- Saudi Arabia

- /

- Banks

- /

- SASE:1080

3 Prominent Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets show signs of recovery with U.S. indexes approaching record highs and a strong labor market driving positive sentiment, investors are increasingly turning their attention to stable income-generating options like dividend stocks. In the current economic climate, characterized by broad-based gains and geopolitical uncertainties, selecting dividend stocks that offer reliable payouts can be an effective strategy for those seeking steady returns amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.78% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.47% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.20% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.58% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.30% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.30% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.88% | ★★★★★★ |

Click here to see the full list of 1958 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

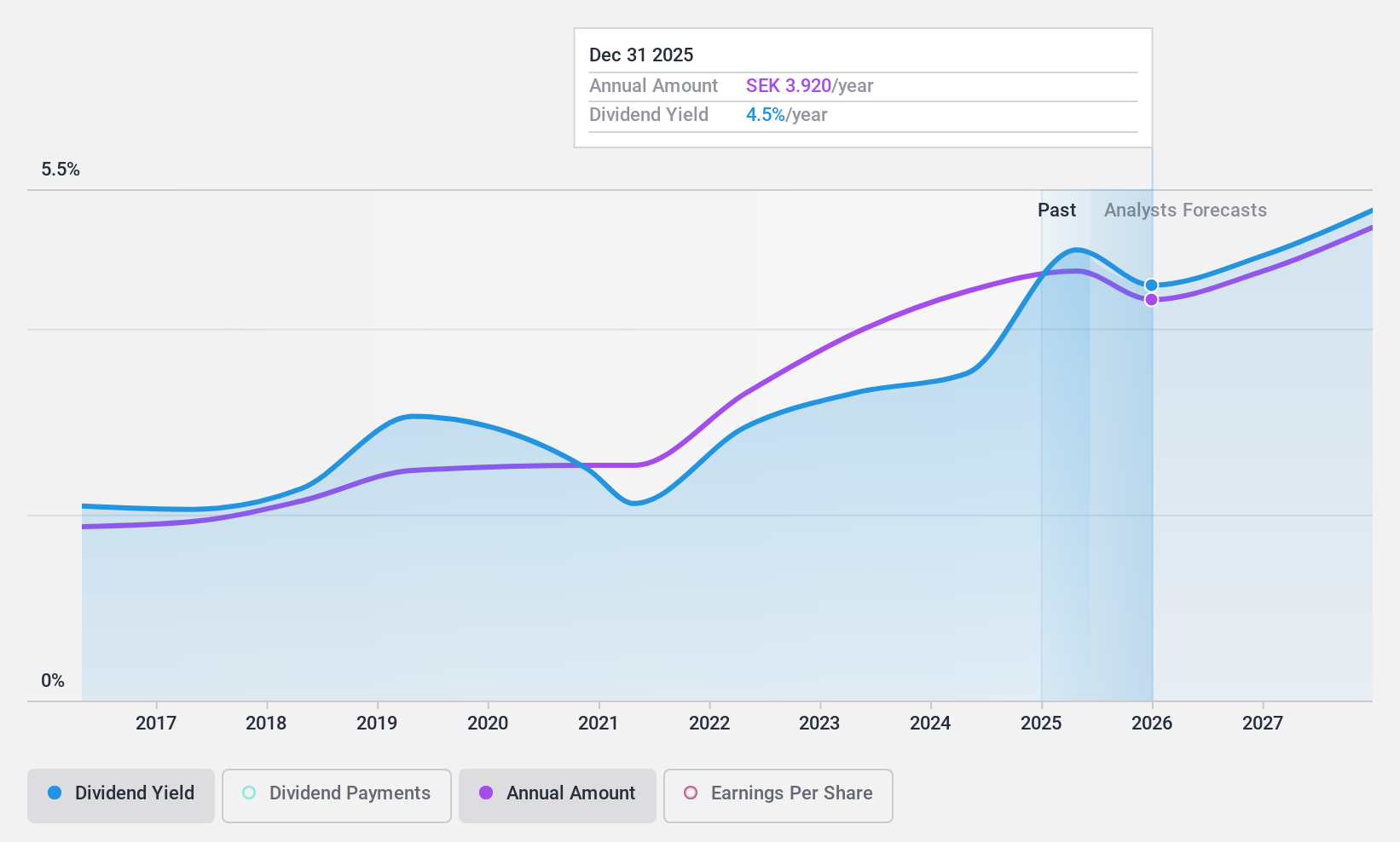

HEXPOL (OM:HPOL B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HEXPOL AB (publ) develops, manufactures, and sells various polymer compounds and engineered products across Sweden, Europe, the Americas, and Asia with a market cap of approximately SEK36.92 billion.

Operations: HEXPOL AB's revenue is primarily generated from its HEXPOL Compounding segment, which accounts for SEK19.70 billion, and its HEXPOL Engineered Products segment, contributing SEK1.61 billion.

Dividend Yield: 3.7%

HEXPOL offers a stable dividend profile with consistent payments over the past decade, supported by a manageable payout ratio of 58% from earnings and 62.7% from cash flows. Despite a lower yield of 3.73% compared to top-tier Swedish dividend payers, its dividends are reliable with historical growth and minimal volatility. Recent financials show decreased sales and earnings due to macroeconomic factors, but the company is actively pursuing M&A opportunities for future growth.

- Delve into the full analysis dividend report here for a deeper understanding of HEXPOL.

- Our valuation report here indicates HEXPOL may be undervalued.

