- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3533

3 Prominent Stocks Estimated To Be Up To 49.2% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets react to policy shifts and economic indicators, investors are navigating a landscape marked by fluctuating sector performances and interest rate expectations. Amidst this uncertainty, identifying undervalued stocks becomes crucial, as these investments can offer potential value when priced below their intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shenzhen Lifotronic Technology (SHSE:688389) | CN¥15.53 | CN¥30.97 | 49.9% |

| Giant Biogene Holding (SEHK:2367) | HK$49.10 | HK$97.68 | 49.7% |

| Oddity Tech (NasdaqGM:ODD) | US$43.12 | US$85.73 | 49.7% |

| Jetpak Top Holding (OM:JETPAK) | SEK106.00 | SEK211.87 | 50% |

| S-Pool (TSE:2471) | ¥341.00 | ¥679.53 | 49.8% |

| Loihde Oyj (HLSE:LOIHDE) | €10.80 | €21.48 | 49.7% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.96 | THB9.88 | 49.8% |

| Ai-Media Technologies (ASX:AIM) | A$0.705 | A$1.40 | 49.7% |

| Nokian Renkaat Oyj (HLSE:TYRES) | €7.388 | €14.69 | 49.7% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥64.04 | CN¥127.37 | 49.7% |

Let's dive into some prime choices out of the screener.

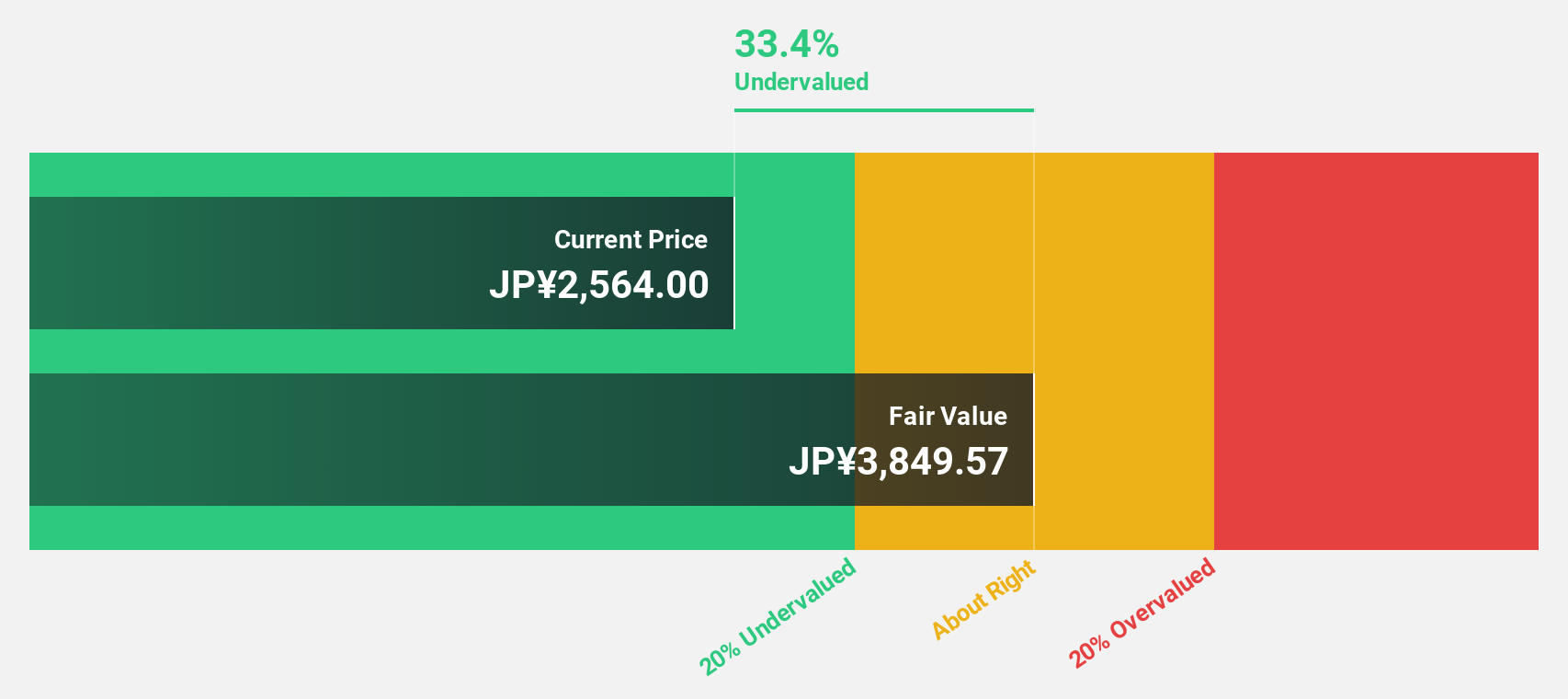

Mercari (TSE:4385)

Overview: Mercari, Inc. operates marketplace applications in Japan and the United States, with a market cap of ¥339.38 billion.

