- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3310

Chialin Precision Industrial (GTSM:3310) Seems To Use Debt Quite Sensibly

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Chialin Precision Industrial Co., Ltd (GTSM:3310) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Chialin Precision Industrial

What Is Chialin Precision Industrial's Net Debt?

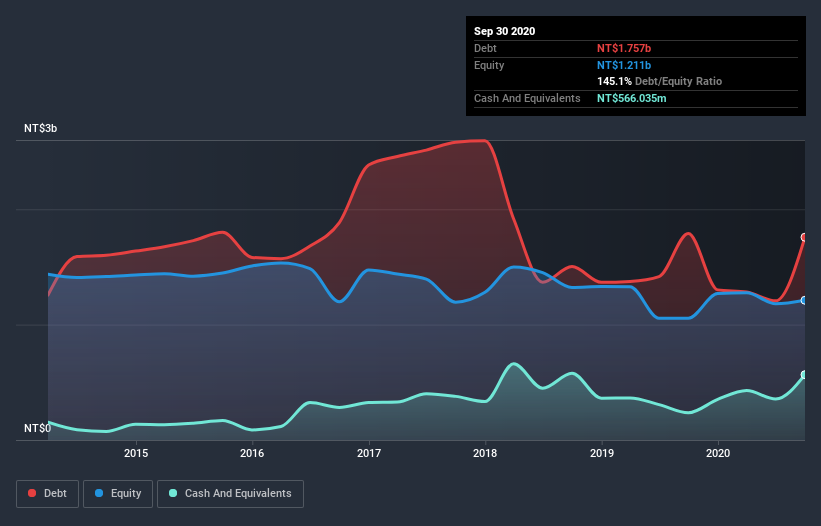

The chart below, which you can click on for greater detail, shows that Chialin Precision Industrial had NT$1.76b in debt in September 2020; about the same as the year before. On the flip side, it has NT$566.0m in cash leading to net debt of about NT$1.19b.

How Strong Is Chialin Precision Industrial's Balance Sheet?

We can see from the most recent balance sheet that Chialin Precision Industrial had liabilities of NT$1.49b falling due within a year, and liabilities of NT$618.7m due beyond that. Offsetting this, it had NT$566.0m in cash and NT$375.6m in receivables that were due within 12 months. So it has liabilities totalling NT$1.16b more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of NT$1.54b, so it does suggest shareholders should keep an eye on Chialin Precision Industrial's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Chialin Precision Industrial has a debt to EBITDA ratio of 3.1, which signals significant debt, but is still pretty reasonable for most types of business. However, its interest coverage of 14.8 is very high, suggesting that the interest expense on the debt is currently quite low. Pleasingly, Chialin Precision Industrial is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 2,472% gain in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But it is Chialin Precision Industrial's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Chialin Precision Industrial actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

Chialin Precision Industrial's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But, on a more sombre note, we are a little concerned by its level of total liabilities. Taking all this data into account, it seems to us that Chialin Precision Industrial takes a pretty sensible approach to debt. While that brings some risk, it can also enhance returns for shareholders. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 4 warning signs for Chialin Precision Industrial that you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading Chialin Precision Industrial or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3310

Chialin Precision Industrial

Engages in the automotive connectors and light-emitting diodes supply chain businesses in Taiwan, China, Thailand, Vietnam, Singapore, Italy, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion