China Pacific Insurance Group And 2 Other Exceptional Dividend Stocks

Reviewed by Simply Wall St

As global markets experience a rebound driven by easing inflation and strong bank earnings, investors are increasingly looking towards dividend stocks as a reliable source of income amidst economic fluctuations. In this context, companies like China Pacific Insurance Group stand out for their potential to offer stable returns through dividends, making them an attractive option for those seeking consistent income in the current market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.32% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.03% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.47% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.45% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.02% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.97% | ★★★★★★ |

Click here to see the full list of 1975 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

China Pacific Insurance (Group) (SHSE:601601)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Pacific Insurance (Group) Co., Ltd. offers a range of insurance products to both individual and institutional clients in China, with a market capitalization of approximately CN¥275.91 billion.

Operations: China Pacific Insurance (Group) Co., Ltd. generates its revenue through providing a variety of insurance products to both individual and institutional customers across China.

Dividend Yield: 3.2%

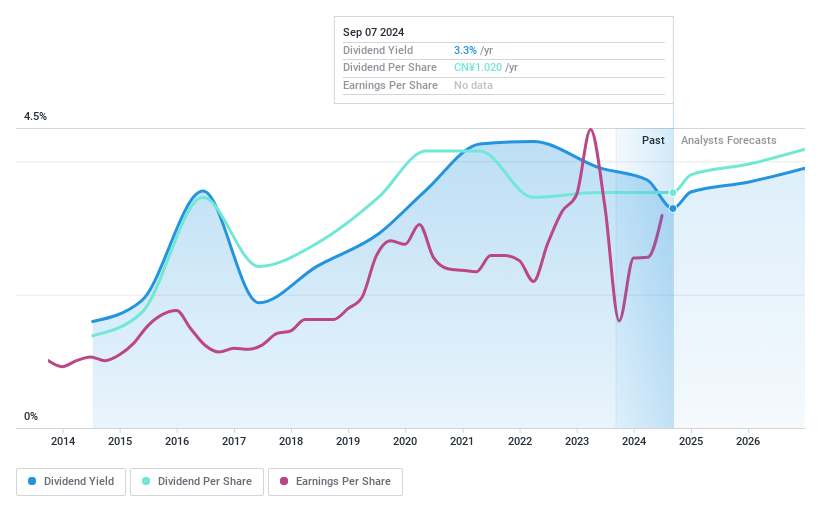

China Pacific Insurance (Group) offers a well-covered dividend with a low payout ratio of 23.2%, supported by strong earnings and cash flows, indicating sustainability. Despite recent earnings growth of CNY 38.31 billion, the company's dividends have been volatile over the past decade, reflecting an unstable track record. Trading at 58.4% below estimated fair value, it provides a dividend yield in the top quartile of its market but remains unreliable due to historical volatility.

- Click here and access our complete dividend analysis report to understand the dynamics of China Pacific Insurance (Group).

- Our valuation report unveils the possibility China Pacific Insurance (Group)'s shares may be trading at a discount.

Taiwan Fertilizer (TWSE:1722)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taiwan Fertilizer Co., Ltd., along with its subsidiaries, produces and distributes inorganic and organic fertilizers as well as other chemical products in Taiwan, the Middle East, and internationally, with a market cap of NT$50.57 billion.

Operations: Taiwan Fertilizer Co., Ltd. generates revenue primarily from Chemical Fertilizers amounting to NT$9.18 billion and its Property and Investment Business contributing NT$2.38 billion.

Dividend Yield: 5.1%

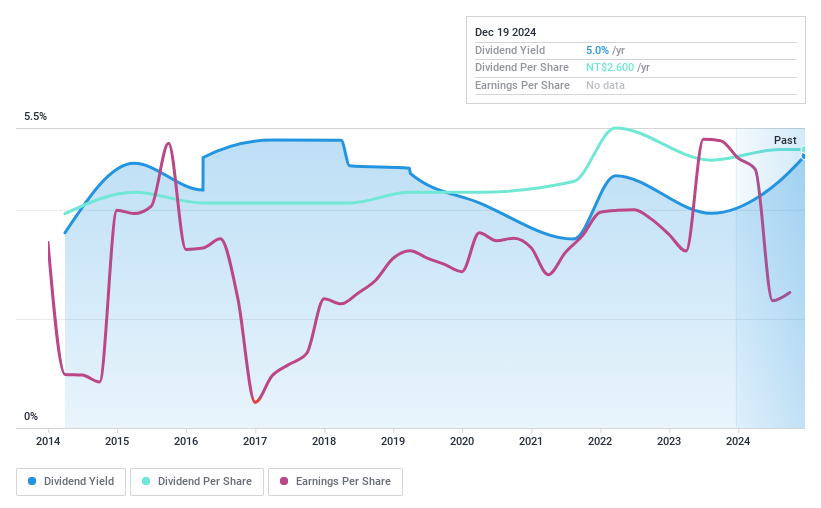

Taiwan Fertilizer's dividend yield of 5.07% ranks in the top 25% in Taiwan, yet its high payout ratio of 147.9% and a cash payout ratio of 95% suggest dividends are not well covered by earnings or cash flows. Despite this, dividends have been stable and growing over the past decade. Recent earnings showed an increase to TWD 737.93 million for Q3, though nine-month figures reflect a decline compared to last year.

