Amidst a backdrop of geopolitical tensions and tariff concerns affecting global markets, Asian tech stocks have shown resilience with notable strength in China's technology sector. When considering high-growth tech stocks in Asia, it's essential to focus on companies that demonstrate robust earnings potential and adaptability to shifting economic landscapes, particularly those benefiting from supportive government policies or innovation-driven growth.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 35.12% | 34.05% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Arizon RFID Technology (Cayman) | 27.55% | 28.53% | ★★★★★★ |

| eWeLLLtd | 24.94% | 24.24% | ★★★★★★ |

| PharmaResearch | 23.41% | 26.41% | ★★★★★★ |

| Yggdrazil Group | 52.42% | 134.19% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

We'll examine a selection from our screener results.

SUNeVision Holdings (SEHK:1686)

Simply Wall St Growth Rating: ★★★★☆☆

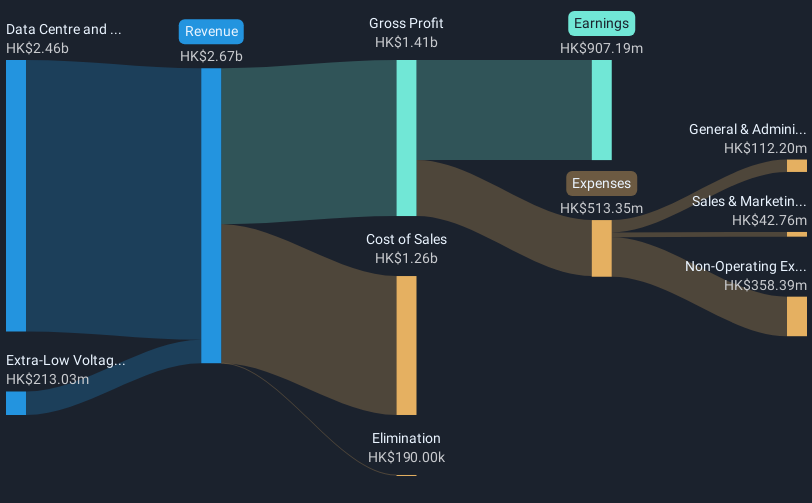

Overview: SUNeVision Holdings Ltd. is an investment holding company that offers data centre and IT facility services in Hong Kong, with a market capitalization of approximately HK$35.56 billion.

Operations: The company generates revenue primarily from its data centre and IT facilities segment, contributing approximately HK$2.64 billion. An additional revenue stream comes from the Extra-Low Voltage (ELV) and IT systems segment, which adds around HK$217.70 million.

SUNeVision Holdings, a standout in Asia's tech landscape, reported a robust half-year with sales reaching HKD 1.47 billion, up from HKD 1.29 billion year-over-year, and net income rising to HKD 484 million from HKD 435 million. This performance reflects an annualized revenue growth of 16.9% and earnings growth of 17.9%, outpacing the Hong Kong market averages of 8% and 11.7%, respectively. The company's commitment to innovation is evident in its R&D spending trends which align closely with its revenue gains, underscoring a strategic focus on sustainable technological advancements rather than short-term gains. Despite not leading the high-growth tech sector in Asia universally, SUNeVision's recent financial outcomes suggest it is navigating market challenges adeptly with potential for future growth bolstered by strategic R&D investments that enhance its competitive edge in critical tech domains.

- Click here and access our complete health analysis report to understand the dynamics of SUNeVision Holdings.

Assess SUNeVision Holdings' past performance with our detailed historical performance reports.

Alltop Technology (TPEX:3526)