Operations: The company's revenue segments include ¥41.96 billion from the United States and ¥140.39 billion from Japan.

Estimated Discount To Fair Value: 49.2%

Mercari is trading at ¥2100, significantly below its estimated fair value of ¥4135.6, suggesting it could be undervalued based on cash flows. Despite high volatility in recent months, the company's earnings are projected to grow at 16.44% annually, outpacing the Japanese market's growth rate of 7.9%. However, revenue growth is expected to be moderate at 6% annually and includes a high level of non-cash earnings.

- In light of our recent growth report, it seems possible that Mercari's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Mercari.

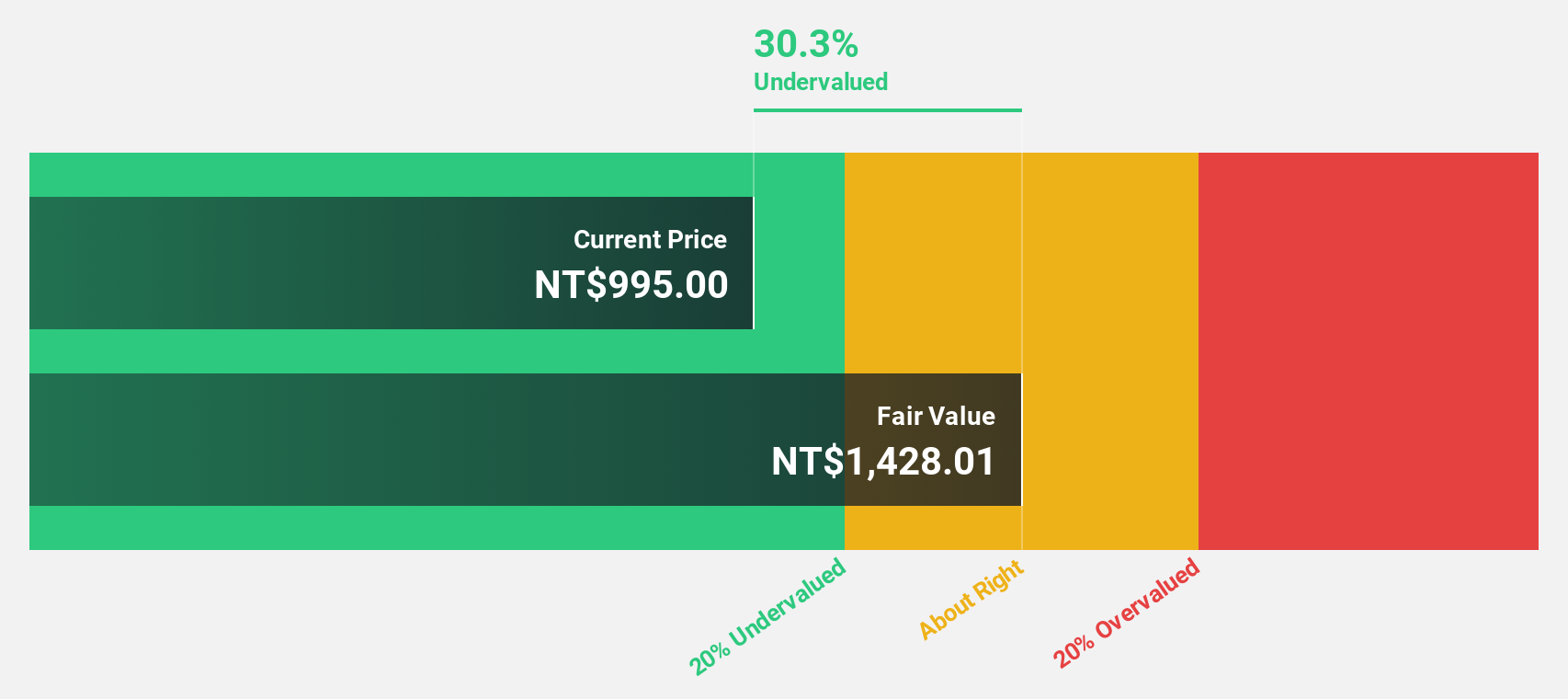

Taiwan Semiconductor Manufacturing (TWSE:2330)

Overview: Taiwan Semiconductor Manufacturing Company Limited, along with its subsidiaries, is involved in the manufacturing, packaging, testing, and selling of integrated circuits and semiconductor devices globally, with a market cap of NT$26.19 trillion.

Operations: The company's revenue segment primarily consists of its Foundry operations, which generated NT$2.65 billion.

Estimated Discount To Fair Value: 18.3%

Taiwan Semiconductor Manufacturing is trading at NT$1045, below its estimated fair value of NT$1279.2, indicating potential undervaluation based on cash flows. Recent revenue growth of 31.5% year-to-date and a net income increase highlight robust financial performance. Earnings are forecast to grow by 19.7% annually, surpassing the Taiwanese market average. The company's strategic collaborations and dividend increases further bolster its position despite moderate revenue growth projections compared to peers and industry standards.

- The growth report we've compiled suggests that Taiwan Semiconductor Manufacturing's future prospects could be on the up.

- Take a closer look at Taiwan Semiconductor Manufacturing's balance sheet health here in our report.

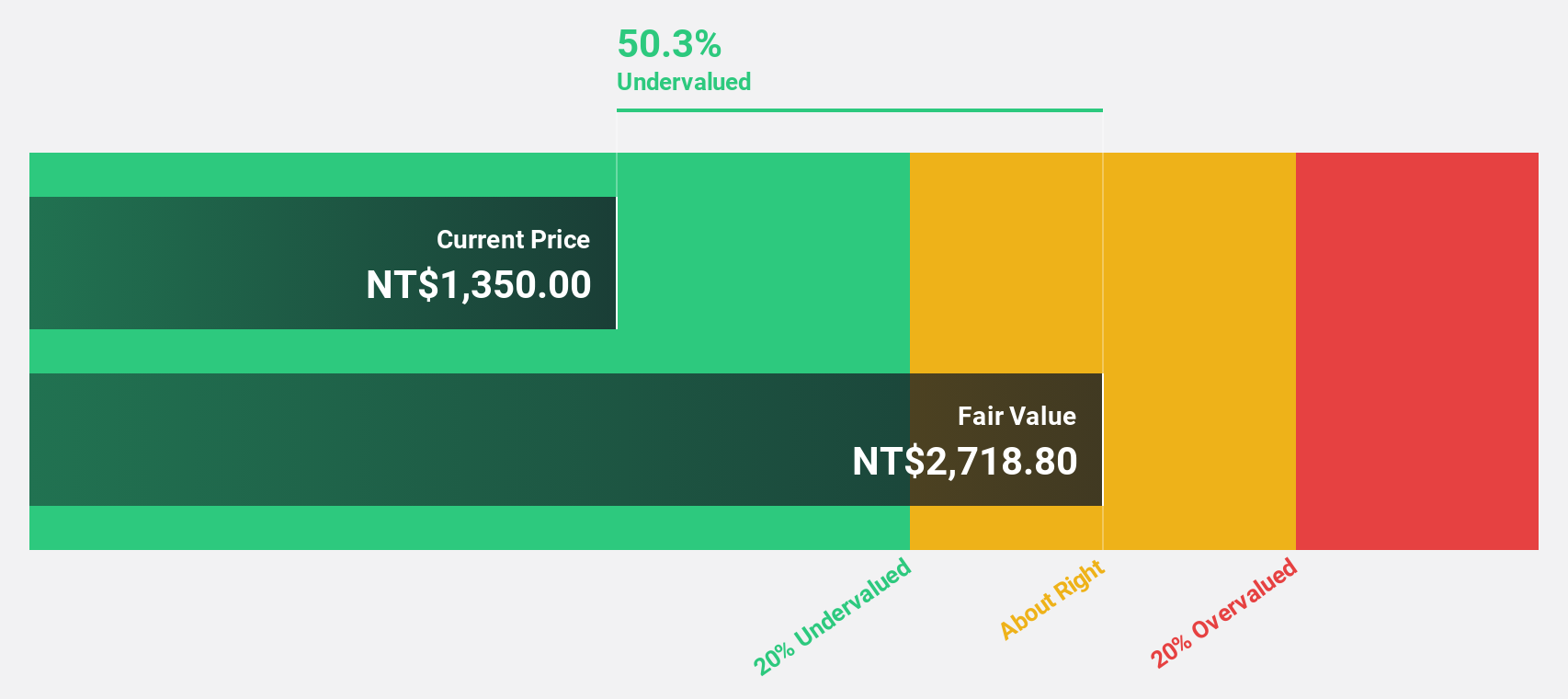

Lotes (TWSE:3533)

Overview: Lotes Co., Ltd designs, manufactures, and sells electronic interconnect and hardware components in Taiwan, Mainland China, and internationally, with a market cap of NT$190.18 billion.

Operations: Lotes generates revenue primarily through the design, manufacturing, and sale of electronic interconnect and hardware components across Taiwan, Mainland China, and international markets.

Estimated Discount To Fair Value: 37.1%

Lotes is trading at NT$1760, significantly below its estimated fair value of NT$2799.62, highlighting potential undervaluation based on cash flows. Despite high share price volatility recently, earnings grew 31.9% last year and are forecast to grow 19.76% annually, outpacing the Taiwanese market's average growth rate. Revenue is expected to increase by 16.1% per year, above the market average of 12.6%, reinforcing its attractive valuation profile amidst stable operational updates.

- The analysis detailed in our Lotes growth report hints at robust future financial performance.

- Navigate through the intricacies of Lotes with our comprehensive financial health report here.

Where To Now?

- Reveal the 915 hidden gems among our Undervalued Stocks Based On Cash Flows screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3533

Lotes

Designs, manufactures, and sells electronic interconnect and hardware components in Taiwan, Mainland China, and internationally.

Very undervalued with outstanding track record and pays a dividend.