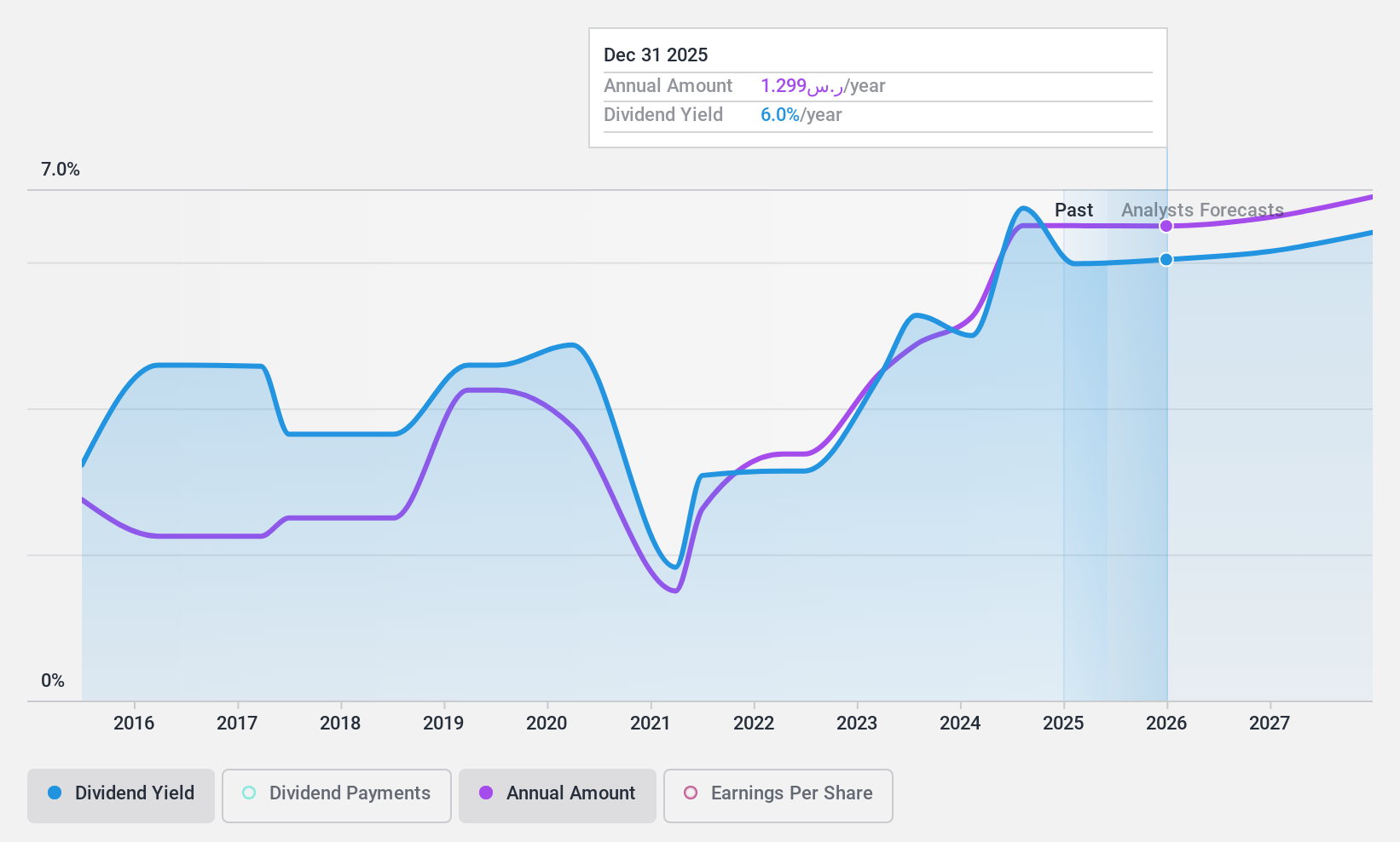

Arab National Bank (SASE:1080)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Arab National Bank offers a range of banking products and services in Saudi Arabia and the United Kingdom, with a market cap of SAR39.80 billion.

Operations: Arab National Bank's revenue is primarily derived from its Corporate Banking segment at SAR6.56 billion, followed by Retail Banking at SAR2.15 billion, and Investment and Brokerage Services contributing SAR499.79 million.

Dividend Yield: 6.5%

Arab National Bank's dividend yield of 6.53% ranks in the top 25% of Saudi Arabian dividend payers, though its dividend history has been volatile over the past decade. Despite this instability, dividends are currently covered by earnings with a payout ratio of 50.5%, and forecasted to remain sustainable at similar levels in three years. Recent financial results show strong growth, with Q3 net income rising to SAR 1.24 billion from SAR 1.08 billion year-on-year.

- Dive into the specifics of Arab National Bank here with our thorough dividend report.

- Our expertly prepared valuation report Arab National Bank implies its share price may be lower than expected.

