- Taiwan

- /

- Semiconductors

- /

- TPEX:8084

Shareholders Are Raving About How The Chip Hope (GTSM:8084) Share Price Increased 308%

It might be of some concern to shareholders to see the Chip Hope Co., Ltd (GTSM:8084) share price down 16% in the last month. But that doesn't change the fact that the returns over the last year have been spectacular. In that time, shareholders have had the pleasure of a 308% boost to the share price. So we wouldn't blame sellers for taking some profits. The real question is whether the fundamental business performance can justify the strong increase over the long term.

Check out our latest analysis for Chip Hope

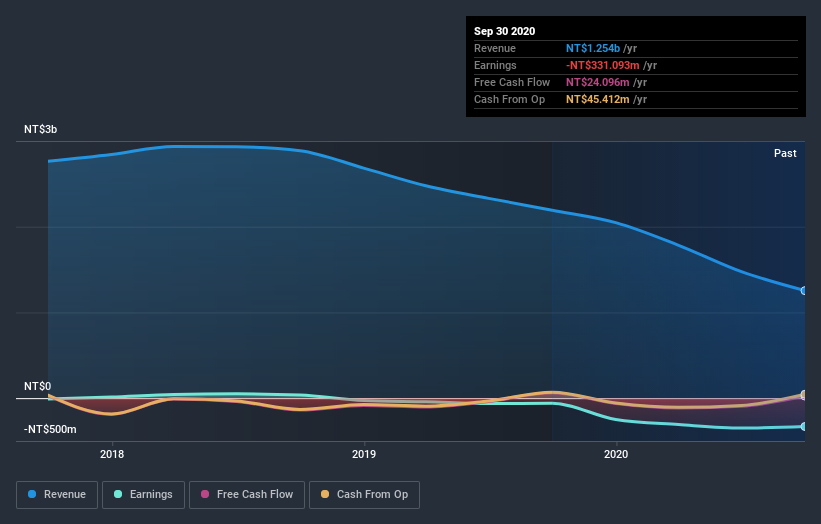

Because Chip Hope made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Chip Hope saw its revenue shrink by 43%. This is in stark contrast to the splendorous stock price, which has rocketed 308% since this time a year ago. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. To us, a gain like this looks like speculation, but there might be historical trends to back it up.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Chip Hope stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that Chip Hope has rewarded shareholders with a total shareholder return of 308% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 26% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Chip Hope .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade Chip Hope, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:8084

Chip Hope

Engages in the manufacture and trading of memory products in Taiwan and China.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives