- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3516

Is ADO Optronics (GTSM:3516) Using Debt Sensibly?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that ADO Optronics Corporation (GTSM:3516) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for ADO Optronics

What Is ADO Optronics's Net Debt?

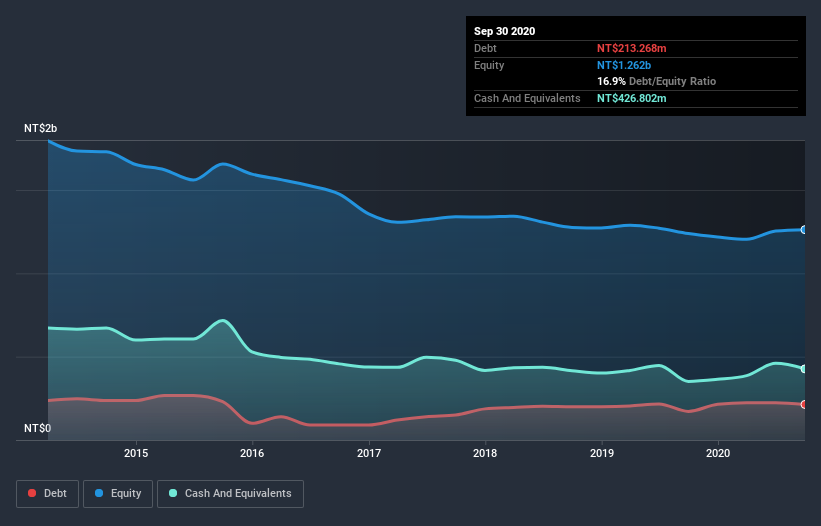

You can click the graphic below for the historical numbers, but it shows that as of September 2020 ADO Optronics had NT$213.3m of debt, an increase on NT$171.7m, over one year. However, its balance sheet shows it holds NT$426.8m in cash, so it actually has NT$213.5m net cash.

A Look At ADO Optronics' Liabilities

We can see from the most recent balance sheet that ADO Optronics had liabilities of NT$379.2m falling due within a year, and liabilities of NT$55.1m due beyond that. Offsetting these obligations, it had cash of NT$426.8m as well as receivables valued at NT$350.8m due within 12 months. So it can boast NT$343.3m more liquid assets than total liabilities.

This excess liquidity is a great indication that ADO Optronics' balance sheet is almost as strong as Fort Knox. Having regard to this fact, we think its balance sheet is as strong as an ox. Simply put, the fact that ADO Optronics has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since ADO Optronics will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, ADO Optronics saw its revenue hold pretty steady, and it did not report positive earnings before interest and tax. While that hardly impresses, its not too bad either.

So How Risky Is ADO Optronics?

Although ADO Optronics had an earnings before interest and tax (EBIT) loss over the last twelve months, it made a statutory profit of NT$46m. So taking that on face value, and considering the cash, we don't think its very risky in the near term. We'll feel more comfortable with the stock once EBIT is positive, given the lacklustre revenue growth. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for ADO Optronics you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading ADO Optronics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3516

ADO Optronics

Engages in the manufacturing, processing, and trading of various connectors, plugs, electronic components, and lighting products.

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)