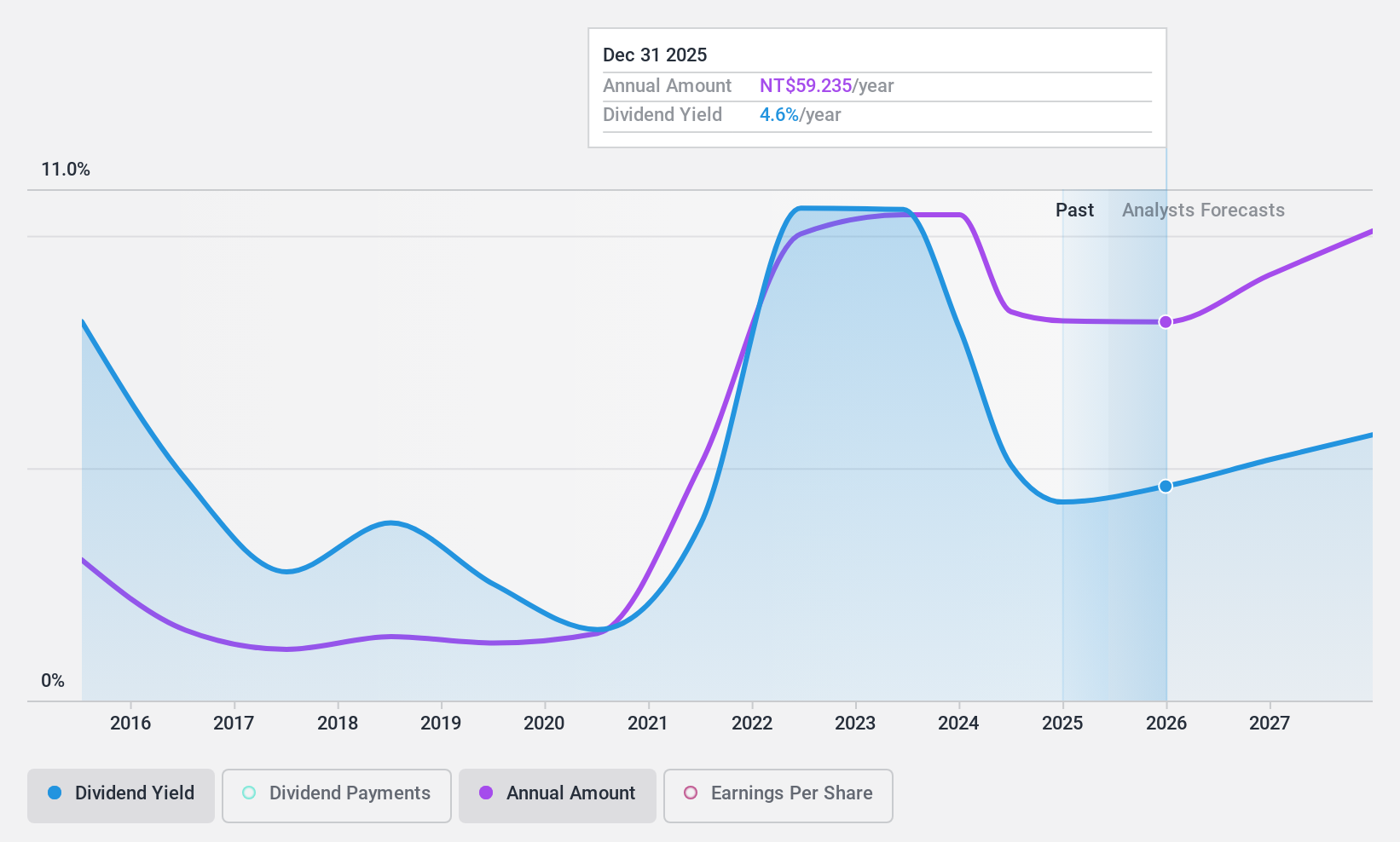

MediaTek (TWSE:2454)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MediaTek Inc. is involved in the research, development, production, manufacture, and marketing of multimedia integrated circuits (ICs) across Taiwan, the rest of Asia, and internationally with a market cap of NT$2.09 trillion.

Operations: MediaTek Inc.'s revenue is primarily derived from its multimedia and mobile phone chips and other integrated circuit design products, totaling NT$522.10 billion.

Dividend Yield: 4.5%

MediaTek's dividend yield of 4.53% is among the top 25% in Taiwan, though its dividend history has been volatile. Despite this, dividends are covered by earnings and cash flows with payout ratios of 87.2% and 49.6%, respectively. Recent financial results show robust growth, with Q3 net income rising to TWD 25.35 billion from TWD 18.48 billion year-on-year, supported by strong sales performance and strategic product developments in Wi-Fi and broadband solutions.

- Navigate through the intricacies of MediaTek with our comprehensive dividend report here.

- Our expertly prepared valuation report MediaTek implies its share price may be too high.

Turning Ideas Into Actions

- Investigate our full lineup of 1958 Top Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:1080

Arab National Bank

Provides various banking products and services in the Kingdom of Saudi Arabia, Other GCC and the Middle East, Europe, North America, Latin America, Southeast Asia, and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives