affirmation and strategic leadership changes anticipated to drive innovation and market adaptation. Moreover, with earnings outpacing the broader Chinese market's growth expectations and an R&D focus likely intensifying post-leadership restructuring, Boya’s commitment to advancing biopharmaceutical solutions remains evident amidst financial volatilities.

TSC Auto ID Technology (TPEX:3611)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TSC Auto ID Technology Co., Ltd. is involved in the global manufacture and service of auto-identification systems and products, with a market cap of approximately NT$9.45 billion.

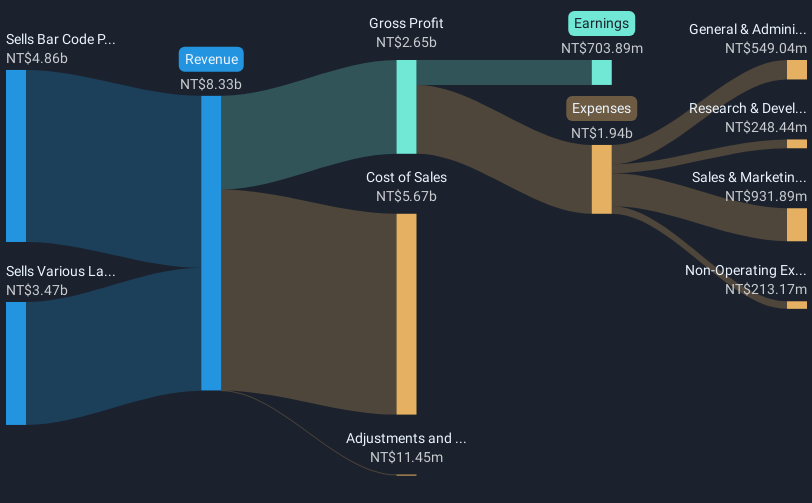

Operations: The company generates revenue primarily from selling bar code printers and their spare parts, accounting for NT$4.86 billion, and from various label papers and consumables for printers, contributing NT$3.47 billion.

TSC Auto ID Technology, amidst a challenging year with a slight dip in nine-month sales to TWD 6.17 billion from TWD 6.21 billion, still projects robust annual earnings growth at 24.1%, outpacing Taiwan's market average of 18.9%. This resilience is underscored by strategic shifts, including the formation of a Sustainable Development Committee aimed at enhancing corporate governance and sustainability practices. Despite a contraction in net income to TWD 533.77 million from TWD 756.75 million and an earnings per share decrease, the company's commitment to innovation and market adaptation through these governance enhancements positions it for potential future gains in the high-tech sector.

- Click here to discover the nuances of TSC Auto ID Technology with our detailed analytical health report.

Learn about TSC Auto ID Technology's historical performance.

Taking Advantage

- Get an in-depth perspective on all 1223 High Growth Tech and AI Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300294

China Resources Boya Bio-pharmaceutical GroupLtd

Engages in the blood product businesses in China.

Flawless balance sheet and good value.