- Dive into the specifics of Taiwan Fertilizer here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Taiwan Fertilizer shares in the market.

United Microelectronics (TWSE:2303)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Microelectronics Corporation is a semiconductor wafer foundry with operations across Taiwan, China, Hong Kong, Japan, Korea, the United States, Europe, and other international markets; it has a market cap of approximately NT$517.50 billion.

Operations: United Microelectronics Corporation's revenue from wafer fabrication amounts to NT$226.87 billion.

Dividend Yield: 7.0%

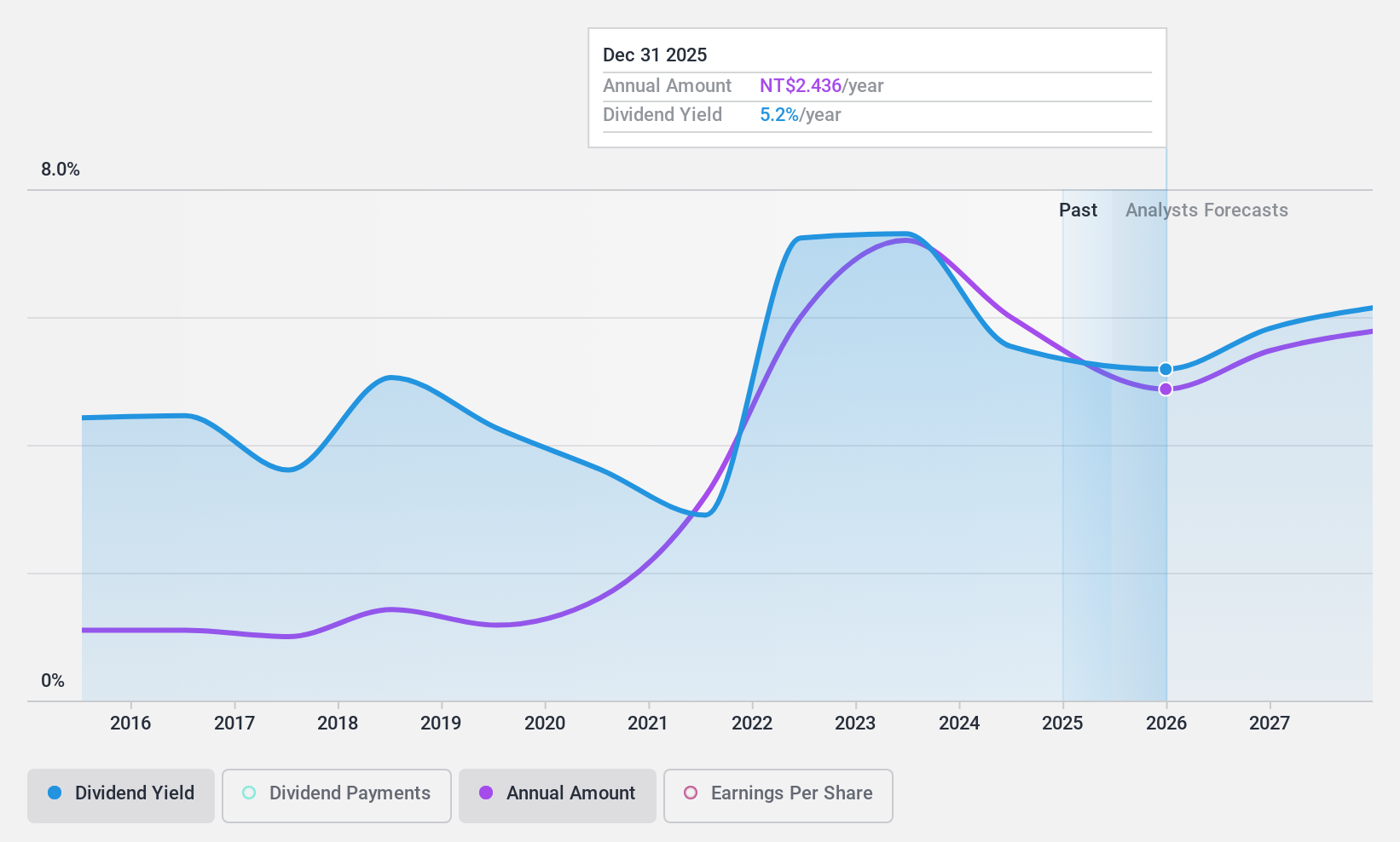

United Microelectronics offers a dividend yield in the top 25% of Taiwan's market, though it struggles with coverage by free cash flows. Despite trading at a significant discount to fair value, its dividend history has been volatile over the past decade. Recent revenue growth is evident, with December 2024 figures showing an increase from the previous year. However, earnings have declined compared to last year, impacting dividend sustainability despite a reasonable payout ratio of 72.2%.

- Click here to discover the nuances of United Microelectronics with our detailed analytical dividend report.

- The valuation report we've compiled suggests that United Microelectronics' current price could be quite moderate.

Where To Now?

- Access the full spectrum of 1975 Top Dividend Stocks by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601601

China Pacific Insurance (Group)

Provides insurance products to individual and institutional customers in the People’s Republic of China.

Undervalued with solid track record and pays a dividend.