Simply Wall St Growth Rating: ★★★★★☆

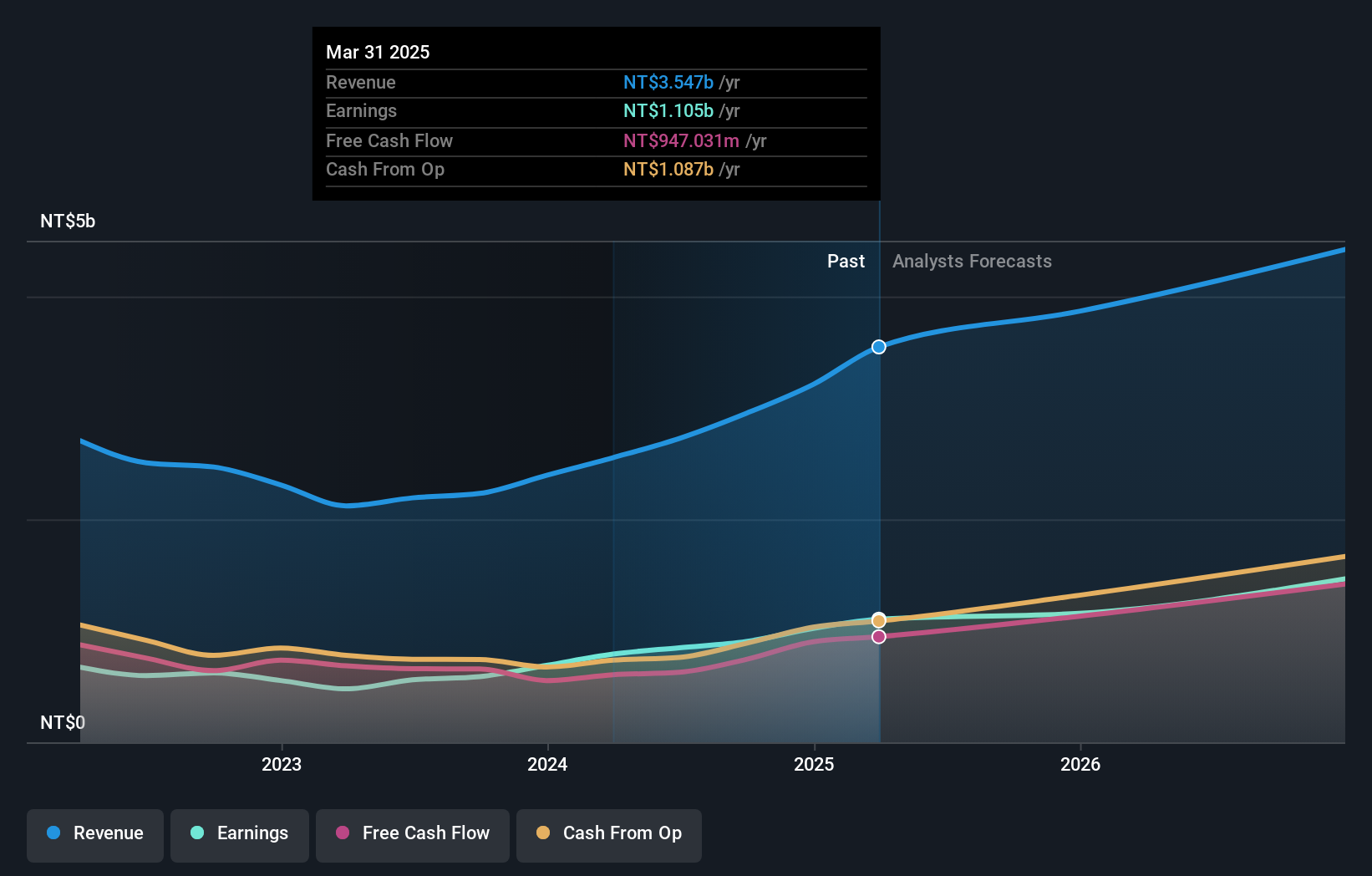

Overview: Alltop Technology Co., Ltd. operates in Taiwan and China, focusing on the research, design, development, manufacture, and sale of electronic connectors with a market capitalization of NT$18.92 billion.

Operations: The company generates revenue primarily from the sale of electronic connectors, contributing NT$2.95 billion. Its operations span research, design, development, and manufacturing within Taiwan and China.

Alltop Technology has demonstrated remarkable financial performance with revenue and earnings growth rates of 23.7% and 25.1% per year, respectively, outstripping the Taiwan market averages significantly. This robust expansion is supported by substantial R&D investment, aligning closely with its revenue increases to fuel ongoing innovation and market competitiveness. With recent board decisions to enhance managerial performance and strategic evaluations, Alltop is poised for sustained growth, leveraging strong market trends and operational excellence in a dynamic tech landscape.

- Delve into the full analysis health report here for a deeper understanding of Alltop Technology.

Gain insights into Alltop Technology's past trends and performance with our Past report.

COVER (TSE:5253)

Simply Wall St Growth Rating: ★★★★★☆

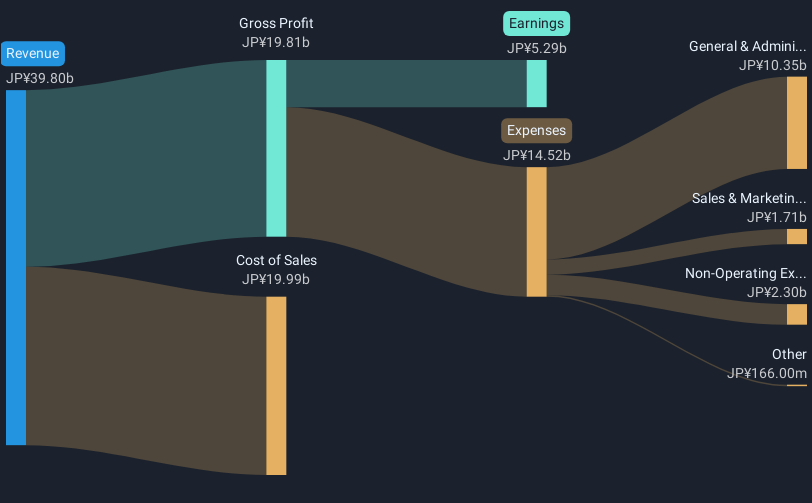

Overview: COVER Corporation operates in the virtual platform, VTuber production, and media mix sectors with a market cap of ¥165.78 billion.

Operations: The company focuses on generating revenue through its virtual platform and VTuber production, contributing significantly to its media mix business. With a market capitalization of ¥165.78 billion, it leverages these segments to drive growth and engage audiences.

COVER Corporation, despite a highly volatile share price recently, showcases robust fundamentals with an annual revenue growth of 17.3% and earnings expansion at 25.2%. This performance outpaces the broader Japanese market's growth rates significantly, indicating strong sectoral momentum. With R&D expenses aligned to foster continuous innovation—critical in the entertainment tech sector—the firm is well-positioned to leverage its advancements for future gains. Especially notable is their earnings surge by 37.3% over the past year, eclipsing industry averages and underscoring their competitive edge in a dynamic market landscape.

Key Takeaways

- Discover the full array of 524 Asian High Growth Tech and AI Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1686

SUNeVision Holdings

An investment holding company, provides data centre and information technology (IT) facility services in Hong Kong.

Reasonable growth potential with acceptable track record.

Market Insights

Community Narratives