- Taiwan

- /

- Semiconductors

- /

- TWSE:3413

Weak Statutory Earnings May Not Tell The Whole Story For Foxsemicon Integrated Technology (TWSE:3413)

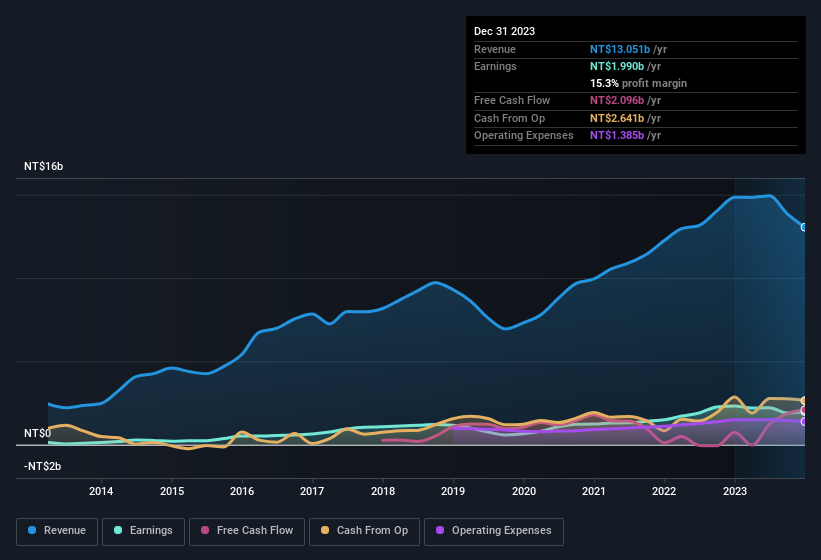

Despite Foxsemicon Integrated Technology Inc.'s (TWSE:3413) recent earnings report having lackluster headline numbers, the market responded positively. While shareholders may be willing to overlook soft profit numbers, we believe that they should also be taking into account some other factors which may be cause for concern.

Check out our latest analysis for Foxsemicon Integrated Technology

The Impact Of Unusual Items On Profit

To properly understand Foxsemicon Integrated Technology's profit results, we need to consider the NT$174m gain attributed to unusual items. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. Which is hardly surprising, given the name. If Foxsemicon Integrated Technology doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Foxsemicon Integrated Technology's Profit Performance

We'd posit that Foxsemicon Integrated Technology's statutory earnings aren't a clean read on ongoing productivity, due to the large unusual item. Therefore, it seems possible to us that Foxsemicon Integrated Technology's true underlying earnings power is actually less than its statutory profit. Nonetheless, it's still worth noting that its earnings per share have grown at 37% over the last three years. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. At Simply Wall St, we found 1 warning sign for Foxsemicon Integrated Technology and we think they deserve your attention.

This note has only looked at a single factor that sheds light on the nature of Foxsemicon Integrated Technology's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3413

Foxsemicon Integrated Technology

Engages in the research, development, design, manufacturing, and sale of semiconductor equipment subsystems and system integration in Taiwan, the United States, China, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)